Sign in

Sign in

Business

News

Daily Stock Market News under 15 min. No ads. No Politics!

Today's Stock Markets in under 15 min. No ads. No politics! Easy to follow for your morning coffee, dog walk or commute.

Substack Featured 3 times!

Recommended by Doomberg, Adam Taggart, Bill Cara and many others.

Unlock full episodes and Substack content with this discount. notyouradvisor.com/podcast25

Whether you subscribe for free or paid, you will gain value and ability over time to see stock market price movement in a way Wall St does not want you to see.

Paying subscribers get

- Exclusive content on every podcast

- Paid-only written content

- Private chat feed with real time alerts

- Stock screener on balance area setups

- Subscriber chart requests

- Lock in the price forever! www.notyouradvisor.com

Podcast EP 35 "A New Hope" (Aug 23)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesBreadth* 96 New highs* 228 New lows* 72% ADV 23% Dec* 67% under 50 dayI noted on the Tue session that there was a battle between yields and risk assets where both were rising at the same time, and that this had to resolve. Thursday, everyone will be talking nvda or jackson hole. No one will be talking how yields fell today. That gave more tailwinds intraday than any anticipation of $NVDA.Up big after hours. As high as 520.. Settled in at 500Beat expectations and raisedNoted that $1T TAM in data centers are going through a new cycle of upgrades* Upgrading to regenerative ai capabilities* Upgrading tech in general to keep upWorking with VMWare. Name dropped Meta, Google and othersHow much of it is priced in?Jensen Huang, Founder And CEO Of Nvidia Says "A New Computing Era Has Begun. Companies Worldwide Are Transitioning From General-Purpose To Accelerated Computing And Generative AI"08/23/23 4:21 PMNvidia, NVDA approves $25 billion in share buyback. Let's see how the earnings call goes and tmrw. Will news be bought or sold? How will price react to overhead ma? 10 Yr fell today finally, giving some reprieveCup and handle measured move could be 4538StrongWeak$FL , $NKE , $PTON What to watch* Yields* Fed speakers at Jackson Hole* Jerome Powell Friday 10:05am* $NVDA keep its gains or sell the news?Thanks for reading NYUGrad Stocks and Finance! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

09:5024/08/2023

Podcast EP 34 "Always two there are" (Aug 22)

“Always two there are, no more no less. A master and an apprentice.” - Master YodaPodcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesI start with Yoda’s quote because there are two big forces fighting each other the past few sessions. * Higher Yields and 7.5% 30 year mortgages* Risk assets in stocks and the fact fewer and fewer names are holding up the world $NVDA and $TSLA for exampleBreadth* 75 New highs* 329 New Lows* 36% Adv / 58% Dec* % under 50 day maUp big pre-market* ES almost got back to test 4444 level overnight Monday into Tuesday* But the ES and Nasdaq sold off at opening bellWhy do I keep hammering that you should watch breadth? Breadth was weak all morning. And 11:35am indices gave up after sideways action2pm update3pm rally attempt. Breath volume seemed weak vs Mondays close. I suspected a selloff.3:30pmRally attempt was a dudStrongIt was a deceptive sell off day when you compare magnificent 7, vs indices complexion vs breadth. WeakSee above. bull should be weary of worsening breadth. 70% of shares are under the 50 day ma. (nyse / amex / nasdaq)What to watchNVDA reports after close WedFed speakers Thu morningJerome Powell Fri 10:05amThanks for reading NYUGrad Stocks and Finance! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

16:5723/08/2023

Podcast EP 33 A Rare Sight (Aug 21)

Financial Freedom is not free, but the pursuit is worth the treasure. Building a community with that goal. Let's go get it!Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform: “https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesWe all saw a rare sight today. * 10 yr yields at decade highs* Tech and risk assets were strong* Dollar StrengthBreadth* 64 New highs* 337 New lows* Avd decl 45% 50%* 70% under 50 dayStrong open. But 10 yr was also up 2%I noted at 10am all risk assets and the 10 yr cannot go same way for long. Someone was lying. 10:30 risk assets gave up and started selling off4 backtests to 4368 area. Defense Strong$NVDA $TSLA WeakReal Estate, Utilities, Consumer DefensiveWhat to watch* Resolution to Yields up and Risk assets up* $NVDA earnings Wed* Jerome Powell Jackson Hole Fri morning Chart Gallery This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

12:0222/08/2023

Podcast EP 32 Welcome! (Aug 18)

Financial Freedom is not free, but the pursuit is worth the treasure. Building a community with that goal. Let's go get it!Podcast Available on Spotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform: https://nyugrad.substack.com?r=1ec55c* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesThank you again to all the new members who subscribed recently and are coming from X, Doomberg, and the Substack feature. And a special thanks to the below who introduced themselves on the Substack Chat (Only avail on the Substack app) * Ethan M coming from WBD podcast/Doomberg (Vancouver)* Yuri B - Fellow NYU Alum* Victor AJ in Venezuelan living in Germany* Dr Fenton also from Vancouver - World traveler and serial entrepreneur* “Stares Lovingly” - Healthcare professional from humid FloridaStart here links* For new Subscribers, here is the archive so you can catch up on some popular posts.* One I highly recommend. “Market Profile for Dummies”* Daily Podcast* Substack NotesLet’s jump into Friday’s session:Breadth* 42 new highs* 377 new lows* 53% advancing* 41% declining* 70% of NYSE AMEX and NAsdaq are under their 50 day moving avgsWhat stuck out?Crypto hard sell off overnight ThursdayAsia redBroke down premarket The open was bought and it was the low of the day. Back-tested 4368 ish twice but heldYields sill high at 4.25%StrongNot much. it was a defensive day and we managed to tread water. The win for the bulls was the open was the low of the day and prices creeped up higher all dayWeakSee aboveWhat to watch* Wed $NVDA earnings* Jerome Powell speaks Friday from Jackson Hole, 10:05 ET.* China weakness and stimulus? This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

10:3121/08/2023

Podcast EP 31 I'm Just Warming Up! (Aug 17)

Financial Freedom is not free, but the pursuit is worth the treasure. Building a community with that goal. Let's go get it!Available on Spotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral program for existing SubscribersShow NotesI want to first welcome all the new subscribers who are discovering my Substack after it was featured this week! I am humbled and honored you would share your inbox with me. We run a lean program over here. No fluff. Just the markets in context of both Macro and Micro. I am just warming up! How the content flows:* Emails - Daily podcast highlighting what I saw as important, in about 15 min or less. Show Notes like this are exclusively here on Substack. But the podcast can be found on Apple Podcast, Spotify, Amazon Music and YouTube. Releases 5am NY, covering the previous day session.* Emails - Stock Spotlight (this will eventually be a paid feature where I share premium watchlists for both bullish and bearish scenarios)* Substack Notes - Like old Twitter but better. This is where intraday thoughts and analysis will live.* Archive (Sort by New and Top/Most Popular)* More to comeYou can always email me: [email protected]* 47 New highs* 416 New lows* 29% advancing* 66% declining* 70% below 50 day MA (NYSE AMEX and Nasdaq)Stuck outRecord 17 yr high in yields this am. 4.3% 10 yrI stated on Substack Notes in the morning pre open…Lunchtime bounce. Dollar got a lil weaker. Yields still high at 4.3% at 12:30pmAfternoon Selloff. No relief for yieldsStrong* $GOOG 1.4%* CSCO up 3.3%* $PFE Pfizer up 3.1%* JNJ 1%* $BMY 2%* XOM 1.9%Weak* EVERYTHING* ENERGY WAS ONLY GREEN SECTORWhat to watch* $NVDA next week Aug 23* Yields* Bonds* USD* Yen* Watch for bounces. We are very oversold. If you see a bounce, see how prices react if we can get back to the 50 day ma. If we cannot even get to the 50 day before a selloff, that is bad news for buy the dip crowdThanks for reading NYUGrad Stocks and Finance! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

06:5818/08/2023

Podcast Episode 30 Mission Impossible (Aug 16)

Financial Freedom is not free, but the pursuit is worth the treasure. Building a community with that goal. Let's go get it!Available on Spotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral program for existing SubscribersShow NotesYour mission if you choose to accept it, is to fight inflation without causing a recession. Good luck Jerome Powell. This message will self destruct in 5 seconds!Breadth* 73 new highs* 421 new lows* 20% adv 75% declining* 66% are under the 50 day ma. Not good (NYSE AMEX and Nasdaq)Stuck outPremarket was muted but bad Asia sessionOpen flew higher but dow was up 170 and sold offNasdaq laggedMorningWe touched 4444 as I deducted and bounced. 4444 is the high volume area10:05am already weakeningChoose your FOMC adventureBy Noon time12:11PM NYFull day picture. Not good.StrongShort etfs, VolatilityWalmart, Costco, Home depot, TGTWeakWhat to watchYields and USDNVDA earnings Aug 23Magnificent 7Moving avgs. 50, 100, 200Chart GalleryThanks for reading NYUGrad Stocks and Finance! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

07:4416/08/2023

Podcast EP 29 FOMC vs FOMO (Aug 15)

Financial Freedom is not free, but the pursuit is worth the treasure. Building a community with that goal. Let's go get it!Available on Spotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral program for existing SubscribersShow NotesBreadth* 85 new highs* 341 new lows* 18% advancing* 78% decliningPre market selloff. fought backThe strong retail sales was interpreted as strong consumer, and maybe uncle Powell has to stay higher for longer on rates. That was the day in a nutshell. 12:03pmMike Maloney. Video showing rates have never ascended this high as rate of change. Even in 70s. Buffet Berkshire buys* $NVR * $DHI * $LEN Strong* $EXTR pretty much even* $NVDA * $LYFT up 3.78%* $VIX 10.93%Weak* Everything* All sectors red* $JPM downWhat to watchFOMC Minutes and reaction on WedThanks for reading NYUGrad Stocks and Finance! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

05:1716/08/2023

Podcast EP 28 Breadth Smiles at us all (Aug 14)

…all we can do is smile back.Financial Freedom is not free, but the pursuit is worth the treasure. Building a community with that goal. Let's go get it!Available on Spotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral program for existing SubscribersShow NotesHere is the original scene from Gladiator, one of my favorite movies. I chose this episode’s thumbnail as a visual double entendre in a world of celebrity worship and social media mania. What is Rome but the mob!I care not for this battle unless the duel is to the death. But while we wait for this speculative fight, we have a financial market to address. Breadth* 98 New highs* 278 New lows* 39% advancing* 56% decliningRed open reversed by 1030am.Semis pulled up everyone11:07 feeble bounceThen at 3:58pmStrong$SMH and $NVDA pretty much everything was up or down approx .8-1%10 yr yields and mortgages are very highWeakWhat to watchThanks for reading NYUGrad Stocks and Finance! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

07:4715/08/2023

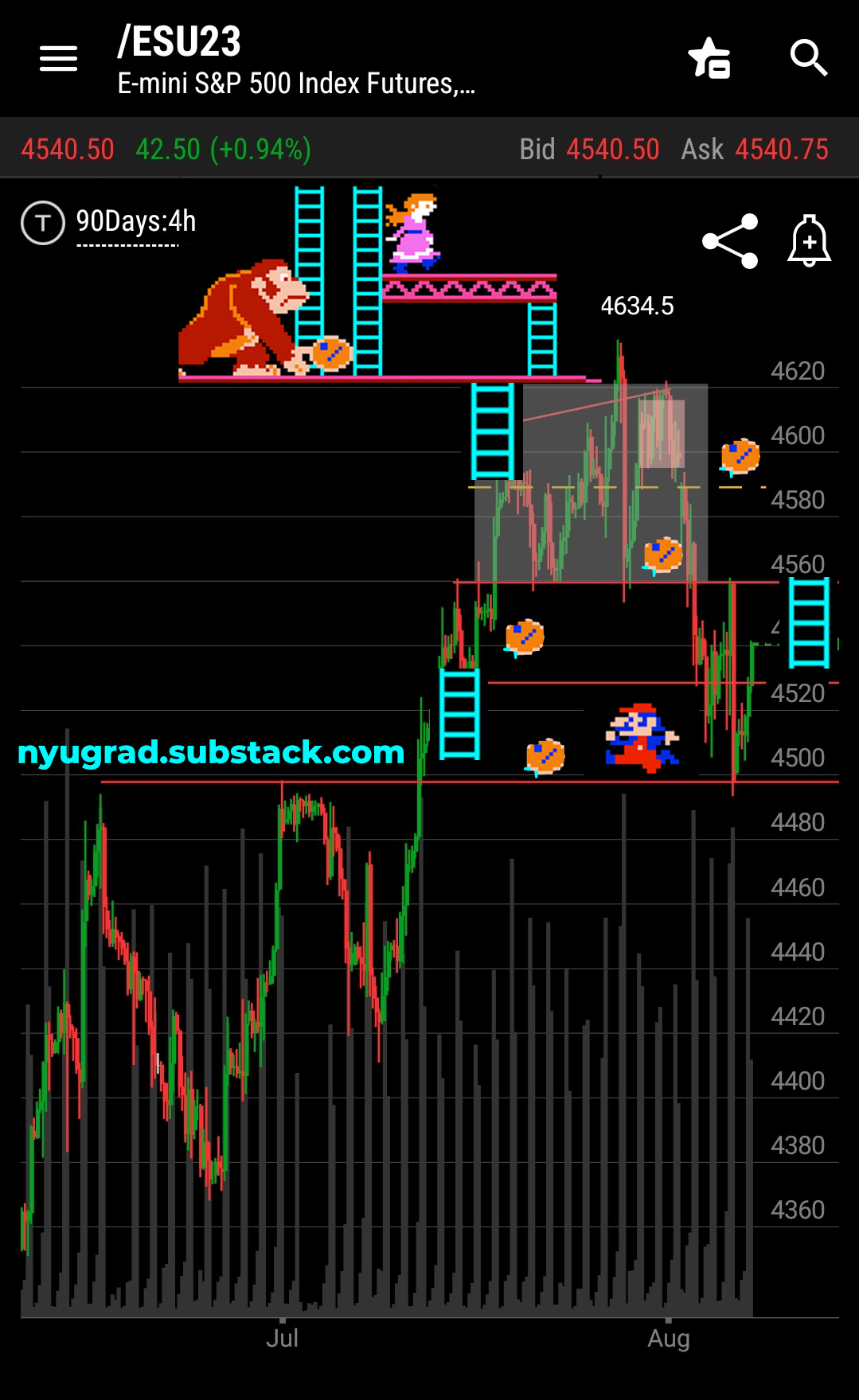

Podcast EP 27 "Your Breadth Stinks! (Aug 9)

Financial Freedom is not free, but the pursuit is worth the treasure. Building a community with that goal. Let's go get it!Available on Spotify | Apple Podcast | Amazon MusicSubstack NotesTwitterReferral program for existing SubscribersShow NotesBreadth * 166 new highs * 232 new lows * 37.9% adv * 57.7% dec MorningI noticed $AAPL and $NVDA were really struggling. Shares of safety are doing better like $ABBV. The breadth is telling me we go lower all day. $EXTR is still green. If you want to learn more about co like $EXTR I invite you to subscribe free…for now. The Stock Spotlight on Extreme Networks will hit your inbox on Friday morning. if you have not subscribed I would love to earn your free subscription.Noon I postedUnless you see breadth pick up, take the day off or enjoy a long lunch break. Note: After CPI we are either breaking below 50day and testing 4444 or we are gonna retest upside 4560 Before the close around 2:30pm NY 👇Thanks for reading NYUGrad Stocks and Finance! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

05:3910/08/2023

Podcast EP 26 WeScrewed (Aug 8)

Financial Freedom is not free, but the pursuit is worth the treasure. Building a community with that goal. Let's go get it!Available on Spotify | Apple Podcast | Amazon MusicSubstack NotesTwitterReferral program for existing SubscribersShow NotesHousekeeping. No podcast episode covering Thu and Fri sessions. Taking a long weekend.Will resume covering Monday Aug 14 session releasing Tue Morning.I will be active sharing analysis on Substack Notes and Twitter as much as I can. Breadth* 130 New Highs* 269 New Lows* 33% Advancing* 61% DecliningHealthcare was only real sector greenMorning broad selloffDow was down 400pts at one timeNASDAQ fell the most intraday but recovered into the closeTon of charts shared during am. If you don’t follow Notes bookmark this link. It basically is like twitter but better! No ads. No hate algo. 2:20 started bouncing but weak breadth volume3pm buying volume came inWhat to watchCPI ThursdayBanksMag 7Financial Freedom is not free but the pursuit is worth the treasure. Building a community with that goal. Let's go get it! This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

07:1009/08/2023

Podcast Episode 25 “Insert Coin to Play” Aug 7

Financial Freedom is not free but the pursuit is worth the treasure. Building a community with that goal. Let's go get it!Subscribe free at nyugrad.substack.comAvailable on Spotify | iTunes | Amazon MusicShow NotesHousekeeping. No episode Thu and Fri. Taking a long weekend. I will post analysis on Substack Notes and Twitter as much as I can. Breadth* 181 New Highs* 216 New lows* 55% advancing* 40% declining* Every Sector is greenAt 11:55am breadth was weakingRotation into dow 30 was evidentSelling of risk was also evidentthe 10 yr closed at 4.1% and remains strong30 yr mortgage very high 7.25%While risk shares looked like it would lag behind the DOW 30 heavily, in the afternoon buying came in and the $VIX got whacked.What Stuck outVanguard Funds in my 401kI posted this morning “Your fees to Wall Street are wasted”Take a look at this. I logged into my 401k plan via Vanguard. I looked at one of the middle of the road performing funds. All it has is a collection of other Vanguard funds. Both are managed by different fund managers! Talk about double dipping. And there is nothing illegal about this.So what isthe composition of the first fund within this fund? The Magnificent 7!And investors are paying fees to at minimum, 4 CFAs/fund managers! Must be a very nice lifestyle!My friend and mentor, Bill Cara reported on this many times and taught many of his mentees why it is so important to know the real battlefield before once can succeed in the game of stocks and speculation.Here is Bill’s recollection…In 1997 or 1998, the Executive Director of the Ontario Securities Commission asked me to be the public’s sole representative in Canada’s final hearing of all securities regulators before they set policy regarding electronic trading. He also asked my opinion of the new Fund of Funds in that meeting.https://www.investopedia.com/terms/f/fundsoffunds.aspI opined that it was double-dipping and would become common among friends in the investment management industry; hence it should be banned.We don’t give enough credit to our regulators. They mean well and work hard. But, in the end, Wall Street gets what Wall Street wants.It’s up to us to fight back by exposing our concerns as you have today.Here from my upcoming book, The Maverick Investor, is the start of Chapter 2:Understanding the Adversary and Focusing on What We Must Do.Investors share a common goal: to achieve wealth accumulation and financial freedom through securities trading. However, in the vast and complex world of financial markets, not all participants have the same interests.Standing opposite independent investors are the formidable sell-side – an entity wielding immense power and influence that directly impacts our financial independence and wealth. Understanding this adversary is crucial for navigating the treacherous waters of the market.The sell-side encompasses diverse entities, from giants like Humongous Bank & Broker (HB&B) of Wall Street to the agents of misinformation found in online and broadcast media. Recognizing and explicitly defining their role and tactics within the financial landscape is the first step in gaining an edge.To comprehend the battlefield, we must understand the battleground itself – a space to the right of your left ear and the left of your right ear – the center of gravity where critical financial decisions are made. From this vantage point, we can unravel the sell-side’s strategy and identify the ways, ends, and means they employ to exert control over independent investors like us.Rather than viewing the sell-side as interminable boogeymen, a more productive approach is to assess their capabilities, needs, and vulnerabilities. While we can’t entirely shut them out, we can become adept at discerning the kernels of truth amidst the chaff in their words and actions. We can submit our complaints to securities regulators, whose job is to protect our rights and interests.StrongEverything into the closeWeakVixWhat to watchCPI ThursdayTreasury budget ThursdayPPI FridayFinancial Freedom is not free but the pursuit is worth the treasure. Building a community with that goal. Let's go get it! This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

15:0108/08/2023

Podcast EP 24 Return of the $VIX Jedi (Aug 4)

Available on Spotify | iTunes | Amazon MusicNew Referral program for existing SubscribersShow Notes: https://nyugrad.substack.comReversal from overhead supply, a thing of beauty.$VIX crushes, vix crush Friday!$AAPL breaks key area. Under 50 day moving avg on a gap down!$OPEN down 23% ah earnings. Still outperforming $AAPL $TSLA $NVDA YTDOil $OIH related all upStrong$TEAM Up 17.21%$AMZN Up 8.3%$EXTR Up 2.53%$UPWK Up 2.92%Weak$SPT Sprout Social down 12%$SQ Block down 13%$NIO down 4%$RIVN down 4.68%What to watchYields bonds usd vix aaplAmazon, "I’ll close with Amazon, which had spectacular earnings and an explosive move higher. Why is this bearish? Because the good news is out, and all it could muster was a shooting star. Want to keep an eye out for something? See if the high for AMZN on Monday is lower than today’s low. If so, we’ve got an island reversal pattern" -Tim Knight from Slopeofhope.comThanks for reading NYUGrad Stocks and Finance! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

22:3606/08/2023

Podcast EP 23 Revenge of the Sith (Aug 3)

Available on Spotify | iTunes | Amazon MusicTwitter: nyugradsubstackThreads: nyugrad.substackNew Referral program for existing SubscribersShow NotesThere aren’t many companies that can’t be replaced. Two companies that I believe fall in this category reported after the close today. Apple Computer and Amazon. Pause for a second. If Google vanished tomorrow, couldn’t $MSFT #TikTok $META pick up where we left off? It’s just cookies and ads!But I do not believe you could replace the scale and economies of scale that $AAPL and $AMZN have built. Can Walmart pick up where your Amazon Prime account left off today if Amazon vanished tonight? Can Android or Samsung pick up where your Apple dependency left off tonight? Probably not.I am typing this as I listen to the Amazon earnings call. Who can compete with their scale? delivery times? It would take so much capital and time to setup a competitor. Ask Walmart’s board.If $TSLA vanished tomorrow and $AAPL stepped in and built EV refrigerators with wheels, would anyone miss Elon Musk? Probably not.I still believe Apple and Amazon are going to keep their leadership position and use their scale, operating leverage, and cash war chest to crush future competitors.Be cautious though, these two names are now blue chip safety stocks. it is very hard to fly when you are as large as they are. For now, $AMZN is leveraging AWS to generate the large scale growth.$AAPL is becoming a $PFE or $PG and a ETF onto itself.We are now in the cycle of finance where a few juggernauts are holding up all of our prosperity. And their prosperity also depends on the consumer continuing to #BrrrrrrrrrrrrrrrrrPS Apple is soft ah on 3 qtrs of declining declining revenues and slowing iphone sales.Vision Pro is still not shipping until 2024. By then I do not believe anyone will buy a $2k headset. $10B in deposits for Apple Card Savings is basically a marketed savings account. Is Apple a bank? Tech co? Utility? What is their multiple?75%+ of the stock market have reported. There are a ton of wrecks and a few notables sticking their heads out swimming against the current.With earnings almost behind us, we go back to being held captive to the whims of two souls…God help us all!PS RIP SteveThanks for reading NYUGrad Stocks and Finance! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

09:5104/08/2023

Podcast EP 22 "Begun has the Currency Wars" (Aug 2)

Available on Spotify | iTunes | Amazon MusicNew Referral program for existing SubscribersShow NotesI picked up 50 subscribers in the past 7 days so I want to welcome everyone new to the Substack. I means the world to me. I want to build a great community of investment thinkers who share with each other. Discuss Doomberg leaving XI watched Bloomberg TV today and they marched on an army of talking heads to vindicate Yellen and the US. And act bewildered by Fitch’s downgrade or dismissed it. Yellen dismissed it. Rating agencies are commission eating sell side shills. Devils advocate. Hey they downgraded in USA in 2011 and prices are higher today than 2011. Until you see $ES_F 4185 break down we are still in bullish waters. $AAPL $AMZN could change everything tmrw. i.e Apple could say we are revealing a $20k EV going on sale in 2024, YAY!Defensive names and sectors were green.Drug co, healthcare, $ABBV, $PG P&G,, $SBUX, $MCD, Walgreens $WBA319pm breadth was weak.. no dice …Strong - Swimming upstream in sea of red$CVNA up$EXTR up on earnings$YOU up on earnings (clearme)$DASH up on earning ahWeak$QCOM down 2% ah earnings$ETSY down 2.5% beats but guides low$PYPL down 3% after earnings$WIX down 5% ah earnings$AFRM down 9%$HOOD down 3.5% losing users$Z Zillow down only 1.9% after earnings ah$SHOP down 7% but wishy washy ah earningsThanks for reading NYUGrad Stocks and Finance! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

33:1503/08/2023

Podcast EP 21 We're all Currency Traders! (Aug 1)

Available on Spotify | iTunes | Amazon MusicTwitter: nyugradsubstackThreads: nyugrad.substackShow NotesLink to Bill Cara quoteAfter the close Fitch downgrades US credit rating from AAA to AA+. Hasn’t downgraded since 2011. 10 yr yield still 4%$DXY (USD) up still above 100Fewer job openings than last moAt 10am mag 7 all redAll builders green 10amMarket in a nutshellOpen Door $OPEN outperforming NVDAYTD $OPEN 386% YTD $NVDA 226%$BZH outperforming $AAPL $TSLA!Watch $TLT. If bonds do go down, then Yields will rise to attract buyers. Then USD will also rise, pressuring risk assets like stocks, gold and silver. If yields rise then more options like 4% yielding savings account will keep popping up at $AXP and $JPM and $AAPL / $GS, offering real risk free alternatives to risky a$$ equities.$TBT #BONDSStrong$CAT up 9% on earnings$AMD up 2.7% AH on earnings. Revenue falls 18% as PC market shows continued weakness. Earnings down 40%/ Sales sown 18%Weak$UBER down 4.9%$LYFT down 6% sympathy. Reports next wk$COIN down 7%$NCLH down 13%$JBLU down 6.6% on soft guidance$DASH down 3%$ETSY down 3%$NIO down 4.38%$WD 40% drop in sales. Worst loss ever. But not being punished down 2.4% AH What to watchUSD, 10 Yr yield, Bonds, TLT, TBT, Yen, AAPL AmazonThanks for reading NYUGrad Stocks and Finance! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

23:2502/08/2023

Podcast EP 20 The Empire Strikes Back Last Second (Jul 29)

Available on Spotify | iTunes | Amazon MusicTwitter: nyugradsubstackThreads: nyugrad.substackNew Referral program for existing SubscribersShow NotesThe day can be summed up in the last 10 minutes going into the last day of the month! Miraculously the indices clawed back the entire sessions losses. Like magic. We truly are in Oz.The bullish impulse will not be at risk until prices back test and fail 4185. If it does expect a quick move to 4000. But we have a long way and it seems unfathomable at this point.Range within a range1:19pm. Dow sp and nq went red. Vix greenBreadth showed weakness all morningStrongROKU upADBE up 3%SG up 8%CAVA up 6%W up 6%WIX up 6%WeakHome builders were softEXTR down 2.3%What to watchThanks for reading NYUGrad Stocks and Finance! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

15:2301/08/2023

Podcast EP 19 Print until you drop dead (Jul 28)

Available on Spotify | iTunes | Amazon MusicTwitter: nyugradsubstackThreads: nyugrad.substackShow Notes5 straight months up for S&P 500End of month paint the tape in play?It has been the tale of two markets:I. Backed by liquidity * Inflation reduction act* Banks* Govt spending* Fha programs* Employee retention credit programs* BTFDhttps://www.federalreserve.gov/financial-stability/bank-term-funding-program.htmThe Bank Term Funding Program (BTFP) was created to support American businesses and households by making additional funding available to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.II. The rest of us* 20% credit card interest rates* Average interest rate for new car buyers hit 7.1% in Q2. @Cardealershipguy* *highest since Q4 2007* Highest amount of revolving credit ever* My gut says the student loan payment start date will be kicked down the road to next administrationStrong$BZH up 22%$ROKU up 31.43%$PLTR up 10.25%$EXTR July 19 - Surprising Increase: Mackenzie Financial Corp Boosts Holdings in Extreme Networks, Inc. by 47.3%$CAVA up 6.21%Weak$SG down 8.67% This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

24:3430/07/2023

Podcast EP 18 Rug Pull (Jul 27)

Available on Spotify | iTunes | Amazon MusicTwitter: nyugradsubstackThreads: nyugrad.substackShow NotesI didn’t want to go over 20 min so I forgot to cover two important items. * The Volatility Index. It has been very very profitable to short the $VIX through any number of ways ie, sell options and using the options premium to go long, or buying calls on bearish volatility or puts on bullish volatility. However, The $VIX as it sits now, is arguably and nominally zero. If you are bullish equities, this is a very cheap time to buy hedges on your bullish portfolio. Whether VIX is 14, 12, 9.99 or 5, it is nearing the floor. It reminds me when Oil went to zero! remember that nonsense?!?! many Billionaires were made during that time!* $ENPH reported and they threw up solar panels. I tweeted that I was baffled why a solar panel company is having trouble selling amidst the hottest year on record. And it was brought to my attention by @BasedQian and @BertinBertin that both $SPWR and $RUN were also doing horribly. 9:50am 10 yr Treasury yields up. Meant $USD was up. Stocks were swimming up stream as usual.But as early as 9:55am the sell off began. 20 min after opening bell. at 12:45pm the selling acceleratedBreadth intraday$AAPL Choose your own adventureAs it unfolded Apple Computer was carving out a balance area. I knew there were only a few likely outcomes possible.1.2.3.What was Strong?$ABBV - This is a leading Pharma name. Pays a 4.17% dividend and did you know they own BOTOX!!! They beat and raised guidance. Stock was up 4.9%Look at the balance area from May through Jul, and. now breaking out initiatively higher. $META up 4%. Was up more but you have to give credit and watch stocks that swim upstream like Meta. $ROKU up 8% after earnings after hours. Lets see how it opens. Keep in context this stock is down from its highs of $463!What was Weak?$CROX -14.6% $CMG -9%. Down two days in a rowWhat to watch?Friday Economic DataNext Week is $AAPL earnings on Thursday Aug 3 after the bell!Financial Freedom is not free but the pursuit is worth the treasure. Building a community with that goal. Let's go get it! This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

19:3128/07/2023

Podcast EP 17 Jerome Pow Wow Dud, Jul 26

Available on Spotify and iTunesTwitter: nyugradsubstackThreads: nyugrad.substackShow NotesA record 13 straight up days for the DOW!!!Federal Reserve* Jerome Powell and team raised rates by .25 basis points.* Forecasts No Recession* People are still getting too many good jobs. * Not enough unemployed* Inflation is still too high* Wants to decrease security holdings* It will take time for what they have done to impact inflation3:00pm ET ScreenshotOnce Jerome Powell finished speaking$META Facebook reporting after hours and I must say it was impressive. * Beat revenue estimates by 3% & beat guidance by 4.1%.* Slightly beat user growth estimates for Facebook & its Family of Apps (FOA)* FOA revenue beat estimates by 3.8%.* Beat ad impression growth estimates of 17.8% Y/Y with growth of 34% Y/Y. $CMG Chipotle was down -8.76% after earningsFinancial Freedom is not free but the pursuit is worth the treasure. Building a community with that goal. Let's go get it! This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

13:5427/07/2023

EP 15 Nothing Burger Monday, Jul 24

Listen on Spotify and iTunesTwitter: nyugradsubstackThe world awaits $GOOGL $MSFT $META and #FOMC Wednesday. Don’t forget the Fulton vs Inoua match Tue 8am EST. Here are some photos from East River. Really a great day to take a half day off. Financial Freedom is not free but the pursuit is worth the treasure. Building a community with that goal. Let's go get it! This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

10:4725/07/2023

EP 14 Let's Get Ready To Rumble!!! Jul 21 Data

On Saturday one of my tweets went viral. And I want to to thank you again for subscribing to my Substack and twitter: nyugradsubstack.Below is the content that I tweeted that has over 100k+ impressions over the weekend. I want to thank Danielle DiMartino Booth from Q.I. Research and Craig Fuller from Freight Weight.Knight-Swift Reports 71% Earnings Drop for Q2 $KNX@DiMartinoBooth has been alerting everyone on "destocking". here is another proof point...CEO David Jackson said during a call with investors. “I don’t know that we’ve ever seen freight demand fall this far so fast and for so long without an accompanying economic #recession.”Something fun to look forward to if you like combat sports. Main card should start around 8am NYC time Tuesday on ESPN+. Both undefeated.I am skipping “EP Thirteen” to ward off any bad luck.Friday action was muted. A calm before the storm maybe? But at 3pm breadth kicked into gear south. And Russell 2k lead down all day. $AAPL and Magnificent 7 were being distributed all day.Look at the divergence on $AAPL via RSI and MACD. This is how you sell the largest position in the galaxy. Consistently and before anyone realizes.Breadth272 new highs73 new lows46% advancing 48% advancingWhat stuck out?Consumer Credit is getting maxed out. Below is a clip by Lending Club CEO touting their TAM (Total Addressable Market) from data showing maxed out consumer debt and record high revolving credit interest rates.Here is the interest the government and we are paying on the national debt. This is not sustainable for a country or global reserve currency.What to watchEarningsFomcSlew of data10 YR / USD / BONDS /OILFriday 3:08 PM Charts below. You can see the selling pressure.After hours #WSB reddit #yolo crew buying $AMCThanks for reading NYUGrad Stocks and Finance! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

16:3924/07/2023

EP 12 "ChatGPT A.I needs Work Life Balance!" Jul 20

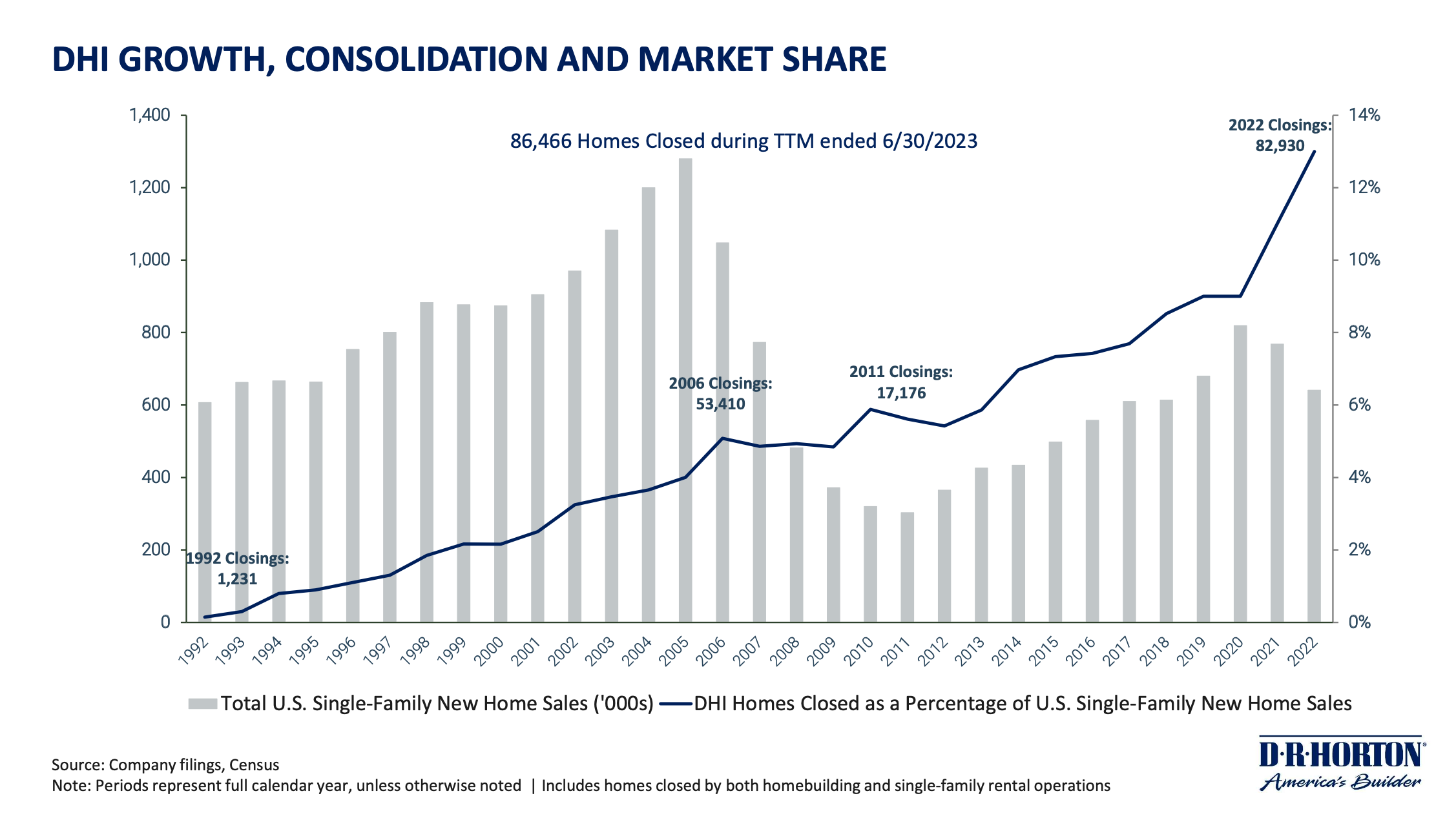

Listen on Spotify and iTunes"Over just a few months, ChatGPT went from correctly answering a simple math problem 98% of the time to just 2%, study finds"…researchers found that in March GPT-4 was able to correctly identify that the number 17077 is a prime number 97.6% of the times it was asked. But just three months later, its accuracy plummeted to a lowly 2.4%.Source: Stanford University$DHI market share of sold/close homes in AmericaSource: Slides from DR Horton Gallery of Home builder stocksReports of Russia bombing grain silos in UkraineFinancial Freedom is not free but the pursuit is worth the treasure. Building a community with that goal. Let's go get it! This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

20:0321/07/2023

EP 11 "Tesla CYBER TRUCK - I ordered my Dream Car!" Jul 19

Listen on Spotify and iTunesHere are some of my photos I took from the boat heading south on the Hudson River today.Yield curve worse than 1929 and 2008 (Game of Trades)Financial Freedom is not free but the pursuit is worth the treasure. Building a community with that goal. Let's go get it! This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

22:4520/07/2023

EP 10 "Bankers Gone Wild" Jul 18

Morgan Stanley, Charles Schwab, BofA all report great earnings. Will Goldman live up? Microsoft is going on the A.I offensive by introducing "CoPilot" for $30 per user per month. Very bullish action covered in under 15 minutes!Subscribe at nyugrad.substack.comtwitter: nyugradsubstack This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

10:4819/07/2023

EP 9 The S&P Sharted (Monday, July 17)

Listen on Spotify and iTunesHere is the ES losing 50% of the days gains in last 30 minutes!One company I forgot to cover is Pfizer $PFE It is now breaking the longterm trend line from 1977!!!Richmont Group was down 10%. Here are their brands:Financial Freedom is not free but the pursuit is worth the treasure. Building a community with that goal. Let's go get it! This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

16:2018/07/2023

EP 8 Bankers No Dice (Friday, July 14)

On this episode I quickly cover a muted Friday session, breadth, healthcare leadership, Consumer Buy Now Pay later, Sixflags, Disney and what to watch next week. Huge thank you to Doomberg for promoting the podcast and welcome to all the new listeners. Financial Freedom is not free but the pursuit is worth the treasure. Building a community with that goal. Let's go get it! This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

08:1317/07/2023

EP 7 #YOLO! My $XRP G-Wagon and Lambo! July 13 data

Listen on iTunes and SpotifyFinancial Freedom is not free but the pursuit is worth the treasure. Building a community with that goal. Let's go get it!below as of Jul 13, 2023 at 9:45pm NYFinancial Freedom is not free but the pursuit is worth the treasure. Building a community with that goal. Let's go get it! This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

16:1014/07/2023

EP6 "Gold and Silver Orgasm!!!" July 12, 2023

Apologies for my voice which sounds like I was pinching my nose. 101 Fever be damned, I am going to create content!Financial Freedom is not free but the pursuit is worth the treasure. Building a community with that goal. Let's go get it!Here is $AAPL vs the broader indices early in the day. It was again for 2nd straight day an anchor for Tom Lee and the bulls. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

12:3712/07/2023

EP5 "Higher and Higher" July 11, 2023

Listen on iTunes and SpotifySubstack regard to NASDAQ 100 RebalancingI misspoke and noted it was S&P 500. Which also should be re-balanced too eventually. Source NerdWallet This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

08:2811/07/2023

EP4 "Eating Risky Sushi" July 10, 2023

Listen on iTunes and SpotifyFinancial Freedom is not free but the pursuit is worth the treasure. Building a community with that goal. Let's go get it! This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

10:5511/07/2023

EP3 "How much for that Happy Ending?!" July 7, 2023

Financial Freedom is not free but the pursuit is worth the treasure. Building a community with that goal. Let's go get it! This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

13:3907/07/2023

EP2 That was Different! July 7, 2023 (Morning)

This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

11:1307/07/2023

EP1 Cruise Control July 6, 2023

Thanks for reading NYUGrad! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

10:1806/07/2023