Sign in

Sign in

Business

News

Daily Stock Market News under 15 min. No ads. No Politics!

Today's Stock Markets in under 15 min. No ads. No politics! Easy to follow for your morning coffee, dog walk or commute.

Substack Featured 3 times!

Recommended by Doomberg, Adam Taggart, Bill Cara and many others.

Unlock full episodes and Substack content with this discount. notyouradvisor.com/podcast25

Whether you subscribe for free or paid, you will gain value and ability over time to see stock market price movement in a way Wall St does not want you to see.

Paying subscribers get

- Exclusive content on every podcast

- Paid-only written content

- Private chat feed with real time alerts

- Stock screener on balance area setups

- Subscriber chart requests

- Lock in the price forever! www.notyouradvisor.com

Podcast EP 136 S&P 5,000 (Feb 8)

*No podcast Friday Feb 9th. Have a Happy Lunar New Year this weekend! Enjoy the SuperbowlPodcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesShow NotesSummary of the dayA moral victory, $SPX S&P 500 got its 5k print.Yet SPY had low volume of only 46m traded!Breadth* 848 new highs* 175 new lows* 55% advancing 40% declining* 43% below 50 day ma* 36% below the 200 day maStuck outReal Estate was the leading sectorStrongAFRM was up as high as 11% before earnings, but having constipation after earnings. You should listen to earnings call. Their prepared remarks were 12 seconds! apparently this is par the course for them. WeakPyplNycbEXPEWhat to watchNext week CPI & PPIWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Recommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

13:1108/02/2024

Podcast EP 135 Tokyo Drift Higher (Feb 7)

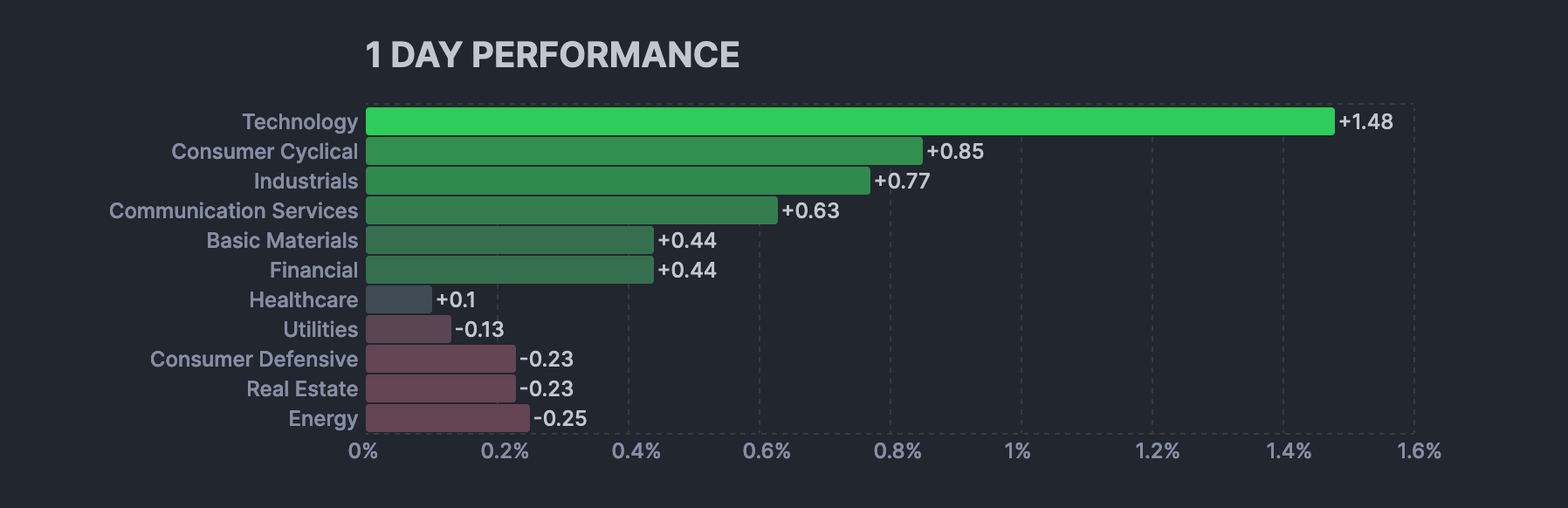

Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesShow NotesSummary of the dayDrifting higherTech in drivers seatSemi ConductorsRobloxBreadth* 996 new highs* 205 new lows* 48% advancing 47% declining* 44% below 50 day ma* 37% below the 200 day maStuck outBroad rally10 yr up to 4.19% yieldStrongWeakWhat to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Recommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

07:0807/02/2024

Podcast EP 134 Oh $SNAP (Feb 6)

Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesShow NotesSummary of the dayHonestly. Do I need to do a podcast tonight?* $SPY 57M shares traded.* $NVDA 67m shares traded* $NYCB down 22%* NQ negative* $TSLA up 2.2%* $SNAP down 30% after earningsBreadth* 383 new highs* 182 new lows* 71% advancing 25% declining* 42% below 50 day ma* 36% below the 200 day maStuck outNYCBNQ negativeStrongWeakWhat to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Recommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

10:3607/02/2024

Podcast EP 133 Welcome to the 2024 HUNGER GAMES! (Feb 5)

Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesShow NotesSummary of the dayDisclaimer: Prices can go a lot higher regardless of all below. Everyone who has a vested interest in higher prices are selling the data and stories that will make it so.That is why it is counter intuitive to consume too much financial content. Even mine. That is also why my podcasts are so short vs what you see out there in the marketplace. I try to focus on the things that matter most in under 15 min.The market already has priced all below news into prices already. That is also why I note that listening to earnings is for entertainment only. The price action is king.When you can ingest “NARRATIVE” data like earnings and sell side packaged news and still function as a trader and win, you are making huge progress in the psychology of trading. So before I get into the narrative data, I want to point out charts and “What Stuck out” section first! Because price action and charts are more important than news and narrative. I would say the healthy ratio of attention or head space for a good trader is at minimum 90:10. 90% price action and psychology vs 10% news, earnings and narrative. Stuck out over the weekend$NDX Nasdaq 100 ratio chart to QQEW Equal Weight NasdaqHere is the Semi-conductor index $SOX:The Semi Conductor index has tested this Red resistance line only three times since the peak of Dot-com. Here we are again!Closeup:I now present to you JP Morgan (Linear chart). $JPM. Maybe it is nothing. Maybe this trend line will be made irrelevant as it roars higher? We just breached it. Since the year 1998, it has only touched this line twice (dotcom and covid) upon which sold off along with broader markets. Well here we are again…$XLF #BANKS#WALLSTHere is #Apple $AAPL (Log chart)This purple trend has been tested 6 times since the Dot-com crash. It got close during the Great Financial Crisis in 2008, but no cigar. 3 times since the bottom of New Yrs Eve 2022. Maybe it is nothing. But if that trend line breaks down, watch out for your retirement accounts! Look at the second chart. We pierced below it on Friday before defending it. Well here we are again…Bouncing today, Monday trying to test 50 day ma.And new data from my weekend content consumption of Adam Taggart and Sven from Northman trader. A negative divergence in Value Line XGV.Financial freedom is not free, but the treasure is worth the pursuit! Now let’s get into the narratives…Mother of all doom scrolls by Elmo. It doesn’t seem everyone is “fine” with how things are going in America as they claim.https://twitter.com/elmo/status/1751995117366296904And in a story I haven’t seen anywhere except via Peter Schiff, Nobody Special on YouTube and Adam Taggart, the Fridays jobs report was simply a lie.I checked the math. All they did was revise last yrs monthly numbers so the narrative can read “America has never been better! Vote for me” No one on @business, @CNBC @FoxBusiness, etc cares about you. They are all sell side shills making money. No one is coming to save us! They all report to team green.Nobody Special on YouTubeYou have to zoom out to see the big picture. Why would the Fed say last Wed no cuts until weakness in employment/wages? Then this fake blowout jobs data is released Friday? Everyone to kingdom come on media saying wow. And that the US economy is so strong! And yet…https://www.youtube.com/live/0jZcAkf4z5oThe answer is kick the can down the road for elections. While we all suffer in reality, they all campaign in fantasy. This is not going to end well. I believe the s**t will hit the fan well before the election.I take some liberty in quoting a mentor Bill Cara out of context but on brand.The independent investors of the West have succumbed to the media onslaught from their governments, Wall Street, central bankers, and WEF globalists. Our people have become sheeple, ready to be sheared of our wealth.When will we learn that ETFs are their Border Collies? If we stop trading their ETFs, we restrict their ability to manage the herd. If we invest only in quality companies based on asset valuations and revenue, cash flow, and earnings growth, we win. It’s only a matter of time.They then trotted Jerome Powell again on a Sunday before the Grammys to sell us. But look at the comments of the video itself! Does that sound like inflation has come down? Breadth* 289 new highs* 343 new lows* 20% advancing 76% declining* 49% below 50 day ma* 39% below the 200 day maStrongNVDAONARMOILWeakWhat to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Recommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

23:4805/02/2024

Podcast EP 132 Fuckbook (Feb 2)

Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesShow NotesSummary of the dayNon Farms payrolls came in double of expectations! Wages also grew per the report. Big big problem for rate cut bros.Biden will use this on the campaign trail. The data is dubious at best. 10 yr spiked 4.84% to 4.04% yieldMETA up 21%!!! Important not to let in biases in trading. Like yesterday when I said I hate Facebook as a co. I bought META when it was originally FB and I made 3x. But it is an important lesson as while I got the trade right, I also shunned the company. Out of sight and out of mind, and never traded it again. So I locked in the gain in yellow. But I never traded the blue area. Breadth* 912 new highs* 279 new lows* 36% advancing 60% declining* 39% below 50 day ma* 36% below the 200 day maStuck outStrongNVDA AMZN METAWeakHousingEXTR down 4.77%KGC down 4.35%KRUS down 3.87%GDX down 3.48%What to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Recommended byDoombergAdam TaggartHerb GreenbergMentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

19:1502/02/2024

Podcast EP 131 Kobe for the WIN! (Feb 1)

Eventually you will have to get on the fieldPodcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesRecommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesAsking for a favorDear Friends Subscribers and Pledgers to my Substack, please post a shout out here if you find my content and work valuable.I created this Substack to share my trading knowledge and also build a community. I also introduced a daily 15 min podcast about the topline of stock markets without ads or politics, after I couldn’t find similar for myself. This really has been a joy to create but I need the support of the 2k+ subscribers. Anything you can do to help amplify I would appreciate :)NYUGrad and Substack Writers so I am notified and others can easily find my publication. Bonus Quote a favorite line or passage from a recent post. PS My tag line is “Financial Freedom is not free, but the treasure is worth the pursuit.”Summary of the dayMETA up 14% ahAMZN up 7% ahAAPL down 3.17% ahIAC to buy Ask Jeeves for $1.85 bln, 2005WTF? why you bringing this up? Listen to the PodcastBreadth* 410 new highs* 177 new lows* 72% advancing 24% declining* 35% below 50 day ma* 34% below the 200 day maStuck out10 yr yield is crashing. Stocks up. Told you. Both can’t trade in tandem for longStrongWhat wasn’t?WeakQCOMKREEXTRAFRMWhat to watchNon Farm Pay roll FridayUnemploymentWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

26:1502/02/2024

Podcast EP 130 Sexy Jutsu! (Jan 31)

Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesRecommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the dayWhat a circus the Financial markets are. We all hold our breath to extrapolate the musings of one organization and one man. People are making careers off reading Jerome Powell’s tea leaves. It’s just one big magic trick to distract while they attack, like Naruto’s most powerful ninja spell, the “SEXY JUTSU!”2pm ET headlines read, “S&P 500 retreats as Fed says it’s not quite ready to cut rates”Most notably he said he would cut rates early if he sees our asses getting fired. Backward world huh? Now the C suite will have to weigh: * Rollover short term debt at 7% rate* Or fire people and get the lower rateWe finished at the lows.And this morning the real big news not getting it’s deserved coverage was $NYCB. Two big CRE loans imploding on them. No one had the courage to ask Powell about it.“BREAKING: New York Community Bank stock, $NYCB, the bank that acquired the collapsed Signature Bank, falls 40% after earnings.The bank announced that they will be cutting their dividend by 70% to meet regulatory requirements.They also reported a 4th quarter LOSS of $260 million while expectations were for a GAIN of that size.This comes just a few weeks before the Fed's emergency loan program is set to expire.Some small banks are still feeling the pain.”https://twitter.com/KobeissiLetter/status/1752705616873955376?t=jK7ODenI1SsfvEOqQLVVEwBreadth* 486 new highs* 180 new lows* 23% advancing 73% declining* 38% below 50 day ma* 36% below the 200 day maStuck outSomething I wanted to share with my subscribers. If you want to go long Semiconductors, just go long $NVDA. It has performed just as well as the 3X long SOXL, with less risk on the downdrafts. StrongQualcomm beats. Up 3.3% ah. However sold off a bit as the call started. Now down 2%.All slides. WeakWhat to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

08:2331/01/2024

Podcast EP 129 Say "AI AI AI AI AI" 150 times (Jan 30)

Meet Bard Alphabets’ new IR moderatorGoogle CEO and team said “AI” over 150 times. Benchmark!Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesRecommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the dayIf you produce $10m top line for the business but if they can replace you with AI that can produce 5m top line at zero costs in sales marketing while boosting enterprise value, you will be cut. Anyone who bought $GOOGL Jan 18 fwd is sweatingRegardless if what happens to the stock $MSFT, Satya Nadella is a real ceo. I dont think msft will go out of business. Fyi. He went to grade school with Adobe $ADBE ceo Shantanu Narayen. They run great great cultures. I know as my employer was acquired by adobe and i had the pleasure of meeting both during a c suite client event. The global role i served under adobe was the best times of my w2 careerBUT GOOGL and MSFT and AMD are selling off after hours. $SMH $SOX are not looking good. Breadth* 876 new highs* 129 new lows* 37% advancing 57% declining* 31% below 50 day ma* 34% below the 200 day maStuck out$SPY volume low again! Everyone is waiting on earnings and The Fed!Volume 55,826,647 vs Avg. Volume 77,671,870Strong10 yr yield still above 4%GM up 7.8%WeakWhat to watchFed Rate Decision and dot plot Wed 2pm. If Jerome confirms we will get a rate cut 6 times in 2024 at minimum, everything will rally for a little while. Until they realize wtf? Why is my mom letting me have ice cream before dinner and date that person she hates so much. Watch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

12:4930/01/2024

Podcast EP 128 Pre Game for Wednesday (Jan 29)

This year’s Super Bowl tickets are the most expensive everAs of Monday, the February 11 game is the most expensive Super Bowl on record, according to TickPick. The average price is hovering around $9,800, which is 70% more expensive than last year’s big game.The current “get-in” price (the cheapest) for this year’s game is $8,188, which is more than 50% more expensive than the cheapest ticket price of last year’s Super Bowl during this time, when it cost $5,997.Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesRecommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the dayNever count out the Fed and their buddies. Low volume rally surgeBreadth* 1000 new highs* 147 new lows* 73% advancing 22% declining* 29% below 50 day ma* 33% below the 200 day maStuck out$VIX greenStrongWeak10 yr yieldAAPL down .36%What to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

08:2329/01/2024

Podcast EP 127 $NVDA Singularity (Jan 26)

NVIDIA is the Market & the Market is NVDAPodcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesRecommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the dayA lot may have happened, but I was focused on not over trading today. No trades, just raising my stops. I was literally watching $NVDA, Breadth, and the 10 yr all day. The market right now is a light switch. NVDA is the lever that is moving all boats. It is in essence the entire tide. All the hopes and dreams of the market. Whether you look at NVDA against its top Semi conductor peers or the Mag 5 (minus aapl and tsla), you can see that NVDA is in the bull market driver seat. Breadth* 615 new highs* 98 new lows* 52% advancing 44% declining* 32% below 50 day ma* 35% below the 200 day maStuck outTech leads down due to Intel and Semi sectorStrongBitcoin bouncedAirbnb up 5.28%HOV up 4.89%WeakIntel finished down 11.91%What to watchEarnings next weekWed Jan 31 Fed rate decisionWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

12:3827/01/2024

Podcast EP 126 Gushing Semi-Conductors (Jan 25)

Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesRecommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the day3:57pm. Very strong close. Lets talk about NVDA. INTEL.Semi-Conductors are running out of gas! Check out $SOX , $SMH , $NVDA , $ASML , $LRCX . My point is watch $NVDA. it is the chip market!It is a race of $META and $NVDA . The largest buyer of NVDA AI Chips and largest supplier of AI chips. Freebie. My 2nd barometric reading is almost there. This is the money printing machine in 1 chart. Multiple crashes and rallies. My long term target for this ratio chart is $25 USD. Either vix is exploding or prices of risk assets declining, and or both. Disclaimer: we can still rally some more from here. Especially if the Fed rate cut happens Jan 31 since everyone is expecting it. Watch the banks as they need lower rates.For your consideration:Here is the follow up debate to Thoughtful Money’s original Doomberg Peak Oil interview. Be ready to learn, think and formulate your own opinion. The best of the best hosted by@Adam Taggart with guests @Doomberg and Adam A. Rozencwajg.#OIL #ENERGYBreadth* 510 new highs* 161 new lows* 68% advancing 26% declining* 32% below 50 day ma* 35% below the 200 day maStuck outLot’s of strength everywhere!But weakness where it matters most! $NVDA, $AAPL, TSLA, Financials were eh.StrongWeakVisa $V off 2.4% on earnings after hours. PAY OFF YOUR CREDIT CARDS!Slides from IRIntel $INTC down 7% plus after earnings. Presentation deck, only 9 slides with content. What to watchJan 31 Fed rate decisionWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

11:4026/01/2024

Podcast EP 125 Bad Decisions (Jan 24)

For those who don’t know, the above is the KPOP group BTS. They have a song titled “Bad Decisions” Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesRecommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the dayHe doesn't post often but always watch out for Diego Parrilla and his work. I recommend his interview below.I love his framework...Stages of expertise* Unconscious incompetence* Conscious incompetence* Conscious competence* Unconscious competenceThe entire video is masterclass. I especially loved at 19min market the hard lesson on conviction and the market doesn’t care about yours. He was in a gold position that was going against him and he asked his boss at JP Morgan if he can double up. Diego was told to sell the position and buy it back twice. In effect his manager was becoming his stop loss. So after he got out of 10,000 ounces of gold and was ready to buy back in 2x the size, he paused and stopped. My takeaway is never ever fall in love with a position. Speaking of bad decisions! Per Slopeofhope.com. In spite of the fact that, even in this brain-dead goes-up-every-day market, TSLA has been bucking the trend day after day, the degenerate gamblers at WSB figured they should put their life savings into TSLA calls.Here’s one example. As the poster says, he started with $250,000, and he put his surviving few thousand bucks into TSLA calls. I suspect his days as a “trader” are now over.Breadth* 970 new highs* 142 new lows* 42% advancing 54% declining* 35% below 50 day ma* 36% below the 200 day maStuck outTSLA after hoursIf you are curious, here is the Tesla Investor Deck. And Webcast. The Q&A is the best part. StrongWeakWhat to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

15:1925/01/2024

Podcast EP 124 Violent Delights Have Violent Ends (Jan 23)

The wonderful show Westworld quotes Shakespeare from Romeo and Juliet. I recommend you check out the series. Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesRecommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the dayWith 10 min to go into close, volume was half the avg! QQQVolume 26,650,188Avg. Volume 47,111,732SPYVolume 38,164,444Avg. Volume 79,973,455Breadth* 538 new highs* 124 new lows* 47% advancing 48% declining* 32% below 50 day ma* 36% below the 200 day maStuck outMag 7 partyTSLA fought back. Earnings ThuDR HortonStrongNFLX higher after earningsTXN lower after earningsWeakReal estateBitcoin couldn’t hold onto $40k.What to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

05:4023/01/2024

Podcast EP 123 Stay Focused Daniel-San (Jan 22)

Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesRecommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the dayWhen you see everyone drunk on euphoria and comingling on one side of the boat including the crew, you must stay focused on the threat of icebergs.These ratio charts compare SMH to Nasdaq 100 and the SPY. As you can see we are challenging the yr 2000. And it took a mountain of debt to get there. Look at the cost to get to these nosebleed levels:Regarding Jobs:The last time we had 12 consecutive months of negative revisions to jobs reports was 2008. Back then it was -65k on avg negative revision. In 2023 we hit negative 43k on avg per month of negative revisions. (Source Danielle DiMartino Booth ) The Bureau of Labor Statistics.81% of job growth was govt jobs for 12 months through December 2023. https://www.youtube.com/live/ZWgH-H8-fjoI realize this has nothing to do with todays price action. But it is important to never lose sight of the Forest.Breadth* 1051 new highs* 292 new lows* 70% advancing 25% declining* 31% below 50 day ma* 36% below the 200 day maStuck outBulls win againStrongWeakWhat to watchJan 31 FOMCWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar EarningsFinancial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

12:4722/01/2024

Podcast EP 122 Dog Eat Dog World (Jan 19)

*Me micromanaging short entries in the afternoon FridayPodcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesRecommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the day* Roller coaster session* S&P breaking out of range, tech leading* Yields still sticky* Strong close* Bitcoin on edge of cliff* Telsa on edge of cliff* Jan 31 is FOMC rate decisionBreadth* 793 new highs* 341 new lows* 66% advancing 29% declining* 34% below 50 day ma* 37% below the 200 day maStuck out10 yr yield 4.13% regardless of this rallyStrongWeakGold relatedBitcoin relatedWhat to watchJan 31 FOMC rate decisionWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

16:3621/01/2024

Podcast EP 121 Made in Taiwan (Jan 18, 2024)

Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesRecommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the day* TSM Taiwan semi conductor ignited AAPL* Strong finish with AAPL carrying the load with rest of Mag 7* TSLA lagging bad* COIN finished near lows* Bitcoin under 50 day* Yields stubbornly strongWill the Fed cut rates when the labor market is the 'best' in over 50 years? Will they manufacture another crisis so they can cut? Breadth* 291 new highs* 310 new lows* 58% advancing 37% declining* 37% below 50 day ma* 39% below the 200 day maStuck out* TSLA lagging bad* COIN finished near lows* Bitcoin under 50 day* Yields stubbornly strongStrongMag 6WeakCOINMARARIVNBRRRBTCOVIXARKBFBTCIBITKVYOWhat to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

09:3019/01/2024

Podcast EP 120 Lie to Me in Davos (Jan 17, 2024)

Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesRecommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the dayHow did we finish? Just like yesterday. Massive selloff impulse into last 10 min. This is controlled selling. You have been warned.My lie detector is still working pretty goodHow is breadth doing since 2pm? While mkts bounced, you could have known the true intentions. On Tue apparently the selling was attributed to Fed head Chris Waller who dissapointed markets with projecting only 3 rate cuts vs 6. How juvenile. It is akin to children begging for sweets. "This view is consistent with the FOMC's economic projections in December, in which the median projection was three 25-basis-point cuts in 2024".This morning Lagarde (ECB) warned that market expectations weren’t helping policy makers in their fight against inflation.“It is not helping our fight against inflation, if the anticipation is such that they are way too high compared with what’s likely to happen."And inflation stopped going down, with what seemed to be an uptick. Keep in mind these are all phony govt numbers. So if their metrics show inflation is slightly reaccelerating, that means it is raging.Breadth* 112 new highs* 451 new lows* 21% advancing 75% declining* 38% below 50 day ma* 39.5% below the 200 day maStuck outYields are risingStrongVolatilityWeakWhat to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

27:2618/01/2024

Podcast EP 119 Snow Job (Jan 16, 2024)

Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesRecommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the dayReverse order with time stamps3:58pm look at the selling momentum into the close! It is telling me that last 10 minute ramp is suspect and a snow job.Breadth* 227 new highs* 346 new lows* 19% advancing 78% declining* 32% below 50 day ma* 37% below the 200 day maStuck out10 yr yield gained 3% to close at 4.06%StrongWeakWhat to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

16:1616/01/2024

Podcast EP 118 Frigid Week Inbound (Jan 12, 2024)

Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesRecommended byDoomberg Adam Taggart Herb Greenberg Mentored by @BillCaraSubstack Featured 2XPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the day* TSLA well below its 200 day* Bitcoin and related ETFs all red* 10 yr sticky at 3.9 - 4%* Real estate shares red* Oil and Nat Gas up on war and weatherBreadth* 588 new highs* 140 new lows* 51% advancing 43% declining* 26% below 50 day ma* 34% below the 200 day maStuck outStrongWeak$TSLA is 3% of Nasdaq 100 and 1.7% of S&P500. It is becoming the next Blackberry. Hertz is selling off 20k EVs and Tesla cars are 80% of that. Not a huge number but Model 3 from Hertz are listed at $17k. After rebates $14k. Seems everyone including Tesla are cutting prices.What to watchEarnings have begunWatch bitcoin relatedWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the treasure is worth the pursuit. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

31:2413/01/2024

Podcast EP 117 She/Her/It Terminator (Jan 11, 2024)

Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the daySo much to cover today!CPI data came in hot. The writers for the sell side went into scamble mode.The bitcoin etfs started trading today and it was messy. $MARA opened up 5% then settled down at the lows. Bitcoin itself hit 49k but sold off.The sell sides Apex Terminator model came onto CNBC and proclaimed it was likely after the etfs were approved, that each $BTC will reach $1.5m USD!!! Yeh and Gold will be $10M USD per ounce! There is nothing to smile about in the top 10 holdings of ARKKThe market tried to rally at lunch time. First the $VIX was pummeled but no rally. Then the 10yr was pressured below 4% and that did the trick.But look at breadth, specifically the NYSE ADV/DEC up down volume as of 3:20pm. It would have told you rallys were to be sold.COIN which is 10% of ARKK finished at lows of the day. Yet they are supposed to be the custodian for the majority of the approved spot bitcoin ETFs.10 yr yields closed at lows of the day. It holds the fate of prices.Breadth* 424 new highs* 202 new lows* 39% advancing 56% declining* 25% below 50 day ma* 34% below the 200 day maStuck out10 Yr Yield under pressureTSLA loses 200 day maStrongMagnificent 6WeakWhat to watchPPI FriWatch Crypto Animal SpiritsWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

14:0811/01/2024

Podcast EP 116 Believe (Jan 10)

Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the dayMy breadth study has confirmed the initial signal to be defensive. This does not mean sell everything. Or short everything. It is one of my indicators of many, but it has proved reliable with minimal fake outs. And I am saying this as NVDA, META, and GOOGL, are making new highs.However the day was very bullish, regardless of slow volume on SPY. The hotly anticipated Bitcoin etf finally arrived after hours…I think?! 11 total ETFs. That is a lot of sales and marketing teams all out pitching and selling.Breadth* 430 new highs* 181 new lows* 53% advancing 42% declining* 23% below 50 day ma* 34% below the 200 day maStuck out10 yr yield not yieldingStrongNew Highs for NVDA, META, GOOGL, ISRG, COST, TJX, HD, VRTX, JNPR, MA, V, GE, LLY, KBH, DHI, PHMWeakEnergyWhat to watchCPI NumbersFri PPIWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

06:5511/01/2024

Podcast EP 115 $1M per $BTC coin (Jan 9, 2024)

Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the dayYou can’t make this up. On the eve if the spot bitcoin etf approval, I wanted to share a reminder…when someone says any 1 unit of measure for a speculative vehicle will go to $1m USD by a certain date…run!Saylor “You do not sell your bitcoin!” (until I sell 1st)Cathie “Bitcoin Will Be $1 Million per Coin by 2030”Breadth* 194 new highs* 172 new lows* 28% advancing 68% declining* 23% below 50 day ma* 34% below the 200 day maStuck outStrongWeakWhat to watchCPI ThuPPI FriWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

14:0210/01/2024

Podcast EP 114 Don't Panic, OK Panic (Jan 8)

Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the daySkipping #113 to avoid bad luckStrong rally all day Lots of anticipation for spot bitcoin ETF approval this weekBreadth* 240 new highs* 173 new lows* 72% advancing 24% declining* 21% below 50 day ma* 33% below the 200 day maStuck out10 yr yield fought back to close above 4%It’s all about the BitcoinsStrongWeakEnergyWhat to watchanimal spirits for spot bitcoin etfCPI data ThuPPI FriWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

09:2309/01/2024

Podcast EP 112 Take some INITIATIVE in 24! (Jan 5, 2024)

Podcast Available onSpotify | Apple | Google Podcasts | AmazonFollow me on Substack NotesPremium Service Preview“Honesty in a sea of deception is of great value” - Ralph (Pledged)“I like your in-depth analyses of the markets as well as pointing out what might lurk underneath that could rise up to bite us” - Sorell (Pledged)—“Your Wrap on the markets every day keeps me focused and grounded” - Lj (Pledged)—"I want to learn how to read the market for longer term trades as opposed to what Wall Street wants me to do” G.M (Pledged)—"I like your objective view on the markets” Ron P (Pledged)—"Good info. Succinct and relevant. Very good calls this month.” Andy J. (Pledged)I want to thank the 2000+ Subscribers who support the Substack! * I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content viewable in daily show notes for Premium subscribers* Complimentary PDF copy of the upcoming book "The Maverick Investor's Handbook" by Bill Cara, one of my mentors. (a $20 value but priceless learnings).*This book is geared toward longer time frame investors, Baby Boomers retiring who want to manage their own 401k/wealth, and younger investors trying to avoid the #YOLO gambling* Over time you will develop ability to analyze the markets and become more comfortable making your own decisions and controlling your own wealthI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”Show NotesSummary of the dayA pullback to the 50 day ma for $SPX would be normal and still maintain bullish momentum. Keep watching yields. Under 4.5% is good. Over 4.5% is bad.Trade setupI wanted to share a freebie trade setup. This is a preview of the type of technical setups I wll share from my observations of hundreds of charts and companies per day. $ARKK. Most will know this stock as ARK Investment Management LLC, managed by Cathie Woods. She is usually a regular on CNBC talking her book. The entire holdings of $ARKK are here. Top 10 below:Perfect setup whether you are bullish or bearish. Defined risk, defined stops. Offers initiative trade expectations. If you got in on Dec 13, 2023, it offered a nice pop for a trade. You could have easily sold for profit before the New Yrs eve party. ARKK today:It is currently offering a similar balance area to watch and trade. If you are bullish in the market and thus bullish on $ARKK, as it has performed very well in line with QQQ, you can go long or buy options as it breaks up initiatively out of this range. If you are bearish the market or ARKK you can sell short or buy options as it breaks initiatively down out of this new range. Each trade offers an attractive risk reward and areas to put in stops. Even better, ARKK is also in a state of back testing a breakout from a huge basing pattern. It will either back test and go up, or backtest and fail. The least likely scenario is that it will chop for a long time. Another example of this setup can be seen if you travel with me in my time machine. $SNPS Synopsys is a company not many people have heard of. Synopsys is an American electronic design automation company based in Mountain View, California that focuses on silicon design and verification, silicon intellectual property and software security and quality. If you bought the multi-year range breakout on Dec 2, 2013 at $37, you would be up 1,200% today. Sure, not as great as $NVDA at 13,000%, but it was an still is a non stop elevator ride. Initiative trades coming out of a balance areas in either direction, are what you should be hunting. Hope you enjoyed this preview of one type out of many setups that my Premium service will focus on, in addition to continued education!Breadth* 148 new highs* 130 new lows* 47% advancing 47% declining* 22% below 50 day ma* 34% below the 200 day maStuck out10 Yr is 4.03%. Russell was weakest but indices didn’t move much.StrongKRUS up 17% on earnings. Might be over extended.WeakWhat to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

21:4105/01/2024

Podcast EP 111 When Chick-fil-A is Closed Sundays! (Jan 4, 2024)