Sign in

Sign in

Business

News

Daily Stock Market News under 15 min. No ads. No Politics!

Today's Stock Markets in under 15 min. No ads. No politics! Easy to follow for your morning coffee, dog walk or commute.

Substack Featured 3 times!

Recommended by Doomberg, Adam Taggart, Bill Cara and many others.

Unlock full episodes and Substack content with this discount. notyouradvisor.com/podcast25

Whether you subscribe for free or paid, you will gain value and ability over time to see stock market price movement in a way Wall St does not want you to see.

Paying subscribers get

- Exclusive content on every podcast

- Paid-only written content

- Private chat feed with real time alerts

- Stock screener on balance area setups

- Subscriber chart requests

- Lock in the price forever! www.notyouradvisor.com

Podcast EP 85 Mexican Standoff (Nov 6)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesSpecial Promotion AnnouncementIt has been less than six months and I want to thank the 1,300+ Subscribers who support the Substack! Going into the holidays I wanted to put together a special promotion which will cost you nothing now, but help show support for the work I am doing.* 33% discount for Pledging to the future paywall (Annual, Monthly or Founders)* I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content* Timing: promotion good through Cyber Monday, November 27thI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”* Enter your information on a page that looks like belowShow NotesSummary of the dayMuch needed breather for markets. It is actually quite healthy for bulls for this pause. But yields fought back today.Breadth* 133 new highs* 132 new lows* 30% advancing 64% declining* 59% below 50 day ma* 66% below the 200 day maStuck outVery quiet dayTSLA only mag 7 red todayStrongFRPTSGDKNGWeakWHOVAICAVADASHABNBAFRMETSYWhat to watchLOT of Fed officials speaking this weekJerome Powell speaks again ThursdayWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

12:2307/11/2023

Podcast EP 84 The Fed Pivoted this Week (Nov 3)

Podcast available on:Spotify | Apple Podcast | Amazon MusicFollow on Substack NotesSpecial Promotion AnnouncementIt has been less than six months and I want to thank the 1,300+ Subscribers who support the Substack! Going into the holidays I wanted to put together a special promotion which will cost you nothing now, but help show support for the work I am doing.* 33% discount for Pledging to the future paywall (Annual, Monthly or Founders)* I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content* Timing: promotion good through Cyber Monday, November 27thI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”* Enter your information on a page that looks like belowShow NotesSummary of the day and weekI believe we just witnessed a Fed Pivot. By the Treasury (Janet Yellen) selling more front end short term debt, and the govt and fed buying it, it increases demand and price. Thus decreasing rates. That news came out Wed but this bounce began Monday so I suspect that too was leaked. Go look at $GS stock price action on Monday Oct 30th. Check out the outperformance vs SPY. Coincidence I am sure.12:50pm last yr we had two 5-6% bounces in a down trend. Could be something. Could be nothing…12:41pm Santa is getting ready* AAPL NVDA MSFT META all above their 50 day ma.* 10 yr 4.5%* 195 new highs vs 82 new lows12:21pm the summary of the week in one photo8:38am Stock futures add 100 points after soft jobs report sends yields lower. ‘people are less prosperous as we hoped, thus we can maybe stop hiking’Sick world huh.PS we went from oversold to overbought this weekBreadth* 233 new highs* 102 new lows* 81% advancing 15% declining* 53% below 50 day ma* 64% below the 200 day maStuck outYields decreased 50 basis pointsStronganything that was weak. Ie housing. Roku, afrm etcWeakvolatilityWhat to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

22:0005/11/2023

Podcast EP 83 Collect Call to Santa (Nov 2)

Have you been Naughty or Nice? JANET YELLEN WILL KNOW!Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesSpecial Promotion AnnouncementIt has been less than six months and I want to thank the 1,300+ Subscribers who support the Substack! Going into the holidays I wanted to put together a special promotion which will cost you nothing now, but help show support for the work I am doing.* 33% discount for Pledging to the future paywall (Annual, Monthly or Founders)* I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content* Timing: promotion good through Cyber Monday, November 27thI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”* Enter your information on a page that looks like belowShow NotesSummary of the day5:25pm $AAPL sinking during conf call5pm My sense is we just pulled fwd most of the santa clause rally so big boys can sell before their holidays3:40pm it is time to buy insurance. At least to begin to. $VIX3:24pm Execellent post by @Based Money. It summarizes this rally. One word “Manipulation”3pm $AAPL approching prices right before iPhone 15 launch news1:20pm perfect ad to intice people to believe in Santa $SPX $SPY 11:35am here is your rally. $TNX tracks the 10 yr yield. For this to continue, hope that the 10 yr doesn’t bounce from here11:07am $RSP equal weight s&p50010:50am Be cautious. (we were nearing blow off top type action)10:20am Yields 4.69. Is helping. As i noted, for Santa rally we need:* Breadth to improve* Mag 7 to rally* And 10 yr below 4.5Looks like we are almost thereBreadth* 151 new highs* 212 new lows* 81% advancing 14% declining* 71% below 50 day ma* 69% below the 200 day maStuck outEverything was green. Apple sold off a bit after the conf call started but let’s see how it behaves before the open FridayStrongMassive short squeezeWeakAnything shortVolatility relatedWhat to watchFriday Jobs # Watch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

12:5002/11/2023

Podcast EP 82 Insert Coin (Nov 1)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesSpecial Promotion AnnouncementIt has been less than six months and I want to thank the 1,500+ Subscribers who support the Substack! Going into the holidays I wanted to put together a special promotion which will cost you nothing now, but help show support for the work I am doing.* 33% discount for Pledging to the future paywall (Annual, Monthly or Founders)* I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content* Timing: promotion good through Cyber Monday, November 27thI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”* Enter your information on a page that looks like belowShow NotesSummary of the day3rd green day in a row!Breadth still brokenMy takeaways:* The Fed is not thinking about thinking about cutting rates* They view that we all are still making too much money and buying too many things* Powell says it is likely that a slowdown will be needed to get inflation downHistorical performance assuming the The Fed has finished hiking already:Hat tip LizAnnSondershttps://twitter.com/LizAnnSonders/status/1719829522734830018?t=EStm7dRJn-F7zJ4PyrAS0w&s=19October tech layoffs up a lot, 2x from September.Breadth* 65 new highs* 498 new lows* 60% advancing 35% declining* 81% below 50 day ma* 75% below the 200 day maStuck outYields closed at the lows 4.75Indices closed at the highsES Levels to watchAAPLStrongHousing related on low yieldsAll sectors greenWeakVolatilityYieldsEXTRCVNAWhat to watchAAPL earnings Thu after closeFriday Jobs numbersWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

22:1302/11/2023

Podcast EP 81 Judgement Day (Oct 31)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesSpecial Promotion AnnouncementIt has been less than six months and I want to thank the 1,300+ Subscribers who support the Substack! Going into the holidays I wanted to put together a special promotion which will cost you nothing now, but help show support for the work I am doing.* 33% discount for Pledging to the future paywall (Annual, Monthly or Founders)* I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content* Timing: promotion good through Cyber Monday, November 27thI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”* Enter your information on a page that looks like belowShow NotesSummary of the dayGreat to see two positive days in a rowBreadth still stinksVolume was unremarkableYields still too highBreadth* 51 new highs* 433 new lows* 65% advancing 30% declining* 82% below 50 day ma* 77% below the 200 day maStuck outNAR ruling and what that could mean for how everyone buys and sells homes in America in near futureStrongWeakLLYAMGNNVDAZGCARTSGLYFTGDXWhat to watchWED - FED RATE HIKE AND DOT PLOTThu Apple earningsWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

15:3801/11/2023

Podcast EP 80 Ludicrous Speed! (Oct 30)

If you have never seen Spaceballs…run and watch!Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesSpecial Promotion AnnouncementIt has been less than six months and I want to thank the 1,300+ Subscribers who support the Substack! Going into the holidays I wanted to put together a special promotion which will cost you nothing now, but help show support for the work I am doing.* 33% discount for Pledging to the future paywall (Annual, Monthly or Founders)* I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content* Timing: promotion good through Cyber Monday, November 27thI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link.* Once you are a subscriber, you should see buttons that say “Pledge your support”* Enter your information on a page that looks like belowShow NotesSummary of the dayDow 30 and Magnificent 7-1, did their job today. TSLA was down today.This is how markets can be green and yet so many more new lows.Breadth remains horrible so that tells me this is not a base or a bottom.New for your consideration $SPX/$VIX ratio chartLink you can bookmarkhttps://schrts.co/irpkgybUBreadth* 49 new highs* 731 new lows* NASDAQ 12 new highs vs 191 new lows!* 66% advancing 28% declining* 83% below 50 day ma* 78% below the 200 day maStuck outOnly 2 stocks in DOW 30 were redVolume was lack luster even though we are so oversoldCrude oil higherStrongDOW 30 Magnificent 7 - 1TSLA down 4.79%All sectors greenWeakVolatilityWhat to watchFED WedAAPL ThursdayWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

22:2231/10/2023

![[Promotion announcement] Podcast EP 79 "Knowledge Lights the Way!" -Yoda (Oct 27) [Promotion announcement] Podcast EP 79 "Knowledge Lights the Way!" -Yoda (Oct 27)](https://substackcdn.com/feed/podcast/815483/post/138350686/7fc5c9b93536e06ae674b1dd89816925.jpg)

[Promotion announcement] Podcast EP 79 "Knowledge Lights the Way!" -Yoda (Oct 27)

“In a dark place we find ourselves, and a little more knowledge lights our way.” – YodaPodcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesSpecial Promotion AnnouncementIt has been less than six months and I want to thank the 1,300+ Subscribers who support the Substack! Going into the holidays I wanted to put together a special promotion which will cost you nothing now, but help show support for the work I am doing. * 33% discount for Pledging to the future paywall (Annual, Monthly or Founders)* I plan to turn on premium when we surpass 3000+ total subs* Pledging requires a credit card but it is not charged until Premium goes live* What will premium include? (at minimum)* Watchlist(s) (Bullish, Bearish, Price levels, if then scenarios)* Webcasts covering charts of all above* Additional Premium only content* Timing: promotion good through Cyber Monday, November 27thI want in! How?Instructions:* Subscribe by clicking “Subscribe” or this link. * Once you are a subscriber, you should see buttons that say “Pledge your support”* Enter your information on a page that looks like belowShow NotesSummary of the dayThere is a great disturbance in the Force!DOW tanks while NASDAQ is upIf you follow me, this should be no surprise whyBreadth* 44 new highs* 1255 new lows* NASDAQ focus: 8 new highs vs 413 new lows* 27% advancing 67% declining* 84% below 50 day ma* 79.9% below the 200 day maStuck outNo quit in sellingAll bounces are poundedVix Crush Friday might be dead10 yr was unchangedStrongGoldVolatilityWeakWhat to watchWednesday Federal Reserve rate decisionAAPL earningsWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

19:1328/10/2023

Podcast EP 78 Fury Road to a Bounce (Oct 26)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayClosed at lowsWhere will the bleeding stop?Breadth* 47 new highs* 1,002 new lows* 44% advancing 51% declining* 83% below 50 day ma* 78% below the 200 day maStuck outRally attempted but failed into closeThis was even with yields fallingStrongReal EstateWeakWhat to watchhow does AMZN react to earningsWatch mag 7 Watch yields Economic dataGeo politicalhttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

10:1827/10/2023

Podcast EP 77 There Can Only Be One (Oct 25)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayMSFT is the sole Magnificent 7 to still be above the 50 day ma!META aka Facebook Reality Labs losses rise, with total expenses to $89 billion!!!Breadth* 52 new highs* 1227 new lows* 21% advancing 74% declining* 83% below 50 day ma* 78% below the 200 day maStuck outThe markets are losing the Magnificent 7Sold off all dayGoogle down 9%+ wowNVDA down 4.31%AMZN down 5.58%META down 4.17% before earnings. Under 50 dayStrongVolatilityMSFT last one standing above 50 day maEnergyYieldsWeakCommunication servicesWhat to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

14:3026/10/2023

Podcast EP 76 Napoleon's Ice Trap (Oct 24)

Battle of AusterlitzBy 2 o’clock, the Coalition centre had ceased to exist, and its army was broken in two. The French masse de décision swung to the south. Too late, Buxhöwden attempted to extricate his men. By 3 o’clock, the Allied line was breaking up, thousands of men fleeing to the south, towards the frozen lakes on the edge of the battlefield. Napoleon ordered up 25 cannon to smash the ice on Lake Satschen. As it broke up, it tipped thousands of Russians into the freezing water beneath; no one is sure how many drowned, but around 2,000 is a likely figure.Source: https://www.military-history.org/feature/the-battle-of-austerlitz-napoleons-masterpiece.htmPodcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayThe Ice is getting thinner each day.Strong day. But breadth makes me pause.only 2 of the Mag 7 are above the 50 day after Alphabet reportedBreadth* 43 new highs* 545 new lows* 66% advancing 28% declining* 81% below 50 day ma* 74% below 200 day maStuck outMeta and MSFT are only Magnificent 7 trading above the 50 day maBreadth is still badFinancials still badLeading sector was UtilitiesStrongWeakBreadthWhat to watchWatch mag 7 Watch yields EarningsEconomic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

08:5025/10/2023

Podcast EP 75 Monday Blues (Oct 23)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the day* Dow and Russell lost all of the pop* S&P lost half the pop* Nasdaq lost 1/3 of the pop* Breadth was flat then weak into close* Today was simply a deadcat bounce trying to toy with the 200 day ma* markets in trouble until breadth isnt horrendous like today and every past dayBreadth* 45 new highs* 1,310 new lows!!! * 30% advancing 65% declining* 83% below 50 day ma* 73% below 200 day maStuck outWe closed 1 pt away from my prediction of 4240 on ESStrongDefine strong? a few mega caps were up 1% to hold the markets upWeakFinancialsReal estateEnergyWhat to watchWatch mag 7 Watch yields EarningsEconomic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

09:4624/10/2023

Podcast EP 74 Friday 13th The Sequel (Oct 20)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the day* Worse than last week’s Friday the 13th!* 8am Fri I posted: I would be surprised if there isn't some rally attempt. After all it is vix crush Friday. 4335 ES is where I think it would run out of gas if there is am attempt. But if we break 4240. Wowzer* It was an ugly ugly dayBreadth* 27 new highs* 1006 new lows* 24% advancing 71% declining* 82% below 50 day ma* 85% below 200 day maStuck outEqual weight s&p and nasdaq looks horribleYields look like they want to continue higherTsla is being sold hardChartsStrongVolatilityYieldsWeakWhat to watchWatch mag 7 Watch EarningsWatch yields Geopolitical ConflictsEconomic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

09:3223/10/2023

Podcast EP 73 Tesla Check Engine light (Oct 19)

This is how our economy has worked since the dot-com crash. S**t might be catching up with the FedTSLA is about to test the 200 day ma. If this breaks there is no telling when buyers will step up.Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayTight range developed in the morningJerome Powell was scheduled to speak at the NY Economic forum at 12 noon. The markets roared higher even before he was speaking. I suspect a massive fakeout. Chart below was taken 12:03pm. The live feed to his speach was also suffering from audio issues. But who cares as it was all prepared remarks anyway.12:13pm TSLA down 8.88%!12:17pm climate protesters disrupted the start of Powells speech.12:23 prepared remarks end. And q&a startsAnd the pop is gone during his q&aBreadth* 50 new highs* 960 new lows* 19% advancing 76% declining* 80% below 50 day ma* 73% below 200 day maStuck outWhipsaw city all dayClosed at the lows of the dayStrongYieldsVolatilityWeakWhat to watchWatch mag 7 Watch yields EarningsGeo-political riskEconomic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

08:5120/10/2023

Podcast EP 72 #YOLO (Oct 18)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the day* TSLA closed at 242.50. Down 4.8% on day ahead of earnings after market. TSLA had a big miss on cashflow.“It's an amazing product but I do want to emphasize that there will be enormous challenges in reaching volume production with the Cybertruck and then in making the Cybertruck cash flow positive,” Musk said during Tesla’s earnings call on Wednesday.“While I think this is potentially our best product ever — I think it is our best product ever — it is going to require immense work to reach high-volume production and be cash flow positive at a price that people can afford.”* NFLX closed at. Down 2.69% on day ahead of earnings after market. Price increases coming on subscriptions* Transports sort of crashed* JB hunt down after earnings* CAT down big* PCLN down big* LTCN down big after hours after earning* MS down big new yearly lows* GS gave back all of earnings pop. New yearly lows* BLK close to new yearly lows* broader markets red open and sold off all day* Posted below at 9am* DONT MISS: Citadel LLC’s Battle with the SEC: What You Need to Know. By Bill Cara* 10 yr yield 4.9%* Leaked recording by LEN executive “The cost of buying down rates has tripled and we have to keep doing this.”“Private builders are under tremendous stress”“We are promising 10% increase in volume when our competitors have not given you that commitment”“Asking all partners to take less to pass the savings to customers”“We have a lot of land”youtube.com/live/sBtEqiYpQR4* Closed at the day lows* NVDA and TSLA being sold off hard* 3:10pmBreadth* 70 new highs* 619 new lows* 17% advancing 78% declining* 78% below 50 day ma* 70% below 200 day maStuck outAll day controlled heavy sellingStrongYieldsVolatilityWeakAll sectors red except EnergyWhat to watchWatch mag 7 Watch yields EarningsEconomic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

06:3519/10/2023

Podcast EP 71 Only Six Remain (Oct 17)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the day$NVDA HAS LOST OVER 100 BILLION in market cap the last 48 hours. All AI chips by U.S. co are banned from being sold to China. Calling $410. If that doesn’t hold, $338.We were very very close to testing the falling 50 day moving avg today on $SPY . Could that be as close as we get? Will be gather enough oomph to pierce it? Prices ran back from the area at 2pm today.I had shared at 10:58amHeadlines this morning* Retail sales rose 0.7% in September, much stronger than estimate* Goldman Sachs tops estimates on stronger-than-expected bond trading* Bank of America tops profit estimates on better-than-expected interest income* Johnson & Johnson beats on earnings and hikes outlook as medtech, pharmaceutical sales surgeBreadth* 125 new highs* 320 new lows* 55% advancing 39% declining* 72% below 50 day ma* 66% below 200 day maStuck outSemi conductorsTested $1 away from 50 day on spy and sold offStrongWeakSemiconductorsWhat to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

08:5718/10/2023

Podcast EP 70 Just Say No to Drugs (Oct 16)

“CVS, Walgreens and Rite Aid are closing thousands of stores. Here’s why”https://www.cnn.com/2023/10/16/business/drug-stores-closing-rite-aid-cvs-walgreens/index.htmlPodcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the day* As I have stated we have a date with the 50 day MA sooner or later this week* Rite Aid has filed for Chapter 11 bankruptcy* Strong rally across the board from 10am through the afternoon. The hopes of a positive resolution to the conflict in Israel and potential cease fire in exchange for hostages. * At 2pm breadth was negative despite the rally. 87 new highs vs 286 new lows.* Some charts* Equal weight S&P about to trigger bearish ma crossAAPL struggling with the 50 day* 2:12pm 10 yr still too bullish* Next fart launches $VIX* $ITB looks like it will fall into the abyss* I still see oil above $110Breadth* 96 new highs* 321 new lows* 69% advancing 26% declining* 75% below 50 day ma* 67% below the 200 day maStuck outYields were green. $TNX up 1.75% StrongEvery sector was greenWeakVolatility down 10.9% giving up a lot of the gains from FridayWhat to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar EarningsFinancial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

06:3417/10/2023

Podcast EP 69 Empty Castles (Oct 13)

33 Liberty Street (NY Federal Reserve Building)From their website…The 22-floor, limestone and sandstone headquarters of the Federal Reserve Bank of New York contrasts sharply with the neighboring steel and glass skyscrapers of the Manhattan’s downtown financial district.Architecturally, the building is reminiscent of the Italian Renaissance period, featuring a robust palazzo design recalling the appearance of Florentine banking houses and elements of Florentine palazzos such as the Strozzi Palace and the Palazzo Vecchio.The Bank’s 20th century American designers, like their 15th century Italian predecessors, sought a structural expression of strength, stability and security. These planners intended to inspire public confidence in the recently formed Federal Reserve System through the architecture.Another example of empty castles and skulls comes from a post by Paul Krugman. He says if you take out food, energy, shelter and cars, that there is no inflation. Lol. It is like saying 1+1+1-3=3 *if you don't count the 3? And this man has won a Pulitzer prize for economics!This is how math works at the top of the pryamid to keep boots on our necks.https://twitter.com/paulkrugman/status/1712494317024026761Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the day and weekFriday the 13th Delivered! So much to cover today. I warned this morning that something smelled fishy and only the magnificent 7 were green while breadth was very weak. I then checked the equal weight Nasdaq and it was testing the 50 day ma already. While the equal weight S&P had not even reached it’s 50 day. Then I looked at VIX and saw it was rallying hard despite the market being fairly flat and the bullish earnings reports of JPM, C, WFC and BLK. Here is the actual Substack note: Breadth* 66 new highs* 502 new lows (7.6 x times!)* 34% advancing 60% declining* 79% below 50 day ma* 70% below 200 day maStuck outThe VIX exploded higher 15% today disproportionately to the selloff. You would think the Dow was down 1,000 points. At one point the VIX was up over 20%.StrongGoldVolatilityWeakWhat to watchWatch mag 7 Watch EnergyWatch yields Geopolitical Risk and new confrontationsEconomic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

14:3915/10/2023

Podcast EP 68 Angels and Demons - Session before Friday the 13th! (Oct 12)

Hank Paulson has a demonic laugh! Homeboy almost falls off his chair!Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the daySelloff after CPI report. Then an attempt to bounce into lunch. Then the 1pm woosh lower.10:34am* Equal weight sp500 down $RSP* Russell 2k down* Breadth volume nil* Means Mag 7 are once again holding things upAll things real estate down1pm Massive selloffApparently the culprit to the 1pm selloff was an ugliest 30Y auction in many years, and the market reacted accordingly with yields surging to session highs. The 10Y rose almost 20bps from session lows to 4.70% in secondsthen look at volume breadth at 3:59pmBreadth* 96 new highs* 504 new lows (5x more)* 18% advancing 77% declining* 79% below 50 day ma* 69% below the 200 day maStuck outThe nature of the selloff had convictionStrongVolatilityYieldsWeakAll recent IPOs seeking new bag holders like BirkenstockWhat to watchJPM WFC C & BLK all report Fri before the bellWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

11:3013/10/2023

Podcast EP 67 Armageddon (Oct 11)

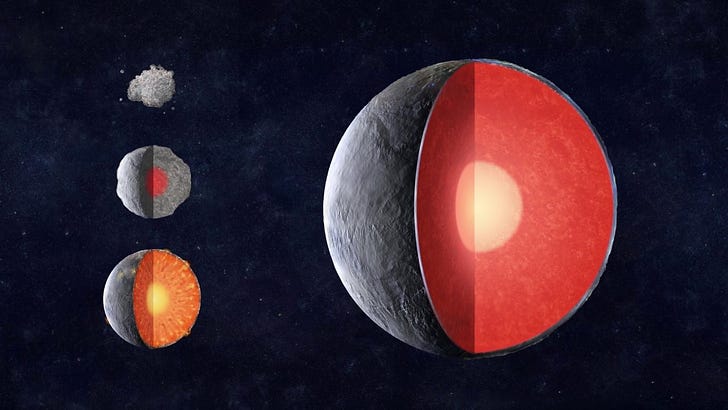

A real life Armageddon style mission launches in 2 days. A trip to a giant metal Asteroid Psyche16. A testament to the positive that Humans can accomplish, in contrast to the horrors!If you have never seen the Bruce Willis movie Amageddon, run and go see it on streaming. Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayWait and see day after PPI and FOMC minutes from Sep meetingEveryone wants to see the CPIWe are approaching the 50 day ma. Let’s see what happens next?Breadth* 101 new highs* 248 new lows* 53% advancing 41% declining* 75% below 50 day ma* 66% below 200 day maStuck outstill more new lows than new highs. 2.5x timesStrongSPT 3.34%ADBE 3.23%KGC 2.70%PHM 2.25%NVDA 2.20%AFRM 2.18%WeakCART -7.36%VIX -5.52%HOV -4.23%TBT -4.02%ZM -3.66%KYVO -3.34%CVNA -3%COIN - 2.85%What to watchCPI and reaction Thu 8:30amFriday 4 big financials report earnings premarket. JP Morgan, Wells Fargo, Citi and BlackrockWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

11:0312/10/2023

Podcast EP 66 In Chaos Lays Opportunity (Oct 10)

“In the Midst of Chaos, There Is Also Opportunity” (Sun Tzu)Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the day* Markets rallied until 1pm, then there was a selloff taking back half of the days gains* but markets closed up and every sector was greenWe are simply trying to backtest the falling 50 day moving avg. On the SPY watch if we can get to $440 and how prices reactMagnificent 7Breadth* 117 new highs* 200 new lows* 70% advancing 25% declining* 77% below 50 day ma* 66% below 200 day maStuck outMSFT and AAPL redStrong* Russell 2000 lead* Many names that are lower quality bounced * 10 yr still too high* 30 yr mortgage now over 8%Weak* VolatilityWhat to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

06:5611/10/2023

Podcast EP 65 Doves Stronger than Madness (Oct 9)

I was a bit under the weather after hosting my two nephews. Kids + Germs! But I felt compelled to get this out to everyone! Hope you have a great day!Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayAs war continues in Israel/Gaza, all it took were a few dovish comments from Fed heads to goose prices. But pay attention to breadth as new lows continues to beat new highs. The dollar index fell sharply after multiple Fed speakers such as Dallas Fed Lorie Logan and Fed vice chair Philip Jefferson reiterating what SF Fed Mary Daly said on Friday, suggesting that soaring 10Y yields have done the Fed's tightening job for them, and no more hikes are coming. This is how UBS's trading desk put it:Fed Vice Chair Philip Jefferson sounds dovish. He said he will remain cognizant of tightening financial conditions through higher bond yields and will keep that in mind when assessing the future path of policy. Also, he said the Fed is in a sensitive period of risk management, where they have to balance the risk of not having tightened enough, against the risk of policy being too restrictive.I still call BS. Here is what I need to see before I can confidently call a reversal:* Weaker yields* Stronger Yen/USD* Weaker Crude Oil under $80* 51% of stocks trading above their 50 day moving avg* More new highs than new lows dailyBreadth* 78 new highs* 407 new lows!* 58% advancing 37% declining* 80% below 50 day ma* 68% below 200 day maStuck outFinancials the only sector in red/break evenStrong* Defense* Software cyber security* Magnificent 5 *NVDA and TSLA downWeakSMH and Financials redWhat to watchAs we approach overhead resistance and the 50 day moving avgs, watch if prices can break up throughWatch mag 7 Watch Crude/EnergyWatch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

08:0910/10/2023

Podcast EP 64 "It's only Hubris, if I fail" Julius Caesar (Oct 6)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayHorrible weekend of tragic actions of a few humans. As a financial Substack and podcast I am not going to get into my opinions on it. Other than saying how tragic war and conflict is and I hope it ends soon. But seeing how this has been going on since 1950s, it prob won’t end soon. Pre-mkt as of 8:30pm NY Make note the DOW was up 288 at Friday’s close. Will it hold onto that gain?So on Friday…700 point dow move from the intraday low!We tanked on bullish job numbers at 830am, then rallied hard near the 200 day ma.Everyone thinks this was the low and new bull into Q4. Recent IPOs were puking while we had the 700 point reversal10 yr still too highBreadth* 72 new highs* 732 new lows* 66% advancing 29% declining* 82% below 50 day ma* 69% below 200 day maStuck outStrong reversal amidst spiking put option activity. Ton of jobs apparently sparked a down 200 dow move than we reversed hard off the 200 day ma area. Only 72 new highs. 10x more new lows!!! And that is with a 700 point dow up from intraday lows.StrongEverything crushed Thursday bounced hard Friday.Yields still strongOil bouncingWeakvolatilityWhat to watchWatch mag 7 Watch yields Watch oilEconomic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

09:0709/10/2023

Podcast EP 63 Respite (Oct 4)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayCompared to yesterday today was much milder. Magnificent 7 did all the heavy lifting. But if others don’t participate, I suspect this bounce will fail before the coming three day weekend!Breadth* 28 new highs* 822 new lows* 58% advancing 36% declining* 85% below 50 day ma* 72% below 200 day maStuck outNothing reallyStrongthe things that got crushed Tue simply bounced todayWeakEnergyWhat to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

02:3004/10/2023

Podcast EP 62 Revenge of the Sith (Oct 3)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the day“Too late for what? The republic to fall? It already has, and you just can't see it, there is no justice, no law, no order, except for the one that will replace it.” - Darth MaulI shared on Monday how breadth was horrendous. I also shared how the magnificent 7 were being bought while everything was being sold off. In Substack notes I pointed to how the Russell 2k was down 1.58% on Monday and a dow equivalent would have been over 500 points. Well that all came to pass today. They sold everything on heavy volume. Yields are above 4.7% on the 10 year. Breadth* 41 new highs* 1,226 new lows!!!* 17% advancing 79% declining* 85% below 50 day ma* 72% below 200 day maChartsMagnificent 7Stuck outCrude oil looks like it wants $110StrongYieldsVolatilityOil, energy, coalWeakEverythingWhat to watchWatch mag 7 and major moving avg (50 day, 150, 200)Watch yields Watch energy pricesEconomic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

27:2404/10/2023

Podcast EP 61 Gov't Open But who Cares? (Oct 2)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayMarkets lost a 200 pt move higher over the weekend after the govt agreed on a temp bill to bless us with no shutdown for 45 days. The intraday action provided 4 sikes or fakeouts to the upside. If you watched breadth all day, it would have told you not to go long. They also tried to save the market by bidding the Magnificent 7, but they too closed off their highs.What would we do without the govt bloat. Thank goodness for their benevolence in finding a stop gap for 45 days…when we can do this all over againAirbnb ($ABNB) Is Fundamentally Broken, Its CEO Says. He Plans to Fix It. “We never fully built the foundation,” Brian Chesky says in a revelatory interview. “It had four pillars when we needed to have 10.”Germany's Birkenstock ($BIRK) targets $9.2 billion valuation in New York IPO. This means as a public co they will be forced to discount heavily in slow times. I love wearing Birks in the summer.11am Breadth check11:15amAnother attempt to buy the mag 7 to boost equitie$VFS Where are the regulators11:30amThere is that 4335 level again. This bounce can’t stick with yields busting up12:30 lunch break. How we doing? Imagine if mag 7 were not green?1:15 pm#Magnificent7 losing steam. Oh boy. If this continues we can have a 300+ down day easy2pmYou tell me. Does this look like bullish breadth? Breadth (as of 3:30pm)* 48 new highs* 793 new lows* 18% advancing 79% declining* 83% below 50 day maStuck outLost the weekend pop on the Govt No-shutdown newsStrongRelatively speaking, the Magnificent 7 was holding up the market all dayYieldsVolatilityWeakRussell 2k$VFS $CVNA $PI $KGC $SLV $AFRM $AI $ALLY $GDXJ $KVYO $KRE $ARM What to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

08:0802/10/2023

Podcast EP 60 No Bounce for You! (Sep 29)

Dedicated to the funniest show to ever airPodcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayIf I sound exhausted, I was. Looooong day fighting this monsoon in NYC. See photos below. * The markets gapped up and then puked. This was despite the Magnificent 7 trying to hold up the markets once again!* The United Auto Workers union will expand strikes against General Motors and Ford Motor* Government shutdown looms over the weekend* 10 Yr yield still high at 4.57%* Crude oil backing off from a high of $93 this week* Monsoon like rains wreaked misery in NYC (I was one of them impacted). Roads flooded, Flights cancelled. Breadth* 69 new highs* 263 new lows* 41% advancing 52% declining* 79% below 50 day maStuck out* Strong open* Limped into close* Magnificent 7 green for the day except GOOG and METAStrongyields, oil, & energy still very elevatedWeakSmall caps lead to the downside todayWhat to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

16:0630/09/2023

Podcast EP 59 A Bounce (Sep 28)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayBreadth* 89 new highs* 580 new lows* 65% advancing 30% declining* 79% below 50 day maStuck outBroader bounce.Weakish closeStrongMag 7Consumer credit and financialsWeakNot much to call out other then gold and miners What to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

04:4229/09/2023

Podcast EP 58 End of Month & Quarter (Sep 27)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayWe are at a logical must-defend area for a bounce. We are also heading into end of month and end of qtr so I suspect wild effort to bounce as well. The up volume simply has not shown up yet. Last four Septembers for the S&P:2020: -3.92%2021: -4.76%2022: -9.34%2023: -5.19% (thru 9/26)Last three Q4s:2020: +11.69%2021: +10.65%2022: +7.08%2023: TBDBreadth* 81 new highs* 752 new lows* 50% advancing 45% declining* 80% below 50 day maStuck outWe closed almost unchanged. Markets were down hard at 2pm but then bounced just as hard and went green. Then we limped into the close.StrongDASH 4.79%PI 4.28%LYFT 4.03%DKNG 3.94%W 3.41%AI 3.34%CVNA 3.29%KYVA 2.81%UCO 2.69%USO 2.5%PJT 2.27%WeakVFS -12.89%CART -4.52%VIX -3.8%GOLD -3.75%GDX -2.99%PYPL -2.7%CAVA -2.69%What to watchJerome Powell speaks Thursday at 4pm ETWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

13:0728/09/2023

Podcast EP 57 "Wall St Paging Mr Powell" (Sep 26)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayDow -388 (1.14%)The DOW is now under the 200 day moving avg!!!S&P 500 -63.91 (1.47%)Nasdaq Composite -207.71 (1.57%)Russell 2000 -22 (1.27%)Magnificent 7 look horrible! All are under their own 50 day moving avg3:52pm Will they try to rally? Watch breadth volume for fakeouts Laat 15 min breadth volume. No rescue.Breadth* 58 new highs* 756 new lows* 20% advancing 76% declining* 81% below 50 day maStuck outPrior the end of day, the selling was controlled and consistentAre main st investors awake? or are they sleeping?$ABBV StrongTravis KelceVolatilityGILDAMGNWeakEVERYTHINGWhat to watchJerome Powell speaks Thu 4pmWatch mag 7 Oil/Energy PricesWatch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Financial Freedom is not free, but the pursuit is worth the treasure! This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

15:0827/09/2023

Podcast EP 56 Hurry Up and Wait (Sep 25)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayToday was so exciting that the top news story in America was the budding new romance between Taylor Swift and Travis Kelce.Breadth* 95 new highs* 759 new lows* 47% advancing 49% declining* 79% below 50 day maStuck outStrongARM +6%TBT +5%CAVA +4.95%KYVO +3.8%TNX +2.34%SQ +1.97%WeakVFA -10.43%CVNA -4.14%RRR -2.37%What to watchJerome Powell 4pm ThursdaySept 21 (Reuters) - Federal Reserve Chair Jerome Powell will host a town hall with educators on Sept. 28 that will also be webcast live, and he will take questions from the audience, the central bank said on Thursday.Watch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Thanks for reading NYUGrad Stocks and Finance! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

07:0426/09/2023

Podcast EP 55 The Boogie Man is Back, and he is PISSED! (Sep 22)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the week* VIX up 30%* Russell 2000 down 3.8%* Nasdaq Composite down 3.6%* Nasdaq 100 down 3.3%* S&P 500 down 2.9%* Dow down 1.9%Summary of the day* Magnificent 7 are all under their 50 day moving averages * UAW says it is prepared to strike for ‘months’ in leaked messages * They tried to rally mid day but that bounce failed miserably and closed near lowsBreadth* 69 new highs* 573 new lows* 41% advancing 54% declining* 79% below 50 day maStuck outYields were down a little on Friday, and yet risk was sold. Not a very good sign$ITB is relatively overprices in context of Housing starts. the two have been in lock step since 2006. There is a massive divergence and this will resolve one way or another. StrongCRUDE OIL$EXTRWeakAFRM -5%COIN -4.65%AI -4.44%TSLA -4.23%DKNG -3.3%ROKU -3.29%FRPT -3.17%What to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Chart GalleryThanks for reading NYUGrad Stocks and Finance! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

09:4324/09/2023

Podcast EP 54 Hawkish Pause (Sep 21)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayBOOOM!Lot’s of destruction the past 48 hoursBreadth* 41 new highs* 723 new lows* 18% advancing 78% declining* 79% below 50 day maStuck outat 1pm, I noted in the am session that the Breadth and volume of breadth looked very controlled and steady today. Not panicked like Thursday. And that my eyes were telling me that we could be closing near the lows today. “Compare the complexion of the down volume from yesterday. Today is steady consistent selling. Yesterday was a panic spike. My eyes say we close near lows today.”The closeStrongYieldsVolatilityWeakEverything elseWhat to watchWhere is the 150 day and 200 day below. Will we bounce now or keep selling to meet those ares?Watch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

15:2622/09/2023

Podcast EP 53 God Complex Fed Rate Edition (Sep 20)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the day* Powell took away the baseline case of a soft landing* There is more yays for Nov rate hike than nays* IPO $ARM $CART $KYVO are all red from ipo pop* We will likely continue with higher rates for longer If 437 breaks, we will head down to that blue box areaBreadth* 105 new highs* 351 new lows* 29% advancing 66% declining* 74% below 50 day maStuck outTech leads downStrongVolatilityYields$SG WeakEverythingWhat to watchWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

15:1521/09/2023

Podcast EP 52 So you're telling me there is a chance! (Sep 19)

If you have never seen Dumb and Dumber, please go treat yourself!“There is no sin except stupidity.”-Oscar WildePodcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayThere is some debate if Rothschild was attributable to this quote, “Give me control of a nation's money and I care not who makes it's laws". But whoever did utter these words, they were correct. The selloff got reversed somewhat into the close. The DOW was down over 300 pts during the day. The Nasdaq was down over 100 at one point, but closed down only 32 points.The Magnificent 7 saved the day from getting much worse. How sad is it that the worlds economy rests on the whims of 1 man who controls the fate of rates and monetary policy.If you are new to trading or were too young to trade 15 years ago during the Great Financial Crisis, here is a blast from the past, when our Fed began the journey to zero. There was a report that Elon Musk told Benjamin Netanyahu that X/Twitter is considering charging ALL users a monthly subscription fee in efforts to rid the platform of bots. The theory is it cost fraudsters a few cents to create bots. If that cost increases to above and beyond a subscription fee, there wouldn’t be an ROI for them anymore. Chris’s Substack Hamish McNeilly I just hope that doesn’t push the trash off X and onto other platforms. Play by play10:30am It took very little down volume to crack the market. Look At breadth and volume of breadth to see if this selloff is a fakeout or early selling.Oil and 10 yr12:35pm a lot of hoopla regarding Instacart ipo ticker CART. They are expecting trading to open at $42.61? A 40 percent rise in the intended offering price. A warning to the public…all ipo’s eventually fall back to the ipo price. 1 session, 10 days, 10 yrs…eventually it always does. See ARM. Klavio goes public later today. My hunch is they are desperately coming to public markets. Breadth* 114 new highs* 402 new lows* 34% advancing 60% declining* 72% below 50 day maStuck out1pm someone pressed the buy button on the Magnificent 7. They all fought back hard into the closeCART closed up 12% on the IPO but down 23% from the 1st hour pop!ARM recent semi-conductor ipo, (2nd time btw) down 4.88%StrongLYFT +3.3%ETSY +2.96%KRUS +2.59%CROX +2.35%WeakCVNA - 8.57%SG -6.67%COIN -4.26%DKNG -3.7%DIS -3.62%HOV -3.57%CAVA -3.08%SQ -2.83%MGM - 2.71%What to watchWednesday 2pm FED Rate decisionWednesday 2:30pm Jerome Powell speaks in front of a microphone and will hem and haw This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

15:2820/09/2023

Podcast EP 51 Be Still Amidst a Rough Sea of Emotions (Sep 18)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayThis will be a short episode as the world waits for fed rate ramblings on Wed. But I do want to share with you this clip which resonates with me so much as a trader. When you hear systems or books or gurus say you need to resolve yourself of all emotions and trade like a robot, that is almost impossible to do. It is much more plausible to be objective with your own emotions, but to do that in trading you must have the time and space to think and master yourself. All while you navigate down river in your boat in a sea of other traders emotions. Breadth* 102 new highs* 376 new lows* 37% advancing 57% declining* 71% below 50 day maStuck outYields remain elevatedS&P500 is still hanging out just underneath the 50 dayOil prices matter. look at the AirlinesSAVE -2.9%ALK -1.49HA -2.64LUV -2%JBLU -5.84AAL - 1.58%UAL - 2.28%DAL -2.51%StrongAFRM 2.63%LEN 2%SNPS 1.7%WeakJBLU -5.63%SHOP -4.6%ARM -4.53%LYFT -4%KRUS -3.84TSLA -3.32%CAVA -2.99%SQ -2.99%DAL -2.53%ROKU -2.45%What to watchFED rate decision Wed 2pmWatch yields Watch oilEconomic datahttps://www.marketwatch.com/economy-politics/calendar This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

07:2119/09/2023

Podcast EP 50 It's Personal (Sep 15)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayForget a follow through day after a bullish Thursday. This was a massacre. So Wall St seems to have waited for both the CPI and PPI data to be digested and the masses to step back into the waters on Thursday with nothing but sunshine, cocktails and sun cabanas. Only to release their tiger sharks on Friday. UAW went on strike strategically hitting the U.S. car makers in their most profitable factory locations. The workers are saying that since the bailouts of the automakers during the great financial crisis, they took concessions to help the auto co’s survive. And that since 2008, the auto companies bounced back but have not paid their workers and have left them in 2008 conditions. The workers are asking for more wages, no tiered ramp up on wages, and a 4 day work week. The car companies are claiming if they give them what they want, they will go bankrupt. The workers are claiming if they get what they want the car companies would still make billions. Then the backdrop is that this is a sign that workers are facing massive inflation. If the UAW wins, other unions and employees in general will continue to push for higher wages and less work in other industries. So the narrative from government and the Fed saying that Inflation is not bad, is a lie. You must know and feel this in your own individual lives. Just look at Crude Oil, it looks like it has a date with $160!!!The 10 year yield is about to break thru to new highs.We are only 8% away from lifetime highs. While the market is on wobbly ground, there still remains a chance at headline shock both up or down. Seasonality for end of yr is usually bullish. And 2024 is election yr. Watch yields, mag 7, interest rate sensitive sectors. Exciting and tumultuous week ahead!Breadth* 130 new highs* 325 new lows* 27% advancing 68% declining* 69% below 50 day maStuck out$SMH if this breaks it will be headed to test the 200 day or overshoot and test 120StrongGold and precious metalsVolatilityYieldsWeakNVDA slices below 50 day, down 3.69%CVNA -6.55%BZH -6.20%ARM -4.47%KBH -4.25%ADBE - 4.21%KRUS -3.80%TOL -3.5%HOV -3.11%SNPS -3.05%AI -3.05%SMH -3.03%CROX -3.01%I can go on and on and ONWhat to watchSep 20 Wednesday 2pm NY Rate decisionhttps://www.marketwatch.com/economy-politics/calendar This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

17:5018/09/2023

Podcast EP 49 Bankers First (Sep 14)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayI can’t help but get the sense we are at the point of the movie before anyone knew of the iceberg. With the majority of the country very hopeful their TSLA and AAPL will remain in good graces. * The largest IPO of the year was trotted onto the markets today in $ARM, note this is Softbank whose investment track record is not too stellar* PE 110! Softbank owns 90%* SPY is 9 points away from 1 yr highs. or 7% from lifetime highs, despite all the economic headwinds I noted for weeks* Bond prices continue to fall* Yields and interest rates continue to rise and remain high* Oil is going much higher* Russell 2000 led today* Cup and Handle in playBreadth* 174 new highs* 248 new lows* 70% advancing 25% declining* 64% below 50 day maStuck outOil, Energy, Rates and Yields all rising along with risk assets. This will not last too many sessionsStrong rally, all sectors greenTechnology was 2nd to last thoughStrongARMCVNAKMXCOINETSYWeakVIXSGNFLXZGWhat to watchSep 20, 2pm Fed rate decision and guidanceWatch Mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

07:4714/09/2023

Podcast EP 48 The Death Star is almost complete (Sep 13)

I had an audio issue and the audio only goes to 5 min 46 sec. But it was the majority of the content. The only piece that got lost was picked up on the show notes below in the section “Stuck out”. One note I would like to add is that the indices are just as likely to go to new highs as new lows since its so heavily weighted to a few stocks. We are in the middle of a converging price zone and it seems the main event, as usual, will be the Fed Rate decision Wed Sep 20. That is when the Death Star will either zap the bulls or the bears.Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayOn the surface this chart is the entire story for the year. The next chapter starts next week with rate decision and guidance Sep 20 at 2pm ET. As you can see in the chart, we can easily go up to new highs or crack the teal and or purple lines of support below. For the broader market we are still just stuck 3%-3.5% below this yr high on SPY and QQQQIntraday10:24am Still fighting this line1:37pm Complexion…risk is being sold while they prop the markets through Mag 7.86 new highs vs 238 new lowsBreadth and Breadth volume.Breadth* 95 new highs* 308 new lows* 36% advancing 58% declining* 71% below 50 day maStuck outJust some macro signs to be weary ofEcon sensitive stocks all rolling overIndustrial, construction, housing, housing related. ExamplesUnited RentalsParker HannifinBuilders First SourceRetail group is weakCA unemployment is picking up. Now 4.6%Auto loans outstanding 1.5 trillion, a recordAvg home is 3x salary during great depression vs today at 8XDebt to income ratio for home buyers hit 40%. 1st time in history. In 2008 it was 39%Breadth is horribleMegacaps are holding up the world again.Amazon new yearly highs todayAdobe reports thu.StrongAMZNWeakNFLXSGZGHOVEXTRROKUCVNADALCROXAFRMWhat to watchPPI ThuWatch the mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Thanks for reading NYUGrad Stocks and Finance! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

05:4614/09/2023

Podcast EP 47 Fortunes can turn on a dime (Sep 12)

Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayYesterday was nullified and given backApple event* First 35 min focused on Apple Watch* 20 min for iPhone 15* 4 min specific for iPhone 15 Pro Titanium* The most impressive part of the event was the HQ Campus. Breadth* 147 new highs* 290 new lows* 41% advancing 54% declining* 70% below 50 day maStuck outHome builders down dispite 10 yr not being greenStrongVIXGMWeakORCL down 13.5%MDB down 5%SG down 4.5%CAVA down 4%ADBE down 3.9%ROKU down 3.5%Home buildersMelody Wright has shared a great deep dive, “Down and Dirty” as well as this awesome interview on YouTubeWhat to watchCPI wedWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

05:0712/09/2023

Podcast EP 46 Jet Propulsion (Sep 11)

The Aaron Rodgers Jet’s era begins!Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesSummary of the dayBulls cannot complain. Morning weakness turned into a day for the ages on $TSLA. $META also contributed to the party. 9:42 am $NVDA $AAPL selling offBreadth* 153 new highs* 286 new lows* 56 % advancing 39% declining* 67% below 50 day maStuck outConsumer CyclicalStrongTSLA up 10%CVNA up 8.2%AFRM up 4.9%LYFT up 4.7%MDB up 4.5%UBER up 3.6%AMZN up 3.5%META up 3.25%WeakCAVA down 4.13%KRUS down 3.44%ETSY 3.44%VFS down 3.3%MGM down 2.3% hackedWhat to watchTue: Apple iphone produce newsWed: CPIWatch mag 7 Watch yields Economic datahttps://www.marketwatch.com/economy-politics/calendar Thanks for reading NYUGrad Stocks and Finance! Subscribe for free to receive new posts and support my work. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

09:1411/09/2023

Podcast EP 45 Come Back to Bed! (Sep 8)

Friday was non climactic. Should have stayed in bed.Podcast Available onSpotify | Apple Podcast | Amazon MusicFollow on Substack NotesReferral Program for existing Subscribers* When you use the “Refer a friend” link below or the “Share” button on any post, you’ll get credit for any new subscribers. Here is the link you can copy and paste into any email, text or social media platform:“https://nyugrad.substack.com?r=1ec55c”* Once I launch a paywall, your referral credits earned will be retroactive immediatelyShow NotesYou will be listening to this Podcast on or after Monday September 11, 2023. As a New Yorker, today has a gravitas that is even more extreme than as an American. My thanks to all 1st responders and military who jumped into action in the years following. As horrible as that day was, I also have never seen this country and New Yorkers united together aa close as then. Something this country needs again, hopefully not under such horrible forces.Summary of the Friday sessionOvernight we took elevator back down to test 4444 area twice. 5am and 7:45am, setting up intraday double bottom. Prices launched off that.11:48am snapshot11:30 heading into EU close prices are bouncing around in 4470s.$NVDA Weak all morning. Only Mag 7 red by noon.Vix weak12:40pm how is the up volume on breadth looking? Weak. 2:55pm just a summationActual closeBreadth* 103 new highs* 344 new lows* 46% advancing 48% declining* 70% below 50 day maStuck outNVDA and TSLA downStrongEnergy and Utilities ledWeakReal Estate and Industrials weak$VFS $CAVA $CROX What to watchApple Event Tue. iPhone 15 announcementCPI wedWatch mag 7 Watch yields Economic Calhttps://www.marketwatch.com/economy-politics/calendar This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.notyouradvisor.com/subscribe

12:1211/09/2023

Podcast EP 44 Boards Don't Hit Back (Sep 7)