Sign in

Sign in

Business

News

Tim Burrowes

Media and marketing news with all the in-depth analysis, insight and context you need.

Unmade offers industry news from an Australian perspective, from the founder of Mumbrella and the author of the best-selling book Media Unmade, Tim Burrowes www.unmade.media

Start the Week: How the TV networks are planning a premium video exchange; Web rankings redux; The rise of subscription video

Welcome to Start the Week, our Monday morning scene-setter for the week ahead.Today:* Australia’s TV networks plot a BVOD exchange* Introducing Australia’s new audience measurement service - Iris* The continued rise of retail media* New data suggests more people are consuming subscription video than free TVToday’s episode feature Tim Burrowes and Abe Udy.Further reading:* The Australian: The not so secret rise of retail media networks* Australian Financial Review: TV industry asks tech to help build YouTube-killer ad network* The Australian: Viewers flock to paid streaming services, new report showsAudio production was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts.Message us: [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

19:4206/03/2023

Nearly time to turn off the transmitters. The viewing shift is happening faster than you think

Welcome to an audio-led edition of Unmade.TV’s inflection point is coming. Any time now (or maybe it happened in the last few weeks), the proportion of the Australian population who watch television the traditional way will fall below half for the first time.But as fast as traditional ways of watching are falling, new viewing habits are forming - or that’s what the data in Think TV’s regularly produced Fact Pack suggests.Analysis of OzTam data for the second half of last year by Think TV suggests that commercial audiences are on the move - from television consumed via their aerials, to video streams.In today’s Unmade podcast, Tim Burrowes talks to Think TV’s director of research, insights & education Steve Weaver and to the organisation’s CEO Kim Portrate about the meaning behind the numbers.In the first half of 2022, just over 14.1m Australians - or 54.3% of the potential viewing population - were watching TV and only doing it the linear way, via their aerials or Foxtel dish.By the second half of 2022, that number had fallen to 13.3m, or 51%.A question Portrate and Waver address during the conversation is whether in the early months of 2023, we have since passed the inflection point, and less than 50% of Australians are now watching TV the old-fangled way.Also revealed in the data is that in the first half of last year, 3.6m (or 13.7% of the population) were watching commercial TV on a combination of linear TV or via streaming. That rose to 4.1m, or 15.6% of the population, by the second half.The number of people giving up on their aerial or dish to watch broadcast TV only via streaming also rose sharply - from 1.5m to 1.8m. With some smart TVs, the viewers may not even have realised that’s what they were doing.Reassuringly for the TV industry, the jump in streaming viewing seems to be going up almost as fast as the linear switchoff is occurring. Total reach across linear and BVOD (broadcast video on demand) only dipped from 19.23m to 19.17m, a fall of just 0.3%.It’s worth noting that all of the analysis is based on OzTam data which only covers Australia’s broadcasters, not streaming-only platforms like Netflix or Stan.During the wide ranging conversation, we raise the issue of the TV industry’s slow implementation of a daily total viewing number to move away from the fast-fading overnight metro metric.Portrate says that will happen this year. In the conversation she was also challenged to predict how long until the TV transmitters can be turned off altogether as streamign becomes the only means of viewing. It might be sooner than you think. And we canvassed both Weaver and Portrate on whether the likes of Netflix would be welcomed onto OzTam in the same way the streamer has been allowed onto the UK’s audience measurement service.The full Fact Pack is available on the Think TV websiteTim BurrowesPublisher - [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

36:1101/03/2023

Start the Week: Local podcast spend revealed; Another HBO lifeline for Binge; What results season told us

Welcome to Start the Week, our Monday morning scene-setter for the week ahead.Today:* Australia’s podcasting spend revealed* Another HBO extension for Foxtel* A Logies mystery* Will the government take on the networks on quotas?* What we learned from results seasonToday’s episode feature Tim Burrowes and Abe UdyFurther reading:* IAB Australia: Digital Audio Advertising Spend Surges To $221m In Australia* The Australian: Foxtel poised to ink multi-year deal with US media giant Warner Bros Discovery* The Australian: Media Diary: The Logies: no date, no location* The Australian: Albanese government faces pushback on streaming content obligations* Unmade: Nine's Sneesby gets better at navigating the awkward questions* Unmade: Tuesdata: Profits begin to fall as Seven West Media prepares for a chilly 2023* Unmade: Tuesdata: Unpacking Ooh Media's financial results; can the good old days of 2019 return?* Unmade: The end game approaches for HT&E* Unmade: Southern Cross Austereo has had its worst ever start to a financial year. Can Listnr change the trajectory?Audio production was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts.Message us: [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

22:0726/02/2023

Start the Week: Meta launches paid verification; Results season unpacked; How media companies are prepping for a downturn

Welcome to Start the Week, our Monday morning scene-setter for the week ahead.Today:* Meta launches paid verification (but that’s not the bit worth paying for);* Adland prepares for the downturn;* What to expect in the last big week of results seasonToday’s episode feature Tim Burrowes and Abe UdyFurther reading:* Meta Newsroom: Testing Meta Verified to Help Creators Establish Their Presence* The Australian: ABC’s triple apology to Kamahl over Phillip Adams tweet misses the mark* Australian Financial Review: News Corp’s REA asks workers to go into ‘negative leave’ to cut costs* Australian Financial Review: Why TV execs aren’t (too) worried about a 22pc plunge in ad spend* Unmade: Southern Cross Austereo has had its worst ever start to a financial year. Can Listnr change the trajectory?* Unmade: Profits begin to fall as Seven West Media prepares for a chilly 2023* Australian Financial Review: HT&E’s biggest investor sees benefits to media consolidationAudio production was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts.Message us: [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

18:2919/02/2023

Spinach's Ben Willee on the meaning of Nine's Olympics win, why it's okay to say the R-word, and loyalty in a fickle industry

Welcome to an interview-led edition of Unmade. Today’s primary focus is Melbourne media veteran Ben WilleeFor a second week in a row, Unmade’s podcast features a Melbourne based media expert called Ben. This week’s guest is Ben Willee, GM and media director of the WPP-aligned Spinach Advertising. Willee has been with Spinach for the last 11 years. Earlier in his career he spent a decade with IPG’s Initiative, in London and Melbourne.The interview, with Unmade’s Tim Burrowes, focuses on the short term and long term media outlook (Without predicting a recession, Willee is considering for the eventuality); he offers his interpretation of the first results from reporting season; and he assesses the importance of The Olympics in Nine’s strategy.Willee also suggests that some of those who’ve got used to flitting between jobs in a tight talent market might be about to get a painful surprise. And like all of us, he wishes there were more LinkedIn thought pieces on what ChatGPT means for marketing.Audio production was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

37:4815/02/2023

Start the Week: A Seven-HT&E merger?; Breaking Bad wins the Super Bowl; What to watch for in financial results season

Welcome to Start the Week, our Monday morning scene-setter for the week ahead.Today:* M&A chat: a tie-up between Seven West Media and HT&E?;* Results season - How News Corp fared and the outlook for SWM, Southern Cross Austereo, Enero and Domain this week;* Breaking Bad pulls in the Super Bowl attention;* How Married At First Sight is killing the oppositionToday’s episode feature Tim Burrowes and Abe UdyFurther reading:* Australian Financial Review: Seven eyes plan to create Australia’s next $1 billion media company* Unmade: Wind turns for News Corp* CBS Sports: Super Bowl commercials - A sneak peak at the ads that will air during Super Bowl 57 between Eagles and Chiefs* NFL Game Pass* Nine: TV Ratings Week 6* The Australian: Media Diary - The Project battles after Carrie and Lisa exitsAudio production was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts.Message us: [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

26:1712/02/2023

Ben Shepherd on why retail media is up with adwords as a media invention; how sales people can get his attention; and the 2023 outlook

Welcome to an interview-led edition of Unmade. Today’s primary focus is Ben Shepherd’s first in depth interview since joining Dentsu as chief investment officer. Talking DentsuIn the first Unmade podcast interview of the year, Dentsu’s new chief investment officer Ben Shepherd joined Unmade’s Tim Burrowes.In the wide-ranging interview, Shepherd explains why he sees retail media as one of the most elegant, “wealth creating” media developments since adwords; he argues that there’s nothing wrong with leaving a job after a couple of years if you feel you’re not making the impact you want to; and he explains the style he will bring to negotiations with media owners.Audio production was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

48:2708/02/2023

Start the Week: Catalano and Janz both make moves; What to look for in the News Corp results; TV ad revenue falls

Welcome to Start the Week, our Monday morning scene-setter for the week ahead.Today:News Corp gears up for results week, and weighs cuts with ‘Audience 25’ project;Will the new quotas be a boost for Foxtel’s HBO hopes?Chris Janz prepares to exit stealth modeANZ invests in Antony Catalano’s real estate play;Has the TV ad market peaked?Today’s episode feature Tim Burrowes and Abe UdyFurther reading:Sydney Morning Herald: Murdoch’s News Corp Australia prepares to slash costs by $20 millionSydney Morning Herald: What next for White Lotus? Content rules may change HBO’s streaming plansAustralian Financial Review: Former Fairfax executives score VC backing for mystery start-upAustralian Financial Review: ANZ went house hunting at Domain, bought at View MediaThink TV: Total TV advertising market records $4.1 billion in ad revenue for 2022Unmade: Waiting for VOZAudio production was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts.Message us: [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

25:4505/02/2023

The year in review: CMO moves; brand crises; a Netflix U-turn; war for the Market Herald; the madness of Musk and ABC's audio audience collapse

Welcome to the final Start the Week podcast of 2022, in which Tim Burrowes and Abe Udy look back on the ten biggest stories of the year.Brand PR crises of 2022:* Unmade: Has Qantas got a brand crisis or just a PR problem?* Unmade: Optus writes a new chapter in the crisis handbookThe big marketer moves:* Unmade: Biggest CMO move of the year - Thinking Smart* Unmade: Lisa Ronson departs one of the biggest CMO roles, but how to mark her Coles scorecard?* Unmade: Marketers on the move - Melissa Hopkins to SWMThe AFL TV rights renewal:* Unmade: Why Seven and Foxtel are willing to pay $40,000 per minute for the AFL dealThe Market Herald saga:* Unmade: The Unmade podcast: Jag Sanger of The Market Herald on buying Gumtree and Carsguide, and launching a newspaper* Unmade: Inside the The Market Herald's civil warThe ABC’s audio audience decline:* Unmade: Is the ABC's next generation of radio listeners coming through? Not according to the ratings* Unmade: Triple J's youth audience has fled. And no, it's (mostly) not the internet's fault - they've switched to commercial radio* Unmade: Australia's most influential radio show has never had fewer listeners. The ABC's audience problem is getting worse* Unmade: The collapse of Patricia Karvelas’ RN audienceMusk’s Twitter purchase:* Unmade: Why Elon Musk's Twitter takeover will probably fail* Unmade: Rich, talented arseholes* Unmade: Elon’s Twitter bloodbath begins* Unmade: Musk's 'thermonuclear' threat to advertisersThe legal year:* Unmade: Media's season in court: How The Teacher's Pet changed Australia's podcast landscapeThe year of audio:* Unmade: What we learned from Listnr* Unmade: The economics of podcasting* Unmade: Mamamia takes on the podcast giantsNetflix moves in to advertising:* Unmade: The Netflix U-turnThe year in Unmade:* Unmade: Two awards, a fraud, and an unwelcome exit: the messy trajectory of Unmade’s startup phaseAudio production was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts.ITim [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

32:1018/12/2022

Start the Week: Ten swings for the cricket; Musk goes after Twitter alumni; Paul Barry closes on Media Watch record

Welcome to the Start the Week podcast, looking at the agenda for the week ahead. Today:* Ten closes on cricket rights* Another chaotic weekend inside the brain of Elon Musk* Paul Barry set for Media Watch recordToday’s episode feature Tim Burrowes and Abe UdyFurther reading:* Australian Financial Review: Ten vows to ‘restore cricket to former prominence’ after $200m+ bid* The Australian: Cricket chiefs face final pitches for broadcast rights* The Australian: Paul Barry signs on to top Media Watch recordAudio production was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts.Message us: [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

19:0011/12/2022

StW: Brand trouble from the bondage bear; The Twitter files; TMH's bloody boardroom coup

Welcome to the Start the Week podcast. Today:* Anti-siphoning lobbying goes into overdrive* Will TikTok and YouTube be pulled into the News Media Bargaining Code?* What the Balenciaga scandal says about fashion mags* Musk’s feeble “Twitter Files”* The war at The Market HeraldToday’s episode feature Tim Burrowes and Abe UdyFurther reading:* Sydney Morning Herald: TikTok, YouTube could be targeted under Australia’s media code* Australian Financial Review: Seven, Nine, Ten fight to keep sport on free to air TV* The Australian: ‘Outdated, anti-competitive’: TV’s anti-siphoning laws face overhaul* New Daily: Balenciaga’s reputation in tatters after ‘creepy’ photo shoot* New Daily: What Balenciaga’s BDSM controversy tells us about high fashion’s dire problems* Wired: The Twitter Files Revealed One Thing: Elon Musk Is Trapped* Unmade: How the ASX’s fastest growing media company implodedAudio production was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts.Message us: [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

23:0104/12/2022

StW: New faces at Today and A Current Affair; Winners of the TV ratings year; Molloy in Sydney

Welcome to the Start the Week podcast, recorded first thing on Monday, looking at the agenda for the week ahead. Today:* Winners and losers of the TV ratings year* All change at A Current Affair and Today* Mick Molloy’s return to Triple MFurther reading:* Australian Financial Review: TV ratings spark fighting and soul-searching among executives* The Australian: Seven casts a wide sports net* Mumbrella: OzTam ratings 2022: Seven retains total audience crown, while Nine keeps key demos* Unmade: In praise of The Project - why teatime telly still matters to the networks* The Australian: Intrigue grows over how Ten plans to redeploy Lisa Wilkinson* Unmade: Can Molloy win over Sydneysiders from 700km away?Audio production was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts.Message us: [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

20:0027/11/2022

Marketing in 2023 with Nick Garrett, Naomi Johnston, Richard Curtis and Andrea Dixon

Today’s edition features highlights from last week’s live event in Melbourne where our panel discussed the year just gone, and the outlook for marketing in 2023.Last Tuesday saw Unmade’s first live event in Melbourne, with 70 or so guests joining us at the Grace Darling in Collingwood for on on stage debate about the industry’s direction of travel.The panel featured Nick Garrett, partner at Deloitte Creative; Naomi Johnston, GM of Havas Media; Richard Curtis, owner of Futurebrand Australia and Andrea Dixon, head of marketing at DocuSign.Among the questions the panel raced through were: the work and people that impressed them in the year just gone; what the word ‘brand’ now means; the state of talent and recruitment, the economic headwinds that seem set for 2023; and reasons for optimism.The event was sponsored by Beatgrid.Even more thanks than usual for the podcast edit go to Abe’s Audio, who salvaged our low-fi backup recording into something [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

54:3324/11/2022

StW: The journo departure lounge; Return of Twitter's most toxic; The readership sausage

Welcome to the Start the Week podcast looking at the agenda for the week ahead. Today:* Lisa Wilkinson leaves The Project* Chris Dore leaves The Australian* Peter Fray takes a break from Crikey* Elon Musk gives up on brand safety, and reinstates Twitter’s most toxic - Jordan Peterson, Donald Trump, Kanye West and Andrew Tate* How the sausage is made in newspaper readership dataFurther reading:* Sydney Morning Herald: Top News Corp editor departed after lewd comments towards woman* Sydney Morning Herald: Crikey editor-in-chief on indefinite leave after journalism awards incident* Unmade: #RIPTwitter?* Bloomberg: Twitter’s Survival as a Subscription Service Depends on Apple and Google* The Australian: Readership: The Australian stays well ahead of rival in latest Roy Morgan researchAudio production was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts.Message us: [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

22:5620/11/2022

The Unmakers: Jamie Harding, CEO of Theatrix - the new streaming platform for the arts

In today's episode of The Unmakers, Unmade’s Tim Burrowes talk to Jamie Harding, founder and CEO of streaming platform Theatrix.Theatrix targets arts-loving consumers who want to recapture the experience of attending the theatre, at home.Still at an early stage, the platform has launched and begun to sign up subscribers at a fee of $8 per month.The content offered by Theatrix is filmed arts performances including theatre and dance.In the interview, Harding talks about how Theatrix was conceived, and the challenges of launching a streaming platform at the height of Covid. Theatrix is currently undergoing an investment round aimed at widening its reach.Today's episode of The Unmakers was edited by Abe's Audio. If you're an unmaker with a story to tell about how you're changing the media and marketing world, we’d love to hear from you on [email protected]. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

29:1415/11/2022

Start the Week: Why 2GB split with Jim Wilson; Closing in on a cricket deal; Mega Meta cuts

Welcome to the Start the Week podcast, looking at the agenda for the week ahead.Today:* Cricket, Olympics and tennis rights play out* Who won the TV ratings week* Why 2GB moved on from Jim Wilson;* Kyle & Jackie O’s unusual ratings jump* Communications minister on the stalled media regulations* Did the news media bargaining code work?* More chaos at TwitterFurther reading:* The Australian: Cricket Australia eyeing off a pre-Christmas broadcast rights deal* Sydney Morning Herald: Olympic bosses fly in to negotiate Games broadcast deal* Nine / OzTam: Weekly TV ratings wrap* Unmade: The mystery of Kyle & Jackie O* Australian Financial Review: Media giants flush with Facebook-Google money like the new normal* SMH: ‘Stuck in a rut’: Diversity rules to be overhauled in major media reform* SMH: Meta Australia braces for impact of global job cutsAudio production was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts.Message us: [email protected] you’re in Melbourne, don’t forget to take a look at out Marketing in 2023 event, which is next week.I’ll be back tomorrow with Tuesdata for our paying members.Have a great day.Toodlepip…Tim [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

21:3913/11/2022

Start the Week: Musk's 'thermonuclear' threat to advertisers; Nine to extend tennis deal as cricket bidding begins; ABC shakeup

Welcome to the Start the Week podcast, recorded first thing on Monday, looking at the agenda for the week ahead.Today:* Twitter lays off half its staff, including most of the Australian team* Musk threatens ‘thermonuclear’ retaliation against marketers who cancel advertising;* Nine closes in on tennis rights extension as cricket bidding opens* The ABC prepares for radical management restructureToday’s episode features Tim Burrowes and Abe Udy. As always, we’d love to hear what you think at [email protected] reading:* Australian Financial Review: Nine on verge of new Australian Open deal, as Cricket accepts bids* Sydney Morning Herald: ABC boss David Anderson to restructure organisation, shift to BBC model* Marketing Week: Mark Ritson - Five lessons on how not to do pricing from Elon Musk’s TwitterAudio production was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts.Message us: [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

21:3506/11/2022

Why Ooh Media's Cathy O'Connor has been anything but bored with outdoor

Welcome to an audio-led edition of Unmade.Today’s interview features Ooh Media boss Cathy O’Connor reflecting on her first two years with the company, while further down we have the details of a red day on the Unmade Index.In today’s Unmade interview, I chat to Cathy O’Connor as she approaches the two year mark with Ooh Media.We cover a lot of ground, beginning with her reminding me that when she took the job I’d (wrongly) suggested she might find it boring, after the excitement of running Lachlan Murdoch’s radio company Nova Entertainment.We discuss Ooh’s pledge to make public spaces better in the wake of the backlash to QMS’s City of Sydney rollout; the adjustment from running a private business to an ASX-listed company; why she’s the only female CEO of a big media company; her decision to sell Junkee; and her agenda for the Outdoor Media Association after boss Charmaine Moldrich departs next year.We also cover off the announcements from last week’s Ooh Outfront event - including the push into retail media through ReOoh, a tie up with Tennis Australia; measuring creative effectiveness in outdoor, and buying out of home advertising programatically.We also cover what O’Connor did not know when she took the job, and what she’d like to change about the industry. It’s a packed 36 minutes.Audio production was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts.Tim [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

37:2903/11/2022

Start the Week: Elon's Twitter bloodbath begins; Mutiny's new start; the Rebel Wilson verdict

Welcome to the Start the Week podcastToday:* Elon Musk bursts into Twitter* Mutiny rebrands as Mutinex, and makes a big hire* Verdict on the Seven and Ooh Media upfronts* Press Council verdict on the outing of Rebel WilsonToday’s episode features Tim Burrowes and Abe Udy. As always, we’d love to hear what you think at [email protected] production was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

24:4730/10/2022

What good is doing good? Leo Burnett's Catherine King on what the public expects from brands

Today’s topic: Do the public expect brands to do good, and what does that actually look like?Truth be told, when I was first offered the opportunity to cover today’s topic, I was hesitant.There’s been a lot of bandwagon jumping around the area of brand purpose and corporate social responsibility, not just in brands trying to boost their credentials in the space, but agencies positioning themselves as the ones to do so.But the subject of today’s podcast - Leo Burnett’s study of public expectations around brands doing good - is more pragmatic.In my conversation with Catherine King, chief strategy officer of Leo Burnett, we cover a lot of ground - including scepticism around brands’ true intent, the reality that companies’ underlying behaviour matters more than actions happening only at a branding level, and the moment when brands can actually start talking about their activities.We also dive into the intriguing statistic that Sky News Australia viewers appear to be the most likely to be selfish, with 27% of them saying they’d be unwilling to pay more for a brand that does the right thing. By contrast, Ten News viewers are the most altruistic, with 84% saying they’d be willing to pay [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

25:0426/10/2022

StW: Hi, Bayo: Foxtel set to merge Binge and Kayo; Will Nine swoop for early tennis deal? ABC shifts priorities

Welcome to the Start the Week podcast, recorded first thing on Monday, looking at the agenda for the week ahead.Today:* Foxtel plans for Binge and Kayo merger* Nine considers its options for Stan* The ABC prepares to shift budget to digital* Tennis rights set for early renewalToday’s episode features Tim Burrowes and Abe Udy. As always, we’d love to hear what you think at [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

19:4023/10/2022

The Unmakers: Sinorbis founder Nico Chu on helping western marketers crack Asia

Welcome to an audio-led edition of The Unmakers, featuring Nicolas Chu, founder and CEO of Australian marketing technology startup Sinorbis.As well as running Sinorbis, Chu is former MD of Expedia Asia Pacific and Professor of Practice at UNSW Business School.Sinorbis helps marketers, mostly in the higher education and B2B sector, to tailor their messages using the right language and platforms for the countries they are targeting. The company already offers its services to clients in Australia, New Zealand, the UK and US.Yesterday Sinorbis announced it was expanding its offering from covering just the Chinese market to the whole of Asia.If you’ve been forwarded this by someone else, don’t forget to sign up for our almost-daily email at unmade.mediaIf you’re doing something new in media and marketing, I’d love to talk to you on The Unmakers. Email me at [email protected] production on the podcast was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts.Have a great dayToodlepip…Tim Burrowes This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

26:4119/10/2022

StW: News Corp's merger; Stan to lose its NBCU deal? A disastrous media launch; Frankly's ratings stinker

Today:* Implications of the News Corp - Fox Corporation re-merger* Modernising the anti-siphoning laws* Who won the ratings week?* Frankly’s weak ratings start* Nine and Stan set to lose NBC Universal content* Carrie Bickmore’s million dollar pay packet* Ten gets sued by its own employee* The failing launch of news.netToday’s episode features Tim Burrowes and Abe Udy. As always, we’d love to hear what you think at [email protected] us: [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

26:1716/10/2022

The Unmakers: How Storipress founder Alex Pan wants to reinvent digital publishing

Today's edition of The Unmakers features Alex Pan, founder of Australia-based publishing technology startup Storipress. The Unmakers is Unmade’s podcast where I interview entrepreneurs starting new businesses and projects seeking to change how the media and marketing industry does business.Created as a code-free alternative to the likes of WordPress and Substack, Storipress broke cover back in July, revealing it had raised $500,000 in seed funding.Storipress has been accepted onto the local startup accelerator project Startmate, with early investors including former Junkee Media cofounder Tim Duggan.In the conversation, Pan shares the story of how frustrations with his own publishing venture inspired him to create a new platform, and shares his philosophy on what’s needed to fix the ecosystem and how he wants to become “Shopify for media companies”.If you’re doing something new in media and marketing, I’d love to talk to you. Email me at [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

28:3712/10/2022

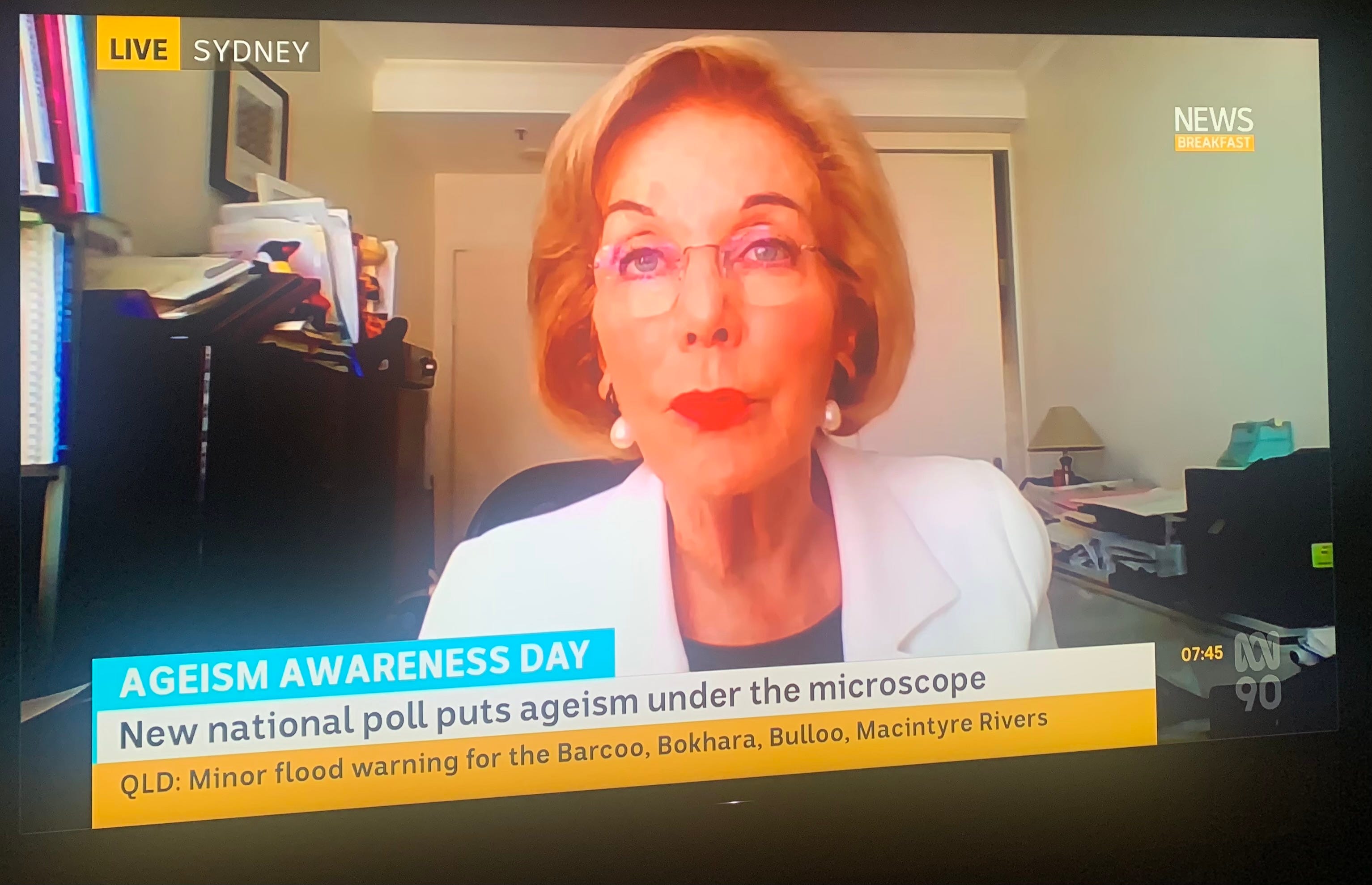

StW: F1 shambles; Dodgy government ad spend; Ita doubles down on missing ABC audience; Networks lobby on CTV

Welcome to the Start the Week podcast, recorded first thing on Monday, looking at the agenda for the week ahead. Today:* Formula 1 finale’s TV shambles* Grand finals ratings: Comparing the codes* Paramount shifts target to cricket* Government offers connected TV support for local players* Ratings duds from Love Boat and Frankly* ABC rejects youth criticisms* Governments’ questionable ad spendToday’s episode features Tim Burrowes and Abe Udy. As always, we’d love to hear what you think at [email protected] message from our sponsor:Global but proudly local, Paramount ANZ is taking brands into tomorrow.From a mountain of content to innovative advertising solutions, Paramount ANZ connects brands with future generations who are tomorrow’s customers. See tomorrow.Relevant links:* news.com.au: Max Verstappen crowned world champion in farcical scenes* Sydney Morning Herald: Paramount could bat for cricket, remains bullish on sports rights* Sydney Morning Herald: Dropping the ball? What to make of the TV ratings for footy grand finals* Australian Financial Review: Streaming apps come to the rescue for local TV networks* Nine: Weekly Oztam analysis* The Australian: Ita defends Fran* Australian Financial Review: Governments spend more on ads than Harvey Norman and MaccasAudio production was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts.Message us: [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

22:2609/10/2022

Paramount Upfront: How the Pluto FAST channels will change the game

Of the big three, we’re now two Upfronts in. Nine went first, back in mid-September, and yesterday it was the turn of Ten’s owner, Paramount, which took over the ICC for the afternoon to tell us its plans for 2023.Returning from the pandemic live event hiatus, there have been new Upfronts themes. Both Nine and Ten opened with performances from indigenous Australians. Both leaned into the dry ice. Nine went for flames, while Ten had glitter cannons in the ceiling. Both gave almost as much prominence to their tech partnerships as they did the content slate. And both emphasised the scale of their wider companies.This is where they begin to diverge.In Nine’s case, the scale comes from width - the multi-platform nature of the company, with TV, radio and publishing offerings. In the case of Paramount, the scale comes from depth - being the only free to air network that’s part of a global media organisation. Being the people who brought you Top Gun is quite the halo.While Nine’s theme last month was “Australia belong here”, Paramount’s was “See tomorrow”.As you’ll see from the top of this page, there’s also audio embedded, and available as a podcast to accompany this post. Earlier this week, I interviewed Paramount’s content boss Beverley McGarvey and commercial boss Jarrod Villani and we talked not just about 2023, but the company more widely.I realised that I had automatically labelled the file where I stored my interview notes “Paramount”, not “Ten”. Five years after Ten was bought out of administration by CBS (which quickly became Viacom-CBS and then Paramount), it now feels like a company that adds up to more than Ten-and-the-other-bits.Paramount owns not just the pay TV brands of MTV and Nickelodeon, but also the subscription streaming platform Paramount Plus and, as the company announced yesterday, the free ad supported TV channels offering of Pluto TV.The hot new acronym is FAST - free ad-supported streaming television. FAST will be as important to the next phase of the TV networks as the launch of BVOD (broadcast video on demand) was five or six years ago. It’s the next TV battleground.Viewers consume FAST channels differently to video on demand. For anyone who’s lost half an hour dithering over a menu of shows, FAST restores the curation of broadcast, and that means more video consumption.The point of FAST channels is that, like broadcast television, the choice is made for the viewer. It’s lean back, not lean forward. Channel surfing is back too.I wrote about the likely arrival of Pluto TV late last year, so it’s not a surprise to see it coming.As you’ll hear in the podcast, Paramount is being cagey about how many Pluto channels will be offered initially as part of its free 10play streaming platform. When I pushed Villani on it a couple of times, all he’d share was “a number”. Although he wouldn’t say so, I understand that number will be initially be between 10 and 20. In terms of timing, Villani said it would be this side of Christmas.My guess is that just as Ten All Access rebranded to Paramount Plus, in time 10play will fully rebrand to Pluto TV. Pluto is big business for Paramount globally, already writing a billion dollars in revenues.Nine announced at its Upfront that it will launch its own FAST channels, but had so little detail my guess is that it is some way off launch. For something so strategically important that feels like a miss.Meanwhile, Seven West Media - which holds its Upfront in just over a fortnight from now - was actually first mover in this market and already offers 50 FAST channels on Seven Plus in addition to its broadcast brands.Another point of difference for Ten was that unlike Nine, it revealed its programming grid for the year. Curiously, it broke 2023 into two uneven halves - the eight months up to August, and the final four from September onwards.In recent years Ten has started its main schedule early, while Nine and Seven are still airing their summer sports of tennis and cricket. But I’m A Celebrity will no longer kick off Ten’s year, shifting back to Easter, with production returning to Africa rather than the rain forest of Murwillumbah.Instead, Ten will start the year with The Bachelors, as it remixes the format with three Bachelors instead of one. It will also be resting companion series The Bachelorette this year. The revised format had previously been announced, but footage from the show got one of the strongest reactions in the room yesterday. I could see myself enjoying hate watching these nitwits.Conversely, I suspect that the Paramount team would have been more disappointed with the in-room reaction to the announcement of a local version of the UK show Taskmaster. It is well cast with Tom Gleeson as the local Taskmaster, but it’s one of those shows that unless you’ve seen it, it’s hard to understand the appeal. Although it will run in the first half, it’s not yet in local production, so there were no clips. Extracts from the UK version didn’t do much to advance that understanding. The Ten promo department usually does a better job.That said, the chase format Hunted, which launched last year, was similarly hard to capture in a sizzle reel beforehand, but that didn’t stop it from being one of Ten’s successes of 2022.Other detail for the first half included a shorter series of Masterchef than usual, and a UK-Australian co-production of cop-out-of-water comedy drama North Shore.The other trailer which got a big reaction was Last King of the Cross, the Underbelly-style glorification of the less than savoury John Ibrahim. This will run in the second half of 2023.There are more new formats in H2.Ten will offer a spin-off from Masterchef, Dessert Masters. It will also air The Traitors, a murder mystery guessing game hosted by Rodger Corser. There was already footage in the can of this one which suggests Ten isn’t exactly itching to rush it on air as soon as possible. The trailer felt more like a dinner party game than primetime.Bravely, Ten also announced a second season of The Real Love Boat. In an awful piece of timing, it made its debut on Wednesday night to poor ratings of just 215,000 metro viewers. Unless those improve dramatically over the next couple of weeks, there seems little prospect of that making the 2023 schedule despite what the grid said.Meanwhile, the announcements about technology were tactical rather than strategic.A shop-the-tweet integration between Ten and Twitter called The Checkout felt a few years late. remember companion apps?And a number of announcements around connected television advertising integration and measurement came across as necessary but not particularly exciting plumbing.The See Tomorrow theme was appropriate for a number of reasons. The major one is that we are yet to see the Paramount spending power unleashed on sport. The company only narrowly missed out on AFL rights last month. Imagine how different yesterday’s event would have been if it had won.Instead Villani referred on stage a couple of times to the $12bn parent company’s financial strength. You don‘t have to read too far between the lines to see that as a willingness to continue to chase big sports rights. As the network that made Big Bash a hit in the first place, Ten is a more natural home for short form cricket than Seven. And to a global company like Paramount, the Olympics must be of major interest too.Sport is the major missing piece for Paramount. In the last financial year, Ten’s revenue share of the metro broadcast advertising market was less than 24%, while Nine and Seven did about 38% each. Ten can only grow that by growing its audience.See tomorrow? We will eventually.Tim Burrowestim @unmade.media This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

39:1306/10/2022

The Unmade podcast: Rich Curtis on the biggest names on the FutureBrand Index, election campaigning and Meta's reputation recovery

Welcome to a Thursday edition of the Unmade podcast featuring the CEO of FutureBrand Australia, Rich Curtis. In the conversation, we talk about the top global companies featured in this year’s FutureBrand Index, and how he ended up helping win an outsider election campaign.The FutureBrand Index is an exploration of perceptions of the world’s top 100 global brands by size.Just two Australian-headquartered brands are big enough to make it onto the list - BHP and CommBank.Among the surprises is the improvement in Meta’s ranking since the rebranding of Facebook’s parent company. And the number one company on the index has almost no profile in Australia - Curtis explains how it got so far up the list.During the interview, Curtis reveals the behind-the-scenes role he played in the last Federal election, and offers his own verdict on the trajectory of local brands including the head-to-head battle between Coles and Woolworths, and the decline of Qantas.Audio production on Media Unmade was courtesy of Abe’s Audio This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

45:0005/10/2022

Start the Week: Seven closes on Peacock; Lachlan Murdoch's Nova profits revealed; what to expect at Ten's upfronts

Today’s topics:Nova’s financials revealedSeven closes in on NBC Universal dealNine says goodbye to Nick FalloonWhat to expect in Ten’s upfrontsToday’s episode features Tim Burrowes and Abe Udy. As always, we’d love to hear what you think at [email protected], or comment below.Further reading on today’s topics:Sydney Morning Herald: Nova radio tunes in with advertising reboundAustralian Financial Review: TV rights battle could lead to new Netflix, Disney+ competitorNine ASX announcement: Director retirement - Nick FalloonAudio production on Media Unmade was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

17:0602/10/2022

The Unmade podcast: Jag Sanger of The Market Herald on buying Gumtree and Carsguide, and launching a newspaper

This has been a significant week for the biggest Australian media company that you probably haven’t heard of. Headquartered in Perth and with more than 100 staff, The Market Herald has completed a $27m fund raising to buy classified sites Gumtree, Carsguide and, Autotrader.The Market Herald is parent company of the Hot Copper trading forum and the new acquisitions will catapult it the front row of the classified media battle. TMH is the seventh largest media company (of seven) listed on the ASX.In the Unmade interview, TMH’s CEO and founder Jag Sanger explains the company’s business model, and reveals his plans to launch a new national weekly business newspaper alongside a push into lifestyle publishing and a 24 hour business news streaming channel.Today's episode of the Unmade podcast was edited by Abe's audio.TranscriptTim Burrowes:I'm talking today to the founder and CEO of the biggest Australian media company that you've probably never heard of. Jag Sanger is the boss of The Market Herald, who surprised the market by announcing that they were buying Gumtree, Carsguide and Autotrader. The move makes them a big player in the classified advertising space. The Market Herald itself is a publication focusing on business news in both written and video form. Tim Burrowes:They've got big ambitions including a new weekly national business newspaper and a 24-hour business channel. The company also owns the gossipy investor forum, Hot Copper. I began by asking Jag how the company got to this point.Jag Sanger:Well, thank you. That's a good question. Right now we're at about 110 people split between Australia and Canada. I think one of the reasons why we're somewhat under the radar is in Australia, we're based in Perth, which is perhaps not known as a hotbed of media, and in Canada we're based in Vancouver.Jag Sanger:I think one of the things that has happened, and it hasn't been a deliberate plan on our part, is that because we've built an audience which is in Australia and it's in Vancouver, but it's also... Sorry in Canada, but it's also very much a global audience and we're building some activities which are outside of Australia, people haven't noticed who we are. In Nielsen always though, as a finance play, we've always been number one for impressions.Jag Sanger:We always are delighted about the success of our legacy competitor, the AFR. I think because there is a misunderstanding sometimes of business media, people don't quite understand that we're here, but we're here and we're growing very fast.Tim Burrowes:Well, in a moment we'll talk about The Market Herald now and let's talk about the wider portfolio as well. You're also... I'm not sure if the right phrase is to be owner of a community, but let's say it is. You're also the owner of probably the best-known finance community in Hot Copper. How do you think about that within the portfolio?Jag Sanger:Sure. I think this is a very important part of our journey and a very important part of how we think media organisations are evolving. If we look at how media business has worked, that once upon a time you would have, let's say a newspaper and then you would have classifieds and then by accident you had a community. Classifieds made all the money, community were people who sent you letters and your reason for being was the front page.Jag Sanger:We are that almost in opposite. We have built digital communities. Here in Australia, Hot Copper is easily the largest community for stock market investors. In Canada, Stockhouse is easily the largest community for stock market investors as well, so we own two of the largest communities. We're in that process of acquiring classifieds. We're bucking the trend there. It's a very important part of our business, and the punchline is that we will be releasing broadsheet national business newspapers, in this country and in other countries.Jag Sanger:It will be the first launch of a national business newspaper in this country since what? 1962. There's only two national newspapers in this country. We hope to be the third. This community is incredibly important for us because, one, it gives us readers, it allows us to turn some of the economics of journalism on its head and I'm happy to talk about how that works.Jag Sanger:But it's where we find out what people want to read, we want to find out what people want to view, and that community is a source of petabytes of data for us, which drives our data-led journalism.Tim Burrowes:Well, there's several interesting things there that I'll try and unpack, particularly the launch of a news master head in print form I think you're saying. Let's just talk for a moment about The Market Herald and that model because I'm amused with your labeling the AFR as your legacy competitor but fair enough. How do you think about your publishing ethos for The Market Herald?Jag Sanger:Well, firstly, just to talk about the Financial Review, I used to work for Fairfax. I used to run media and strategy there, a huge affection for the AFR and all its people and as they write about us often I suspect that we're forever in their thoughts as well, so we love to bits.Tim Burrowes:You're referring there to your occasional appearances in the Rear Window column of the AFR.Jag Sanger:You know one day I'll break out of Rear Window and they'll celebrate what we're doing somewhere else in the book and it'll be a happy day for us all. But no, no, we like them and we think they're doing good work. In terms of The Market Herald, just repeat the question. What was the question for The Market Herald?Tim Burrowes:Yeah. The Market Herald, what's your publishing ethos for The Market Herald?Jag Sanger:Sure. One of the things that we think is really important as a news outlet and as a media proposition in a world which is very noisy, with many audiences and huge fragmentation, all the stuff that we know, is to have a very, very clear sense of who your reader or viewer is to understand why they want to read and view you and then make a very, very quick decision, are you in the utility news business or are you in the must-know news business?Jag Sanger:We think utility users is going to a handful of publishers worldwide. There'll be this global giant, but in this must-read world, what we do is help people make decisions in a short period of time without all the information with a financial consequence and we give them that information quickly. Our classic reader is a... And to be horribly gendered for a second, a 55-year-old man who wants to buy a $10,000 worth of Telstra stock. Should I do it? Should I not do it?Jag Sanger:In that moment, we provide the information to them. But again, to be horribly gendered, the other kind of buyer we have is an equally intelligent and often smarter 25-year-old woman who's thinking about spending 10 grand on a used Chanel handbag. She also has information needs, she also needs to know in real time and we serve both those audiences.Jag Sanger:By giving people information they need when they're in state, and this is a very specific language that we use, we're ultimately a data business, when we track this degree of almost psychological arousal for why they must know, we are there and that's what The Market Herald is about.Tim Burrowes:This is both in the written word and in video?Jag Sanger:Absolutely. I think video is very interesting for us. We are easily one of the largest standalone streamers in this country of broadcast quality content. We are running at around nine to 11 million streams a month here in Australia and elsewhere. To understand how people consume media, how they consume video, how they consume the written word, that's something we spend a lot of time in actually working out but that's what we get from the communities we own.Tim Burrowes:Now, something you just mentioned was that you plan on launching a financial broad sheet, which was new information for me. I probably missed an announcement at some point. What is your plan there?Jag Sanger:Sure. We said this right from the beginning that we consider ourselves a newspaper and that we consider there is a viable business model for something we think is as beautiful and as amazing as a newspaper. We think as a product, as a cultural artefact, as a revenue stream, as a reason for being, it's really important to us and it's something we will be launching soon.Tim Burrowes:That's as a daily offering?Jag Sanger:No. I think if you look at the way the business meter is running around the world, it is let's say a Monday through Thursday digital offer, which is what most even print newspapers are doing. Then the weekend offer, which is a very interesting revenue earner and a very different proposition at the weekend for most of the big business press, that will be in print.Jag Sanger:It will be something which will have the cover mounts and the inserts that you have in traditional business news but the two will complement each other. We think a business audience at the weekend looks, feels, consumes differently and we'll serve them as well.Tim Burrowes:This will be available nationally?Jag Sanger:It will be available nationally. We're working out our print runs and our plans right now. We've been talking about this several times and I think it's an important part of the portfolio that we have. We believe here in Australia, we're already number one for online finance news. We are easily number one for business finance, TV streaming news and print is an amazing complement to both of them.Tim Burrowes:Fascinating. Last question on that one, have you yet set a cover price?Jag Sanger:It's a very interesting series of conversations that we're having. All I can say is it will definitely be at a premium.Tim Burrowes:Okay. Now, I suppose one of the other things which interests me about the business model for your portfolio is that some of the business model includes taking effectively shares in some of your advertising clients as they grow their businesses. How does that side of things work?Jag Sanger:There's two ways to look at it. We have a small amount of what exactly what say News Corp does or Seven West does, which is contract. You want to buy X, well, we'll do it in this way. Some of it is that kind of conversation.Tim Burrowes:This for instance would be like where Seven West ventures had stake in Airtasker for instance?Jag Sanger:Correct. They had a stake in Airtasker, they had a stake in... Or they've recently taken a stake in CarExpert, which is a property which we admire greatly and we do some things differently to that but we are kind of in that space. Very similar to that model and it's something that the contra deals people have been doing since the '50s. We get that. We do some of that as well.Jag Sanger:The other thing that we do is because we have a large business audience, one of the areas which we focus on and we see some of our competitors moving into it as well and we think we have different propositions is to provide an opportunity for listed companies and wealth brands to speak to affluent audiences. Now, for these businesses, often which they're smaller, they can be private or they can be listed, we allow them to pay their fees or their cost to ours for billings in stock.Jag Sanger:We don't manage these portfolios. It's not held as a way of making money, just simply a cash flow mechanism for smaller businesses. Sometimes we win and sometimes we lose and every time we're indifferent because it's not about making money on those portfolios, it's just simply a way of reaching different kinds of advertisers who may not yet have funds but who we believe in.Tim Burrowes:Presumably some of this content that you then create for these people is what... The phrase has gone out of fashion a bit, but would've previous been called advertorial or native advertising. How do you ensure the independence of your general reporting on business versus your coverage of those clients?Jag Sanger:One of the things that we do here, which is really interesting is our editorial team and our newsroom, they do not know what is a paying client and what isn't. That's the first thing. The second, when it comes to native, advertorial and sponsored, one of the things that we are almost religiously fixated on is if it's sponsored, it says sponsored at the top in 12-point font, it's orange and it's clear that it's sponsored. Jag Sanger:Our word of sponsored is if we have been paid for it or if there's been any degree of editorial sign-off from a client, then it says sponsored. What we don't do is to do what, for example, Forbes do where I think there is potentially an opportunity to... or a situation where you may begin to devalue some of your trust where sponsored is called something else.Jag Sanger:What we don't do is use the word special report, which again, some of our peers do and what we absolutely don't do, which is what some of our other competitors do, which is to barely mention it at all. The way that we do it is to be very much on the sunny side of the street. We do work with clients, we do advertorial and native sponsorship, but it's say sponsored if it's sponsored.Tim Burrowes:Well, you're about to make, certainly from where I'm sitting, looks like the biggest move in the history of the company so far, which is acquiring Gumtree, Carsguide, Autotrader. Why?Jag Sanger:I think there's a handful of reasons. First of all, the prescription we had for the business media or any kind of media, how it was is you had the front of the... Let's just take a newspaper. You have the front of the book, which is where your reputation sits. You have the back page, which is sports, which is where your readers sit because it's entertainment. But somewhere towards the back you had those traditional rivers of gold, you had those classified sections which paid for the whole shooting match. Jag Sanger:All journalism has always been sponsored, but usually it was sponsored by small ads for cars and houses and jobs. Well known to everybody, everybody knows this, but over the last 10, 20, 25 years, those classified sections have migrated out of newspapers and they become standalone businesses by themselves. You have the very interesting situation where you take for example Nine in this country, which is a $4 billion business-Tim Burrowes:Well, 3.5 these days. They've not had a good couple of weeks.Jag Sanger:I think there are some travails for everybody, but I think we like to go with four. You then look at the largest real estate listing site, the largest car site, the largest job site, and they have an aggregate valuation of $40 billion plus, 10 times bigger than the largest media business. They own no journalists. From our perspective, the largest general classified site in this country is Gumtree. It's a brand which 90% of this country knows. Jag Sanger:There's a degree of affection and warmth to that brand and to build something of that scale and reach would cost us hundreds of millions of dollars. The first thing is we're back in classifieds and we're back in classifieds with a vengeance. Number two, the opportunity to build other products around that audience, especially in terms of streaming video, especially transactional streaming video are huge.Jag Sanger:Great announcement from the news I think this week or last week about in-video commerce and that's something that we are probably going to be natural leaders in. Then the final thing is it gives us scale. Instead of reaching a million, a million and a half, typically male, typically wealth, typically eastern states, we've now got an audience which is almost one in two economically active adults in this country. Jag Sanger:We think we have great editorial opportunities with that and it gives us classifieds, it gives us what we need structurally and it gives us huge reach. That's why we did it.Tim Burrowes:Obviously that plays you into a couple of classified verticals. Are there others you'd be interested in acquiring or launching into? I guess I'm thinking about jobs in real estate, which are obviously lucrative but also quite competitive.Jag Sanger:That's a really good question. I think there are one or two categories where we are very, very well-positioned, and one of those is autos. Against Carsales who we admire and who we like and who we know very well, against Carsales, we now have similar traffic. Over recent years, the business... This is the Gumtree business, has consolidated the second, third and fourth largest competitor to Carsales. One of those is Carsguide, which I was on the board of, and we know it very well and we think we have a red hot chance in cars.Jag Sanger:To put this in context, we've got similar traffic for private party, cars, people selling their own cars. We're bigger than Carsales. For some aspects of dealer, we're kind of at the similar level. Some of the things structurally we're in possibly a better position for... Carsales is a $6/7 billion business so we think there's a huge amount of opportunity there. Jag Sanger:For some other areas, I'm not sure if the brand travels naturally, so we won't push it, but because we're number one in general classifieds, we actually aggregate several thousand categories and within those categories there are always some gems and we'll put our time and effort into those.Tim Burrowes:Now, you're also looking to play yourself into the, I suppose, consumer lifestyle space with the launch of Market Herald Fancy. How are you thinking about that?Jag Sanger:If you look at how business media used to work, and this is the Wall Street Journals, the New York Times, the Financial Times, let's say the AFR here, if you pick up the newspaper on a Friday or a Saturday, the book will have 48 pages, 52 pages, and it will have maybe two or three ads. We like to think that business newspapers took the ads out to make them easier to read. Jag Sanger:But on a Saturday or a Sunday, that same book will have three inserts in it and there will be 74/76 pages and they will be 60% full page, full colour, glossy and they're carrying ads for high ticket consumer, high-engagement but infrequent purchases. It's travel and jewellery and luxury and all that kind of thing. Fancy is in the same vein of that, probably the closest comp would probably be How To Spend It, which is from the Financial Times. How To Spend It is now probably 30% of the EBIT of the entire Financial Times business. Jag Sanger:If you look at the Wall Street Journal, they have Penta, if you look at... Sorry, yeah, they have Penta, the New York Times has the T Magazine. It's very similar. It's a way of selling product and introducing very, very affluent audiences which are hard to reach, to high-end brands. That's something we're doing.Tim Burrowes:Now, you are also looking ever more closely at the streaming space as well, 24 hours streaming with your ambitions for The Market Herald with TMH One. How will you go about that?Jag Sanger:One of the things that we do very well is... And this is something that we talk about and we're very open about and is very much hidden in plain sight, is we've created a different kind of multi-platform journalism and everybody says that, but our newsrooms look different, they act different and they're run different. We begin at the plumbing layer. We are ultimately plumbers. We have built and plumbed a different kind of newsroom, not hired for a different kind of newsroom.Jag Sanger:We're multiplatform from the beginning. Our workflows editorially link into our news gathering and production for video. Our video streaming, we're one of the largest streaming publishers in Asia Pacific. Certainly we're told that by our streaming partners and we built our own play out. What that basically means is we can produce high quality broadcast quality content. We're not terrestrial, but we can do it maybe at 20% of the cost of terrestrial.Jag Sanger:Now, that ability to take that infrastructure and apply it to different kinds of business and then lifestyle programming absolutely is something that we're focused on and is something we'll be talking about more in the next few months. We've committed to launching a streaming channel called TMH One. We're definitely on track and we look forward to getting that out of the tracks very soon.Tim Burrowes:Would you see that as a potential competitor to the likes of Ausbiz for instance?Jag Sanger:I think, Kylie, we have a huge affection and time for. I think that she's-Tim Burrowes:She's Kylie Merritt me who runs Ausbiz?Jag Sanger:Correct. Yeah. I think, look, it's very interesting. Most of the business TV experiments in this country have failed. If you look at CNN Digital, which it was touted as being one of the biggest changes to CNN for many, many years. They spent two years on it, they spent $300 million and they pulled it after six weeks. If you look at the failed experiments in the UK right now, which have been GB News and a handful of others.Tim Burrowes:Well, in defense of GB News, they are beginning to find an audience now, I think.Jag Sanger:You are correct, there are some programs and some slots which have more than zero views, which was a challenge for them for some time. I give you that. They have got at least one view for most of their slots now. Took a while. I think that we've learned a lot from those failed experiments and I think that that model which was embodied in so many people, which was a terrestrial workflow but somehow tweaked for streaming, we don't believe that works. We think a ground-up integrated workflow is the way to do it.Tim Burrowes:Presumably the rise of connected TVs is one of the factors that makes this the timely moment to do so.Jag Sanger:I think that the opportunity for connected TV is both much greater than people think, but will take much longer to get there. I think that the ability to wrap an idea of programmatic TV, which is how advertisers think about connected TV or always on TV or TV everywhere, doesn't quite match the reality of how people engage with that content. Jag Sanger:One of the really interesting opportunities and realities of business television on big screens, especially streaming business television, is more business TV is walked past in lobbies than watched in seats. We're there. We're thinking about it closely. We have learned a lot from the failed experiments of many of the other terrestrial to streaming formats and we hopefully will get it right and we're going to find out very soon, but we're very confident.Tim Burrowes:You're raising something like $27 million at the moment from your existing shareholders. I noticed there's a slight delay in getting that stock back up and trading on the ASX, certainly as we're talking. I think it was about now we were expecting, but maybe there'll be another week's delay or so. What's the reason for that change in timings?Jag Sanger:First of all, the rights... Sorry, the rights issue was incredibly well supported. We have had all of our existing shareholders take it up, especially institutional shareholders. We'll be announcing who some of those are very soon, which will be very interesting because some of them move past certain thresholds. There was the unfortunate death of a monarch this week, which doesn't happen often and that has delayed our timings. Jag Sanger:Then there's this big kicking and jumping game that happens in Victoria. For those two reasons, the timings were pushed out very slightly but we are hugely pleased by how successful the raising was. There are a number of other things that we have to do to finance this transaction but everything is on track.Tim Burrowes:Now, the organisation has a turnover approaching 30 million. The normalised EBITDA I seem to remember as being about 5 or 6 million. In your last annual report, current debt was about 7 million. Usually the markets like the ratio of the debt to be below the EBITDA. After the raising, where are you expecting your debt to sit?Jag Sanger:I think that we put forward a pro forma in our raising documents and we expect to be about $120-ish million revenue. We expect to be at around 20 million dollars EBITDA. Excuse me. We're not giving guidance on either. We are raising debt and there's a number of different things that will come into play there. It's also worth saying that typically for a media business in the growth phase that we're in and we're growing incredibly quickly each year, the ratio of debt to our market cap is often more significant. Jag Sanger:It'd be fair to say that we are somewhat undervalued at this moment. We're very conscious of that, and the reason for that is that we're very tightly held. One of the things that's happened in this rights issue is most of our shareholders... Well, nearly all of our additional investments come from existing shareholders, which means there's not a lot of stock in the market. For all kinds of reasons, as we grow that will change, our valuation will change.Jag Sanger:Clearly we're not making any forward-looking statements, but I think a rerate would possibly be on the card at some point. At that point we do things differently.Tim Burrowes:Let's talk a little bit more about your background. You've touched on some of this already. You actually found your way into the media with ITV, which is the biggest commercial broadcaster in the UK, back in 1989, which would've been before it was one ITV I guess. What was it that interested you in media in the first place?Jag Sanger:That I think is really interesting. First of all, LWT is I think one of the most interesting broadcasters in the world at the time, and certainly was. It was absolutely that kind of stepping stone between this post-war Reithian public service and the brave new world of selling things. There are so many innovations that happened there that a lot of traditional TV around the world learnt from what happened at LWT but nobody's heard about LWT because it's such a long time ago because I'm so old.Tim Burrowes:London Weekend Television.Jag Sanger:Once upon a time you only saw it at weekends. No, I was incredibly fortunate at that time to get a great job, which was carrying bags and getting people's tea and all that kind of thing. But to me it was actually quite fascinating because I remember so vividly at that time, I earned the grand sum of I think about, I don't know, a few hundred pounds a week, and 30 years later a runner in Central London still earns 300 pounds a week, so it's changed and it hasn't.Tim Burrowes:You then went through cable television and also consulting with McKinsey and later with PwC and along the way, as you've already mentioned, two years at Fairfax, which I think was 2006 to 2008, which was probably when things there were at the most panicked and desperate as the newspaper model went away. What did you learn from that?Jag Sanger:Well, look, if I think and reflect on all of those experiences, I began to work first in probably the world's most significant and interesting broadcast, which doesn't exist anymore. Then I worked at Videotron, which was the most important European cable business, which doesn't exist anymore. Then of course CableTel which literally consolidated to European Cable that doesn't exist anymore. Then I came here and worked a bit for Fairfax, which doesn't exist anymore.Jag Sanger:Your conclusion could be you're a desperately unlucky kind of guy, Jag, which would be one conclusion, or I've seen a lot of things and we kind of know what works and what doesn't work and hopefully we're applying some of those lessons.Tim Burrowes:Without giving any forward-looking guidance, what is your take on the economic outlook for media generally at the moment?Jag Sanger:I think that one of the really interesting things is the growth of the streamers and the decline of the streamers, the way that audiences are going to continue to fragment, but media won't care. Then the really interesting opportunity in business media, and clearly I'm talking my own book because we're in business media. We think the growth and the decline of the streamers is that the magnificence of Netflix and then that short period of existential land grab for anybody grossly distorted production around the world.Jag Sanger:We can see that tide flowing out and it will change a lot of things very quickly. Fragmentation of audience, no one's actually going to care because it's as fragmented as it's going to get. There's enough micro audiences and smart people will realise that there's a difference between utility. Everything will be everywhere at the same time and super, super niche and the super, super niche will thrive. Jag Sanger:Then with business, one of the things that we're very conscious of is we attract in large numbers some of the most affluent, influential, engaged, curious and hard to reach audiences on the planet and unlocking that, getting closer to transactional outcomes means good business programming, coverage news will always attract an audience and that audience is more valuable than people think.Tim Burrowes:Just finally for The Market Herald obviously you're doing the big acquisitions now, Gumtree, Carsguide and Autotrader, is that likely to be it for the short and medium term in terms of acquisitions or do you see more down the track as well?Jag Sanger:If you look at my LinkedIn profile, you will see that I say I'm an M&A guy in media, so I would assume that we will do more on both and this is a platform transaction, which as we publicly said, gives us the opportunity and hopefully the right to do more going forward.Tim Burrowes:Look, and I did say it was the last question, but I have thought of just one more actually, which is inspired by you being the M&A guy. I'd love to know what you do think about that wider media landscape on why these big mergers haven't happened yet. Because it felt like two years ago, maybe even just prior to the pandemic, everything was set for some of the big beasts to come together. Has that, well changed or are we still going to see that, do you think?Jag Sanger:Look, I think there's probably two big reasons. Number one is the history of outside in M&A in media is not good. Let's take Australia for a second. If you look at Nine, if you look at Ten, look at Bauer, the winner was the seller. I think that it's an interesting opportunity to better reflect on some of the reasons why. The second is when you look at the shifting priority of non-financial strategic buyers, it's very different.Jag Sanger:Media is not a fast-growth business to some of these people unless you do things very differently. That then means that the future will be driven very much by non-trade financial buyers and those guys are going to be much more operationally focused. They'll look a lot more like we do and we think that that's the kind of player which will begin to consolidate some of these big beasts.Tim Burrowes:Jag, thank you very much indeed for your time.Jag Sanger:No, I appreciate it. Thank you.Tim Burrowes:That's it from the Unmade podcast for today. If you aren't already signed up to the Unmade email, you can do so at unmade.media. Today's podcast was edited by our friends at Abe's Audio. I'm Tim Burrowes and I'll be back with more soon. Toodle-pip.Speaker 4:Unmade. Podcast edit by Abe's Audio. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

32:2528/09/2022

Start the Week: Forbes and Inc in Aussie head-to-head; the Optus hack; underwhelming AFL ratings; blood on the ASX

Today’s topics:Business media’s new battleground as Forbes and Inc both come to Australia;The Optus brand after the hack;How a one-sided Grand Final meant lower AFL ratingsPlummeting prices for media stocksDamo’s last dance (and Unmade’s next events)Today’s episode features Unmade’s Tim Burrowes and Damian Francis. As always, we’d love to hear what you think at [email protected] reading on today’s topics:Australian Financial Review: New business publication to target aspirational eyeballs;Mumbrella: Forbes Australia CEO on what the brand offers advertisers;The Australian: Rift widens over $50m Judith Neilson Institute for Journalism prize;Unmade: Reputation crisis for Optus The New Daily: AFL grand final’s TV audience was a ratings disaster;The Australian: Local content quotas on streaming platforms will cause bottlenecks: Disney chiefAudio production on Media Unmade was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts.Message us: [email protected] This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

42:5725/09/2022

The Unmakers: WeAre8's Lizzie Young on why she wants exactly 6.5% of social media budgets

In today’s episode of The Unmakers, Tim Burrowes talks to Lizzie Young, CEO for the Australian operation of new social media platform WeAre8.In the conversation she explains why it was time to leave Nine, why she wants to capture 6.5% of marketers’ social media budgets and reveals the next major step in WeAre8’s product roadmap.Today's episode of The Unmakers was edited by Abe's audio. This is a public episode. If you’d like to discuss this with other subscribers or get access to bonus episodes, visit www.unmade.media/subscribe

30:3420/09/2022

Start the Week: Most watched TV; a perfect AFL lineup; Ten's Saturday problem