Sign in

Sign in

Business

Mike

An investing podcast + substack for people who want to compound their wealth over the long run and don't mind sailing analogies telltales.substack.com

Cashflow Growth & Economic Insights: Navigating Market Complexities

0:00:00 - Introduction: Overview of the podcast's key economic and financial topics. 0:01:51 - Oil Market Dynamics: Analysis of the complexities in the oil supply and demand. 0:03:56 - U.S. Gas Supply and Demand: Discussion on the U.S. gas industry's current trends and future outlook. 0:06:00 - U.S. Government Financial Health: Insights into the U.S. government's fiscal situation, focusing on revenues and expenses. 0:09:34 - Sponsor Segment: Acknowledgement of our sponsors and their support. 0:10:52 - Company Cash Flow Analysis: Detailed examination of free cash flow changes in various companies. 0:30:00 - Preview of Next Week: Introduction to upcoming topics focusing on cash flow momentum in different sectors. 0:30:57 - Closing Remarks: Summary and key takeaways, along with a look ahead to the next episode.Covered Companies: AT&T: #TVerizon: #VZT-Mobile: #TMUSNetflix: #NFLXWalt Disney: #DISAmazon: #AMZNMeta Platforms (formerly Facebook): #METAApple: #AAPLAlphabet (Google): #GOOGLIntel: #INTCTesla: #TSLAThis podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

31:1506/12/2023

The Next Cashflow King

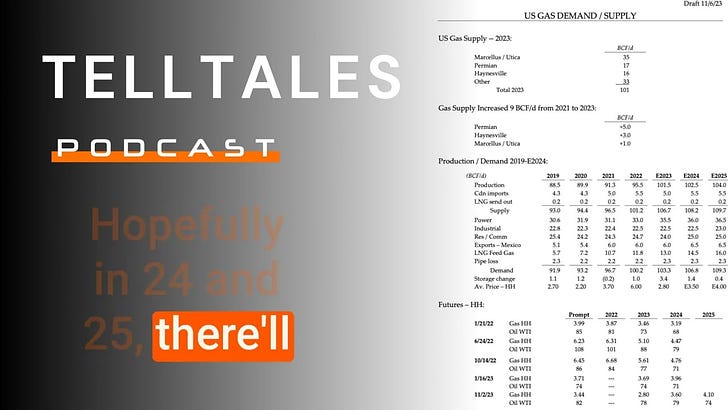

Episode Title: "Telltales E2348: The Next Cashflow King'" Release Date: November 29, 2023 Duration: 33:10 Episode Summary: Dive into a riveting discussion in this episode of "Telltales," where we unravel the dynamic world of technology and media giants. We begin with an in-depth analysis of US gas demand and supply, followed by a critical examination of the US government's financial health. The episode heats up as we explore potential challengers to Apple's cash flow crown and speculate on Tesla's journey to a significant free cash flow milestone. Delve into the strategic positioning of Meta in the AI space, and join us as we compare the content strategies of major media platforms like Netflix, YouTube, and others. We wrap up with the latest insights on telecom leaders Verizon, ATT, and T-Mobile. This episode is packed with insightful analyses and predictions, making it a must-listen for enthusiasts and professionals in the tech and media landscape. Key Highlights: [00:03:52] US Gas Demand / Supply: Analyzing trends and projections. [00:04:32] US Gov't Finances: Exploring government revenues and expenses. [00:04:50] AAPL Cashflow Contenders: Who could surpass Apple? [00:07:37] Surpassing AAPL's Cash Flow: Potential business models and market opportunities. [00:15:01] Tesla's FCF Milestone: Predicting Tesla's financial future. [00:21:04] Media Strategies Comparison: Netflix, Meta, YouTube, and more. [00:26:30] META's AI Positioning: Meta's strategy in AI. [00:28:05] Telecom Update: Insights on Verizon, ATT, & T-Mobile. [00:31:07] Closing & Disclaimer: Important reminders. This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

33:1030/11/2023

OpenAI Drama & Impact on Software & Semiconductor Companies

Title: OpenAI Drama & Impact on Software & Semiconductor Companies Hosted by: Hunt Lawrence, Jason Wallace, Mike Nicoletti Chapters: [00:00:00] Introduction to Telltales Podcast [00:00:46] Discussion on World Oil Supply/Demand and OPEC Meeting Implications [00:01:58] Analysis of US Gas Demand/Supply Trends [00:03:50] Examination of US Government Revenues and Expenses [00:05:55] Impact of OpenAI Drama on Semiconductor and Software Companies [00:25:00] Future of GPUs in Consumer Electronics [00:29:30] White House AI Executive Order and its Implications [00:30:29] Closing Remarks and Preview of Next Week's Topics Key Highlights: World Oil Dynamics: Insights into the latest OPEC meeting and its implications on global oil supply and demand. US Gas Trends: An in-depth look at the US gas market, examining production, demand, and future projections. Government Spending: Analysis of US government spending and the financial implications for the economy. OpenAI's Structural Changes: Discussion on the recent turmoil at OpenAI, its impact on the tech industry, and potential benefits for other tech giants. Future of Consumer Electronics: Exploring how GPUs and AI accelerators are shaping the future of laptops and smartphones. Policy Impacts: How the White House's AI executive order might influence open-source AI models and tech companies. Sponsorship: Episode sponsored by Top Market Capital. This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

32:3323/11/2023

Oil / Gas / Macroeconomics / Marketplace Businesses / Telecommunications / Artificial Intelligence - Telltales Podcast E2346

Description: Join Hunt Lawrence, Jason Wallace, and Mike Nicoletti in this insightful episode of the Telltales podcast, where we delve deep into the world of investing, economics, and technology. Get expert opinions on current market trends, investment strategies, and a detailed analysis of various sectors.Chapters: 00:00 Intro and Disclaimer 00:57 Exhibit C: Analysis of World Oil Supply and Demand 02:38 Exhibit B: U.S. Gas Demand and Supply 04:30 Exhibit A: U.S. Government Revenues and Expenses 06:35 Discussion on Uber, DoorDash, Airbnb, and Five Below 13:35 Analysis of Comcast and Charter in the Cable Industry 18:41 Insights on JPMorgan, Goldman Sachs, and Morgan Stanley 21:54 Microsoft, AI, and Future of Tech Investments 28:42 Outro & DisclaimerHighlighted Topics:World Oil Supply and Demand DynamicsU.S. Gas Market TrendsFiscal Analysis of U.S. GovernmentIn-depth Look at Companies like Uber, DoorDash, Airbnb, and Five BelowCable Industry Analysis Focusing on Comcast and CharterFinancial Institutions: JPMorgan, Goldman Sachs, and Morgan StanleyThe Role of AI in Future Investments, with a Focus on MicrosoftThe Leadership and Strategy of Companies like NVIDIA and IntelLinks and Resources:Telltales Newsletter - www.telltales.usThe Verge Article on Microsoft AI Chips - https://www.theverge.com/2023/11/15/23960345/microsoft-cpu-gpu-ai-chips-azure-maia-cobalt-specifications-cloud-infrastructureThis podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

29:5015/11/2023

Navigating the Currents of Energy, Health, and GPUs

Episode 23.45 of the Telltales Podcast delves into the intricate world of market investments, offering listeners a comprehensive analysis across several dynamic sectors. Join us as we dissect the latest trends in oil and gas markets, exploring the geopolitical and economic factors at play. We take a deep dive into natural gas demands, the US fiscal landscape, and the strategic maneuvers of key players in the energy sector. The discussion takes a pivot to the healthcare industry, where we evaluate the financial health and strategic decisions of giants such as UnitedHealth, CVS, Regeneron, and Biogen. In the ever-evolving tech realm, we analyze Apple's latest earnings, debate the competitive landscape of GPUs with NVIDIA and AMD at the helm, and speculate on the implications of export controls on global distribution, particularly in AI and data center spending. This episode is a must-listen for investors and enthusiasts keen on staying ahead in the investment game, with insights and commentary from our expert hosts. Whether you're looking to understand the current market scenarios or seeking foresight into the future of these pivotal industries, episode 23.45 is your guide through the complex currents of today's investment opportunities.This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

32:2709/11/2023

Analyzing the Memo: A Deep Dive into Pages 13-18

In this week’s episode...[00:01:17] Energy Sector: Kickstarting the episode with a discussion on the current trends and future prospects in the energy sector. What does the landscape look like, and what should investors be aware of?[00:06:01] Banking: Analyzing the financial health and performance of JPMorgan Chase (JPM), Morgan Stanley (MS), and Goldman Sachs (GS). What do these banks have in store for investors?[00:06:54] Industrial and Construction: Delving into Caterpillar (CAT), Deere & Company (DE), and other key players. How are these companies navigating the current economic climate?[00:08:51] Pharmaceutical Innovators: A look at Pfizer (PFE), Moderna (MRNA), and others leading the charge in medical innovation. What should investors know about their recent developments and future potential?[00:11:58] Consumer Favorites: Discussing the performance and strategies of McDonald's (MCD), Starbucks (SBUX), Chipotle (CMG), and more. How are these companies maintaining their appeal to consumers?[00:13:44] Logistics and Apparel: Analyzing FedEx (FDX), UPS, Nike (NKE), Costco (COST), and their roles in their respective industries. What trends are shaping their futures?[00:15:44] Materials and Energy: Exploring Freeport-McMoRan (FCX), Albemarle Corporation (ALB), and others driving innovation in materials and energy. What investment opportunities might they present?[00:18:37] Tech Titans: Diving into Apple (AAPL), Alphabet (Google) (GOOG), Tesla (TSLA), and their impact on the tech industry. How are these giants shaping the future?[00:25:14] Semiconductor Leaders: A closer look at NVIDIA (NVDA), AMD, Intel (INTC), and other key players in the semiconductor industry. What should investors expect from this rapidly evolving sector?This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

30:1501/11/2023

Navigating the Markets: Social Media, AI Strategies, Energy

Episode 23.34 Chapters[00:01:19] Oil, Gas, & Macro: Exhibits A, B & C[00:03:06] Page 5: $CHTR / CMCSA 0.00%↑ [00:06:12] Page 6: $T / $VZ / TMUS 0.00%↑ [00:09:32] Page 7: $MA / $V / PYPL 0.00%↑ [00:11:19] Page 8: $WMT / $TGT / $LOW / $HD / KMX 0.00%↑ [00:12:16] Page 9: $XOM / $CVX / $COP / $OXY / LNG 0.00%↑ [00:14:27] Page 10: $KMI / $EPD / $ET / WES 0.00%↑ [00:15:14] Page 11: $EOG / $MGY / $PR / FANG 0.00%↑ [00:15:40] Page 12: $AR / $EQT / $CHK / AM 0.00%↑ [00:17:11] Sponsor Break[00:17:46] Page 4: $META, TikTok & Cigarettes[00:19:36] Page 1&4: AI Cloud Strategy: $AMZN vs MSFT 0.00%↑ [00:21:12] Page 4: Would you rather: $NFLX or $DIS?[00:22:25] Page 3: $NVDA / $AMD / $INTC / $TSMC / ASML 0.00%↑ [00:23:39] Page 2: $MSFT earningsThis podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

27:5926/10/2023

Turmoil in the Middle East / No Speaker & Continuing Resolution / New Chip Export Restrictions / Tesla & ASML Earnings / The Future of US Defense

In this week’s episode...Telltales Podcast: Episode 23.42 Show NotesEXHIBIT C: WORLD OIL SUPPLY / DEMAND:Delve into the intricacies of world oil supply and demand, especially in the context of recent geopolitical events in Gaza and Iran's production capabilities.Exhibit B: US GAS DEMAND / SUPPLY:A comprehensive look at US natural gas demand and supply, discussing factors influencing prices and the role of geopolitical events.EXHIBIT A: US. GOV’T REVENUES AND EXPENSES:Explore the state of US government revenues and expenses, focusing on the current political landscape, the deficit situation, and the administration's approach to these challenges.PAGE 1: AAPL 0.00%↑ / GOOGL 0.00%↑ / TSLA 0.00%↑ :Dive deep into the performance and trends surrounding tech giants like Apple, Google, and Tesla, discussing stock performance, market dynamics, and future outlooks.PAGE 2: MSFT 0.00%↑ / $CRM / $SNOW / $ORCL:An in-depth analysis of major tech stocks, including Microsoft, Salesforce, Snowflake, and Oracle, with a focus on their respective market positions, challenges, and opportunities.How much of a market is the US market for advanced GPU chips?:Discuss the market for advanced GPU chips in the US, considering their potential use by the Chinese military and implications for US defense contracting.This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

31:3118/10/2023

Gaza, Hamas, and Global Oil Prices: Telltales Episode 23.41

SHOW NOTES: Gaza, Hamas, and Global Oil Prices: Telltales Episode 23.41[00:00:57] IntroductionBrief overview of Exhibit B & C.Effects of the Hamas-Israel War on global energy prices.[00:01:26] U.S. Oil Inventory InsightsYear-over-year inventory analysis.How crude oil prices shifted over the past months.[00:02:54] Middle East Power DynamicsA potential three-way agreement between Israel, Saudi Arabia, and the US.Iran's role in the negotiations and their relationship with Saudi Arabia.How recent events in Israel affected the geopolitical landscape.[00:03:28] Iranian Economy and SanctionsRepublican criticisms.Impact of relaxed sanctions on Iran's oil production.Economic comparisons between Trump and Biden administrations.[00:04:57] The Abraham Accords and Global Oil GameUS's strategy to reduce oil prices.Predictions on Israel's actions against Hamas.Speculations on future negotiations.[00:06:54] Political Turnover in the U.S. GOP HouseThe scenario post-McCarthy.Speculations and political climate surrounding Scalise's nomination.Financial challenges faced by the U.S. and the Fed's plans.[00:09:06] Investing in a 2.5% Real Interest Rate WorldEvaluating the real rate of interest required.Impact of inflation rates.History of real interest rates and potential futures.[00:10:39] Tech Stock AnalysisDeep dive into companies: Apple, Alphabet, Tesla, and Microsoft.Free cash flow evaluations.Growth rates and future valuation predictions.[00:14:52] NVIDIA’s Bright FuturePredictions about NVIDIA's growth.The potential for its GPUS in the world of large language models.[00:15:57] The FTC vs. Google: A Glimpse Inside the TrialFinancial discussions around payments to Apple.The potential implications for Apple's services.[00:17:34] Exploring the Cost of Language Models vs. Traditional SearchTechnical comparison between Google's search and large language models.Potential future developments in the search industry.This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

25:1711/10/2023

Navigating Financial Waters: From Google's Dominance to the Fed's Interventions: Telltales Episode 23.40

This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

32:4904/10/2023

Navigating the Economy: Energy, Macro, and How to Find Supercompounders

[00:40] Exhibit A-C: Oil, Gas, & MacroHunt discusses the unusual behavior of oil in the market, emphasizing its large surplus capacity. The scenario with natural gas is contrasted, noting its struggle due to the fact that supply continues to outpac demand. The conversation touches the broader fiscal landscape, including the challenges the U.S. government faces regarding deficit and security financing.[03:53] Who can double cashflow in next 3-5 years?The chapter delves into potential companies that could see significant progress in their free cash flow over the next 5 years. Tesla and NVIDIA are highlighted, while Celsius and Vertex are also discussed as having the possibility of significantly growing free cashflow. The focus is on understanding the growth prospects of these companies and the factors that might influence their financial trajectories.[23:45] The Basis TradeThis chapter delves into macroeconomic factors, highlighting a concerning article from the Financial Times about the repo market's use by hedge funds in interest rate futures. For more on this, check out this FT article.This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

28:1027/09/2023

Unlocking FCF Growth in Energy and Non-Energy Sectors: Telltales Episode 23.38

In this week’s episode...[00:35] Energy Markets Overview: Exhibit C & B, Pages 11-12. AI Summary: The chapter opens with a discussion on energy inventories, particularly in the U.S., and the current state of oil production from countries like Saudi Arabia and the UAE. The hosts express skepticism over the current oil rally and suggest that it may be overdone.[04:13] Energy: Where to find FCF growth? Pages 9-11. AI Summary: The hosts explore cash flow characteristics of various energy companies and emphasize the importance of free cash flow, especially in a high-interest rate environment. The chapter aims to identify companies that are growing their free cash flow by at least 10% per year.[07:44] Non-Energy: Where to find FCF growth? Pages 14, 3, & 1. AI Summary: The chapter begins by discussing various industrial companies like Caterpillar, Deere, and Generac, each dominant in their respective markets. The conversation also touches upon Fastenal, a hardware supply company, highlighting its impressive long-term investment returns. The hosts then explore the performance of major tech companies, such as Nvidia, in terms of their free cash flow. Nvidia's exceptional performance is contrasted with other companies like Advanced Micro Devices and Intel, focusing on their different valuations and cash flow statuses. The discussion also ventures into the implications of high valuations for companies with significant free cash flow growth, specifically citing Nvidia as an example. Lastly, the conversation delves into broader investment themes, such as the role of artificial intelligence in shaping the future of industries.This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

28:5720/09/2023

Navigating Markets: From Energy to Tech & Biotech — Telltales Podcast E23.37

IN THIS EPISODE...[01:30] EXHIBIT C: WORLD OIL SUPPLY / DEMAND [02:30] EXHIBIT B: US GAS DEMAND / SUPPLY[03:00] EXHIBIT A: US. GOV’T REVENUES AND EXPENSES [03:56] PAGE 9: XOM/CVX/COP/OXY/LNG[05:43] Page 10: KMI / EPD / ET / WES[06:57] PAGE 11: EOG / MGY / PR / FANG[08:31] PAGE 12: AR / EQT / CHK / AM[09:59] PAGE 1: AAPL / GOOG / TSLA[19:43] PAGE 15: PFE / MRNA / LNTH / BNTX / VRTXThis podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

30:0714/09/2023

2023.36 Tech & Economy Unpacked: Insights into Markets, Energy, and Innovation

In this week’s episode...[00:01:26] EXHIBIT A: US. GOV’T REVENUES AND EXPENSES - Hunt delves into the U.S. government's legislative process for revenues and expenses, emphasizing the challenges and implications of budget deficits. The focus is on the role of committees and the Congressional Budget Office's numbers for the year.[00:04:55] EXHIBIT B: US GAS DEMAND / SUPPLY - Hunt discusses the balance between U.S. gas demand and supply, pointing out that increased supply has managed to counteract the rising demand. It also hints at the average gas prices and the future outlook for 2024 and 2025.[00:07:01] EXHIBIT C: WORLD OIL SUPPLY / DEMAND - Hunt talks about global oil demand and supply, with a focus on political issues between leading producers like Saudi Arabia and the United States.[00:08:42] PAGE 1: AAPL / GOOG / TSLA - Jason comments on Google's search result presentation and the unclear nature of paid positions in the results.[00:09:52] PAGE 2: MSFT / CRM / SNOW / ORCL - Mike and Jason discuss tech companies such as Microsoft, Salesforce, Snowflake, and Oracle, with a focus on free cash flow and back-office functions. They touch upon how companies are adapting to the times.[00:20:59] PAGE 3: NVDA/AMD/INTC/TSMC/ASML - The hosts discuss the significance of ASML's latest lithography machines and their impact on semiconductor manufacturing.[00:27:43] PAGE 15: PFE / MRNA / LNTH / BNTX / VRTX - The final section is a brief discussion on biotech companies like Pfizer, Moderna, and others. It also touches upon potential future treatments being developed by Vertex that would replace opioid painkillers.This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

32:5107/09/2023

Is Sam Altman an Evil Genius? Telltales Episode 2023.35

SHOW NOTES[00:01:14] EXHIBIT C: WORLD OIL SUPPLY / DEMAND - This section discusses the dynamics of global oil supply and demand. It delves into various factors affecting the oil market, including geopolitical influences and economic trends.[00:02:18] EXHIBIT B: US GAS DEMAND / SUPPLY - This part focuses on the gas market in the United States, examining the supply and demand aspects. Insights into the domestic production, imports, and consumer trends are provided.[00:03:40] PAGES 1-3: $NVDA EARNINGS, NEW $GOOG AI PRODUCT - The segment talks about Nvidia's recent earnings report and Google's new AI product. It reviews the financial performance of Nvidia and discusses the potential impact of Google's latest AI offering.[00:16:51] CONSPIRACY CORNER: IS SAM ALTMAN A JAMES BOND VILLAN?? - This is a lighter, speculative section that humorously discusses whether Sam Altman, a well-known tech entrepreneur, could be a villain in a James Bond movie. Theories and opinions are shared.[00:19:06] PAGE 4: $AMZN COMPETITIVE POSITIONING IN AI - This segment explores Amazon's positioning in the Artificial Intelligence market. It looks into Amazon's strategies, product offerings, and how it stands against competitors in the AI space.[00:22:41] PAGES 5 - 13: MARKET VALUATION REVIEW - This comprehensive section offers a review of market valuations. Various metrics and indicators are discussed to give an in-depth understanding of the current market scenario.[00:27:19] HOW MUCH TO PAY FOR GROWTH? - The final section of the podcast tackles the topic of growth valuation. It discusses how to assess the value of growth in companies and what metrics can be useful for this purpose.This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

32:4730/08/2023

2023.34 A Deep Dive into Energy, AI, Fintech, and Retail: From Microsoft Copilot to Stripe's Future

This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

29:3824/08/2023

2023.33 Bridging the Digital Divide: Innovations in Internet Technology

This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

29:3916/08/2023

2023.32 Unraveling the Fiscal Future: Navigating Uncertain Numbers

This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

28:3109/08/2023

2023.31 Fitch Cuts US Credit Rating & the Hunt for the Next Nvidia

This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

26:3502/08/2023

2023.30 Unraveling the Intricacies of Energy Prices and the Tech Industry

This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

28:2527/07/2023

2023.29 Breaking Down AI Innovations, Energy Trends, and Healthcare Insights

[00:00:53] Energy News (memo exhibit B & C)[00:05:25] Healthcare News - UNH 0.00 Earnings (memo exhibit A & Page 19) + comp to CVS 0.00 [00:07:56] AI News → MSFT 0.00 Cashflow impact of $30 Office 365 copilot META 0.00’s Llama 2, Impact on NVDA 0.00 GOOG 0.00 GOOGL 0.00 SNOW 0.00 AAPL 0.00 This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

28:4919/07/2023

2023.28 Unearthing Value in the Tech Sector: A Deep Dive into AI and Free Cash Flow

Show NotesHunt begins the podcast with a discussion on AI's role in software companies and the impact of recent actions by OPEC, Russia, and Saudi Arabia on world oil demand.There is a detailed conversation about exhibits A, B, and C, reflecting on current trends in world oil demand, gas numbers, and the impact of the debt ceiling agreement.Various companies across different sectors are examined in-depth, with a focus on free cash flow. These include NVEC, United Health, CVS, Chipotle, Vertex, Lantheus, and more.Mike brings up the transformative influence of technology across various sectors, contributing to the generation of free cash flow. He also discusses the future direction of Amazon and introduces Teradata as a potential opportunity.Jason expands on the tech sector discussion, mentioning companies like Uber and Amazon. He also delves into corporate data management and its implications.Podcast Chapters (Note, see memo pages for reference)[00:00:35] EXHIBIT C[00:01:34] EXHIBIT B[00:03:02] EXHIBIT A[00:03:37] PAGE 20 $NVEC[00:03:53] PAGE 19 $UH $CVS[00:04:09] PAGE 18 $ALB $FCX[00:04:37] PAGE 17 $FDX $UPS, $NKE, $COST[00:04:58] PAGE 18 $CMG $MCD[00:05:10] PAGE 15 $MRNA $BNTX $PFE $VRTX $LNTH[00:05:51] PAGE 14 $GNRC $CAT $DE $TDG $FAST[00:08:01] PAGE 13: $JPM $MS $GS[00:08:09] PAGE X-12 $XOM $[00:08:32] PAGE 8: $TGT $WMT $LOW $HD[00:09:23] PAGE 7: $MC $V $PAYP $SQ[00:09:36] PAGE 5-6: $CHTR $CMCSA[00:09:59] PAGE 1-4[00:10:49] PAGE 2: SoftwareThis podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

28:3712/07/2023

2023.27 - What makes a really good company? And how much should you pay for one?

Podcast Chapters[00:00:55] Comparison of Apple, Google, and Tesla (Memo Page 1: $AAPL $GOOG $TSLA)[00:02:23] Evaluating Tesla's Growth Potential[00:03:06] What Makes a Really Good Company? Examining Apple and Alphabet[00:06:27] Comparing Multiples on $TSLA $NVDA with those of Oil & Gas Companies ($XOM, $CVX, $COP, $OXY, $KMI, $EPD, $ET, $WES, $EOG, $MGY, $PR, $FANG)This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

27:5205/07/2023

2023.26 Crude Realities & Tech Titans: A Multidimensional Discourse

This podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

31:0028/06/2023

2023.25 Oil Surplus, China Geopolitics, and Valuation of Nvidia, ASML, and Taiwan Semiconductor

If you are new, welcome! If you haven’t subscribed, join crew by subscribing here:Description: In this episode of the Telltales podcast, the hosts dive into the world of economics, geopolitics, and technology. They discuss the current state of oil supply and demand, the impact of China's economy on commodity consumption, and the US government's revenue and expenses. Additionally, the hosts delve into the geopolitics surrounding the US-China relationship, particularly focusing on issues of technology transfer and intellectual property theft. The episode also explores the valuation and future prospects of technology companies like Nvidia, ASML, and Taiwan Semiconductor. Join the conversation as they provide insights and analysis on these topics and their potential implications.Key Topics:Oil Supply and Demand: Surplus capacity, OPEC Plus production cuts, and China's commodity consumption.US Gas Demand and Supply: Fluctuating oil prices and concerns over surplus capacity.US Government Revenue and Expenses: Addressing the need to reduce spending and reverse increasing public debt.Geopolitics: China: Discussion on the US-China relationship, technology transfer, and intellectual property theft.Company Valuation: Evaluation of Nvidia, ASML, and Taiwan Semiconductor, considering increased demand for GPU chips and their roles in the AI industry.Podcast Chapters:[00:00:50] Exhibit C: World Oil Supply / Demand[00:03:03] Exhibit B: US Gas Demand / Supply (and Oil Pricing)[00:03:46] Exibit A: Us Gov't Revenue and Expenses[00:05:52] Geopolitics: China[00:12:42] Page 3: $NVDA $AMD $INTC $ASML $TSM[00:16:31] $NVDA Forward Valuation[00:20:51] In house vs outsourced AI?[00:23:24] Which is a better investment now? $NVDA vs $ASML vs $TSMThis podcast and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

28:2221/06/2023

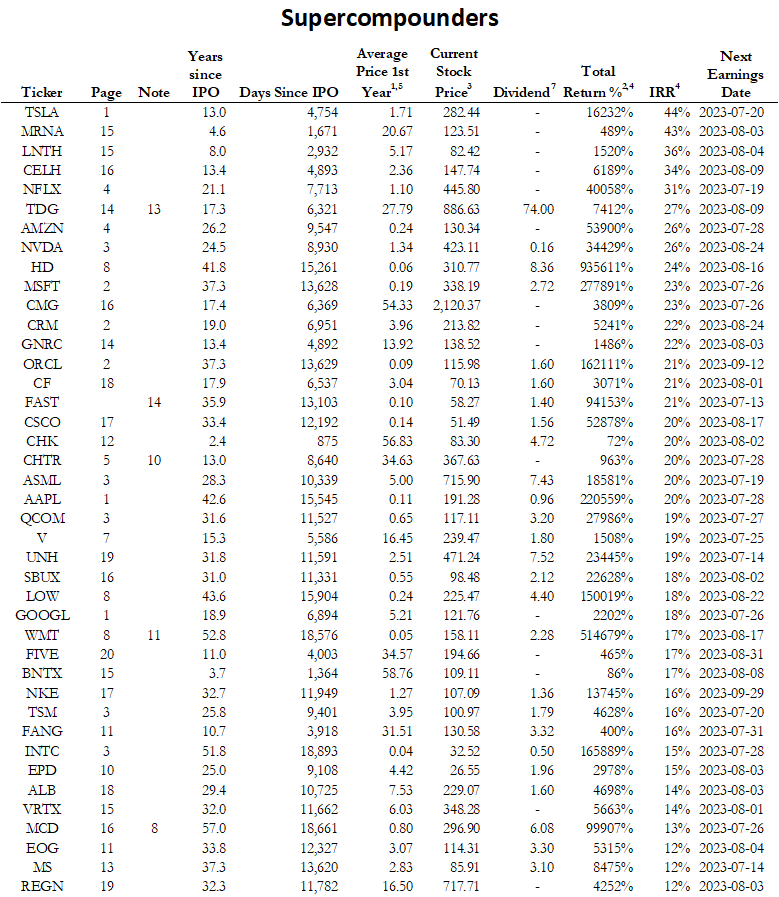

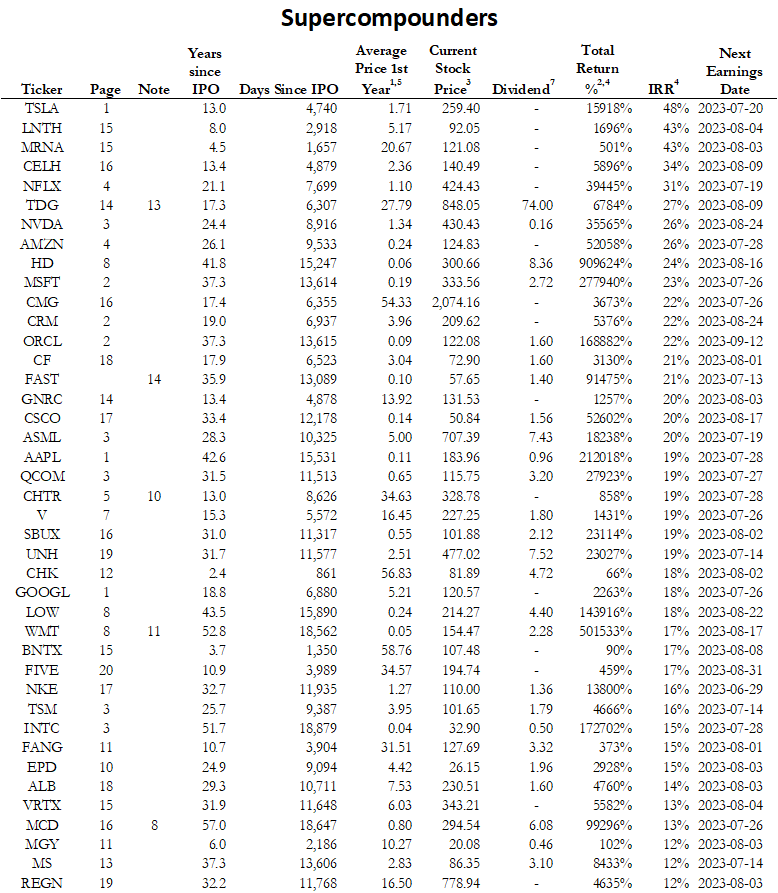

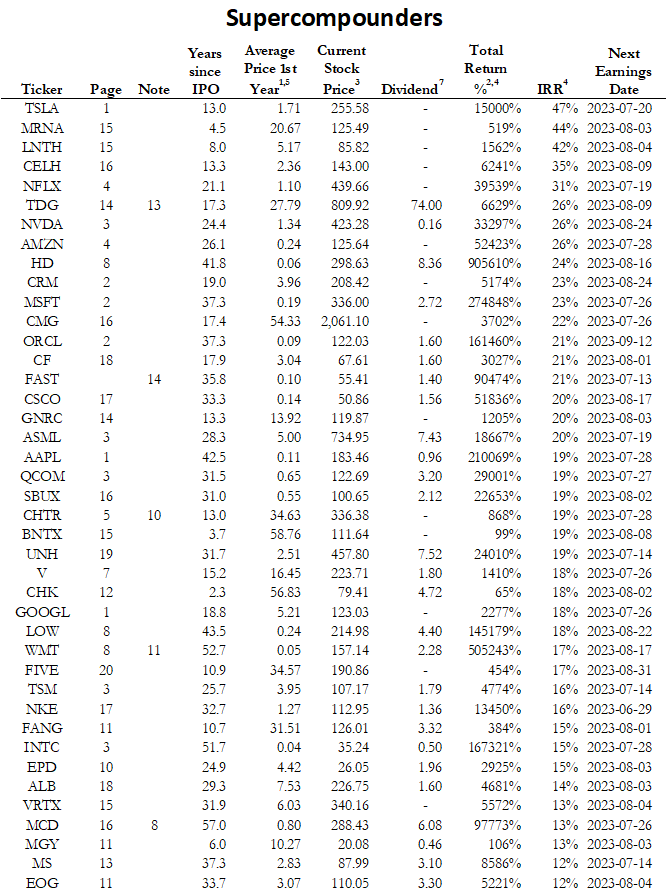

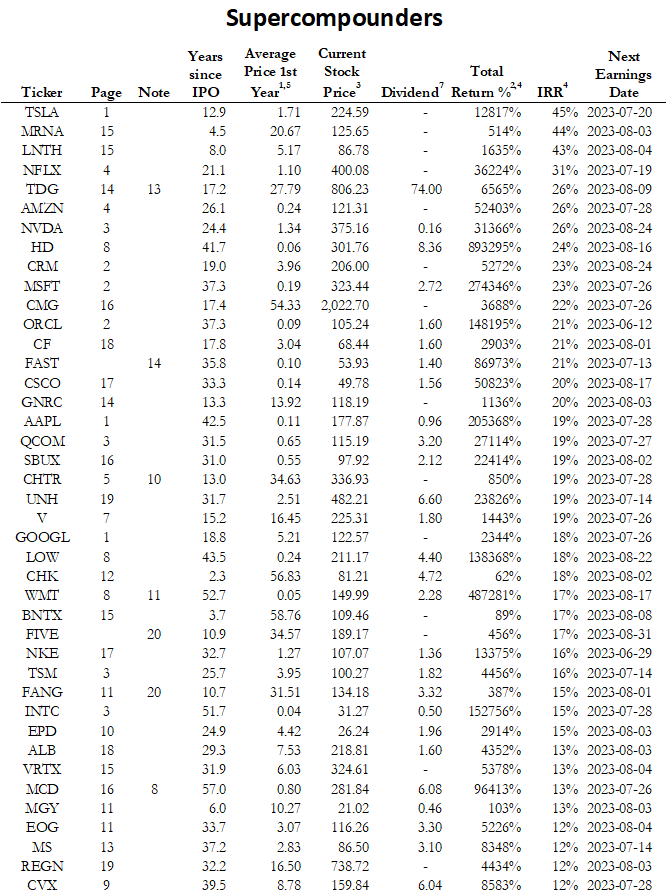

2023.24 $NVDA Cashflow Outlook & Expanding the Energy Drink Market with $CELH

Episode Chapters[00:00:44] Exhibit C: Oil Supply & Demand[00:04:35] Exhibit B: Natural Gas[00:07:56] Exhibit A: US Gov Cashflow[00:09:46] Page 12: Gas Companies $AR $EQT $CHK [00:11:28] Exhibit B & Page 12: Gas Q&A[00:13:54] Other Macro[00:15:39] Page 3: $NVDA $AMD $INTC $TSM / $ASML [00:25:46] Page 8: $KMX , $WMT , $TGT , $LOW , $HD [00:26:46] Page 16: $CELH $MCD $SBUX $CMG [00:30:37] Page 8: $KMX $CVNA [00:31:15] Sign-offIf you are new, welcome! If you haven’t subscribed, join crew by subscribing here: 🎧 To listen to the podcast, click play button above or listen on Apple Podcasts, Spotify, or SoundCloud. Keep reading for supplemental data to accompany the podcast.This newsletter is designed to complement the podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What are Telltales? post.If you know someone who could benefit from Telltales, please share it by clicking here:Weekly Email Format UpdatesYou will notice a slightly revised email format (beginning with episode 2023.22) - that’s because we’ve moved our podcast hosting from Soundcloud to Substack (the same company that hosts this newsletter). This change should not affect your normal listening routine. If you have any issues or questions, feel free to reach out directly.Supplemental Data0. The Memo1. SuperCompoundersThis is a list of all the companies covered in the memo. We calculate Total Return for each company assuming you had bought the stock at the average price during the first year of the IPO and reinvested the dividends. This is not a ranked list of our favorite investments, rather it is meant to provide additional insightful information on the companies we discuss each week (note: ‘Page’ references the page of the memo on which you can find the company). Naturally, it is harder to compound capital at a high rate (see IRR) over longer periods of time, so it is not surprising to see companies like MRNA near the top of the list with only ~4 years as a public company.2. Macro3. Energy4. Tech* Cloud Multiples - Check out the most recent edition of Clouded Judgement for the latest SaaS multiples. * Semiconductors* Semiconductor Industry Association Global Billings Report* Bureau of Economic Analysis Semiconductor Import / Export* CryptocurrencyHow did you like this week’s Telltales? Your feedback helps me make this great.Loved | Great | Good | Meh | Bad | ….. If you liked this post from Telltales, why not share it?This post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

33:2214/06/2023

2023.23 Will recent innovations create a tidal wave of cashflow for $NVDA, $TSLA, and/or $AAPL?

Podcast Chapters[00:00:53] Exhibit C: Oil[00:02:29] Exhibit B: Gas[00:03:40] Exhibit A: US Gov Cash Flow[00:04:55] Page 20: $UBER / $DASH / $ABNB / $FIVE[00:05:36] Page 14: $CAT / $DE / $GNRC / $TDG / $FAST[00:08:30] Is a step change in cash flow coming for $AAPL / $TSLA / $NVDA ? [See page 1( $AAPL / $GOOG / $TSLA ) & 3( $NVDA / $AMD / $INTC / $TSM )][00:24:49] Page 15: $PFE / $MRNA / $BNTX / $LNTH / $VRTXThis post and the information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

33:3507/06/2023

2023.22 Budget Deal, Oil & Gas, Biotech, & How to Find the Next Nvidia ($NVDA)

If you are new, welcome! If you haven’t subscribed, join crew by subscribing here: telltales.us🎧 To listen to the podcast, subscribe on Substack, Apple Podcasts, Spotify, or SoundCloud. Keep reading for supplemental data to accompany the podcast.- Apple: apple.co/3SnW1w3- Spotify: spoti.fi/3CfLGwC- Soundcloud: bit.ly/3SJdAX9This newsletter is designed to complement the podcast and ultimately enable you develop your ability to think critically and independently about investments. Neither the podcast nor this newsletter provide ‘stock tips’ or financial advice. You should always do your own work to determine if an investment is suitable for you. If you are new, please check out the What are Telltales? post.If you know someone who could benefit from Telltales, please feel free share and like it.The information herein are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

30:5831/05/2023

2023.21 Memo Review: Comparing Valuations Across Sectors

Telltales is a weekly podcast where we discuss capital markets. Each week you can expect a discussion that touches on macroeconomics, energy, and technology.Subscribe to our weekly substack to get notified of new episodes and see our data dashboard: www.telltales.usSubscribe to the podcast...- Apple: apple.co/3SnW1w3- Spotify: spoti.fi/3CfLGwC- Soundcloud: bit.ly/3SJdAX9The views expressed herein are the hosts’ alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the hosts nor any of their employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The hosts and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

33:4824/05/2023

2023.20 Navigating the Economic Landscape: Insights on Debt, Energy, Stocks, and Innovative Tech

Telltales is a weekly podcast where we discuss capital markets. Each week you can expect a discussion that touches on macroeconomics, energy, and technology.Subscribe to our weekly substack to get notified of new episodes and see our data dashboard: www.telltales.usSubscribe to the podcast...- Apple: apple.co/3SnW1w3- Spotify: spoti.fi/3CfLGwC- Soundcloud: bit.ly/3SJdAX9The views expressed herein are the hosts’ alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the hosts nor any of their employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The hosts and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

29:2517/05/2023

2023.19 Why We Need a Healthcare Revolution

Telltales is a weekly podcast where we discuss capital markets. Each week you can expect a discussion that touches on macroeconomics, energy, and technology.Subscribe to our weekly substack to get notified of new episodes and see our data dashboard: www.telltales.usSubscribe to the podcast...- Apple: apple.co/3SnW1w3- Spotify: spoti.fi/3CfLGwC- Soundcloud: bit.ly/3SJdAX9The views expressed herein are the hosts’ alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the hosts nor any of their employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The hosts and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

33:0510/05/2023

2023.18 mRNA - Beyond COVID ($PFE $MRNA); Advanced Diagnostics ($LNTH)

In this episode, Hunt covers the latest updates on Oil and Gas supply and Demand and touches on the upcoming debt ceiling. Then Mike, Jason and Hunt discuss mRNA technology, its impact on COVID-19 vaccines, and potential applications in cancer treatment. We explore the promising future of companies like Moderna, Pfizer, BioNTech, and Lantheus, as they leverage this groundbreaking technology to develop novel diagnostics and treatments. Join us as we delve into the financial implications and investment opportunities presented by these trailblazing biotech and pharmaceutical companies.Telltales is a weekly podcast where we discuss capital markets. Each week you can expect a discussion that touches on macroeconomics, energy, and technology.Subscribe to our weekly substack to get notified of new episodes and see our data dashboard: www.telltales.usSubscribe to the podcast...- Apple: apple.co/3SnW1w3- Spotify: spoti.fi/3CfLGwC- Soundcloud: bit.ly/3SJdAX9The views expressed herein are the hosts’ alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the hosts nor any of their employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The hosts and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

31:3203/05/2023

2023.17 Exploring the Future of Oil and Gas & the Impact of Generative AI

In this episode of Telltales, hosts Mike, Hunt, and Jason discuss a wide range of topics related to technology, finance, and business strategy. They begin by exploring the current state of the oil and gas industry, including the impact of rising oil prices, the role of renewable energy, and the challenges facing traditional energy companies. They also discuss the recent news about Oracle's acquisition of Cornerstone, and what this could mean for the future of enterprise software.Later in the episode, the hosts delve into the world of finance, sharing their experiences and insights as investors in companies like Salesforce, Walmart, and Microsoft. They discuss the challenges of investing in high-growth tech companies, the importance of analyzing free cash flow, and the potential benefits of incorporating AI and machine learning into financial analysis.Throughout the episode, the hosts share their perspectives on a variety of topics related to technology, finance, and business, offering valuable insights and thought-provoking commentary on the latest trends and developments in these fields.Key topics discussed in this episode:- The current state of the oil and gas industry, including the impact of rising oil prices and the role of renewable energyOracle's recent acquisition of Cornerstone and what this could mean for the future of enterprise software- The hosts' experiences and insights as investors in companies like Salesforce, Walmart, and Microsoft- The challenges of investing in high-growth tech companies and the importance of analyzing free cash flow- The potential benefits of incorporating AI and machine learning into financial analysisHosts: Mike, Hunt, and JasonTelltales is a weekly podcast where we discuss capital markets. Each week you can expect a discussion that touches on macroeconomics, energy, and technology.Subscribe to our weekly substack to get notified of new episodes and see our data dashboard: www.telltales.usSubscribe to the podcast...- Apple: apple.co/3SnW1w3- Spotify: spoti.fi/3CfLGwC- Soundcloud: bit.ly/3SJdAX9The views expressed herein are the hosts’ alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the hosts nor any of their employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The hosts and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

34:0926/04/2023

2023.16 Navigating Troubled Waters: Unfurling the Sails on Oil, Gas, and AI Copyright Issues

Telltales is a weekly podcast where we discuss capital markets. Each week you can expect a discussion that touches on macroeconomics, energy, and technology.Subscribe to our weekly substack to get notified of new episodes and see our data dashboard: www.telltales.usSubscribe to the podcast...- Apple: apple.co/3SnW1w3- Spotify: spoti.fi/3CfLGwC- Soundcloud: bit.ly/3SJdAX9The views expressed herein are the hosts’ alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the hosts nor any of their employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The hosts and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

30:2419/04/2023

2023.15 Chip glut, oil & gas surplus, recession looming?

This week, in addition to covering oil & gas and macro, we review the effect of AI on pages 17-20 and dig into the semiconductor cycle.Telltales is a weekly podcast where we discuss capital markets. Each week you can expect a discussion that touches on macroeconomics, energy, and technology.Subscribe to our weekly substack to get notified of new episodes and see our data dashboard: www.telltales.usSubscribe to the podcast...- Apple: apple.co/3SnW1w3- Spotify: spoti.fi/3CfLGwC- Soundcloud: bit.ly/3SJdAX9The views expressed herein are the hosts’ alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the hosts nor any of their employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The hosts and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

33:2212/04/2023

2023.14 OPEC Cut Impact on Oil Supply/Demand Imbalance + Impact of AI on pages 1-6

Telltales is a weekly podcast where we discuss capital markets. Each week you can expect a discussion that touches on macroeconomics, energy, and technology.Subscribe to our weekly substack to get notified of new episodes and see our data dashboard: www.telltales.usSubscribe to the podcast...- Apple: apple.co/3SnW1w3- Spotify: spoti.fi/3CfLGwC- Soundcloud: bit.ly/3SJdAX9The views expressed herein are the hosts’ alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the hosts nor any of their employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The hosts and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

33:5805/04/2023

2023.13 EPISODE 100! Oil and Gas surplus, Chips & Ai

Telltales is a weekly podcast where we discuss capital markets. Each week you can expect a discussion that touches on macroeconomics, energy, and technology.Subscribe to our weekly substack to get notified of new episodes and see our data dashboard: www.telltales.usSubscribe to the podcast...- Apple: apple.co/3SnW1w3- Spotify: spoti.fi/3CfLGwC- Soundcloud: bit.ly/3SJdAX9The views expressed herein are the hosts’ alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the hosts nor any of their employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The hosts and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

31:0329/03/2023

2023.12 Is Oil over supplied? A budget showdown is coming. Which Ai business model will win?

Telltales is a weekly podcast where we discuss capital markets. Each week you can expect a discussion that touches on macroeconomics, energy, and technology.Subscribe to our weekly substack to get notified of new episodes and see our data dashboard: www.telltales.usSubscribe to the podcast...- Apple: apple.co/3SnW1w3- Spotify: spoti.fi/3CfLGwC- Soundcloud: bit.ly/3SJdAX9The views expressed herein are the hosts’ alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the hosts nor any of their employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The hosts and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

31:1922/03/2023

2023.11 Banking meltdown: Silicon Valley Bank & Credit Suisse

Telltales is a weekly podcast where we discuss capital markets. Each week you can expect a discussion that touches on macroeconomics, energy, and technology.Subscribe to our weekly substack to get notified of new episodes and see our data dashboard: www.telltales.usSubscribe to the podcast...- Apple: apple.co/3SnW1w3- Spotify: spoti.fi/3CfLGwC- Soundcloud: bit.ly/3SJdAX9The views expressed herein are the hosts’ alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the hosts nor any of their employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The hosts and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit telltales.substack.com

32:2815/03/2023

2023.10 Biden's budget; AI lacks product market fit; Perspectives on re-shoring semi mfg