Super-Spiked Videopods (EP8): Live from St Andrews

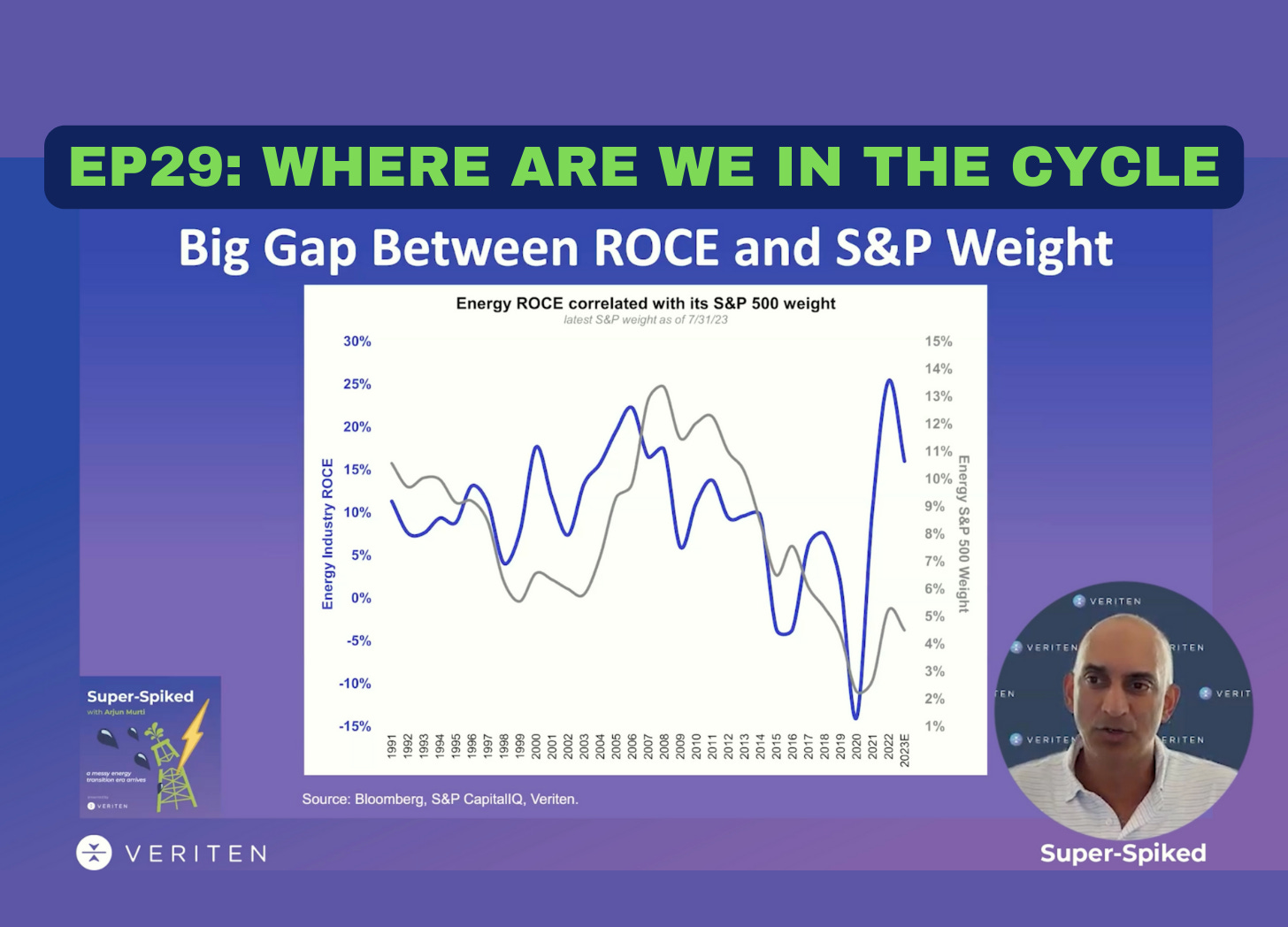

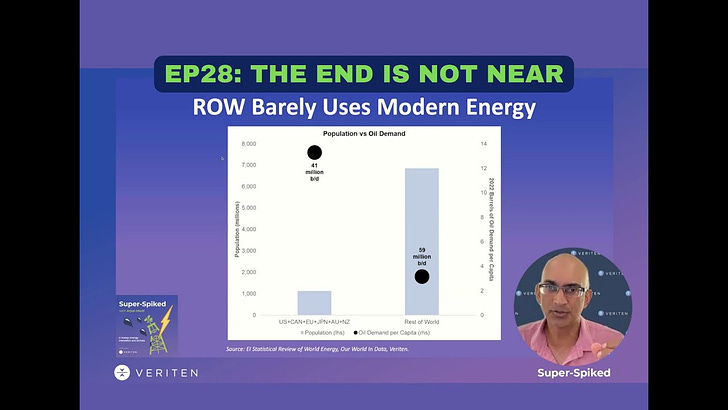

A 9 minute live update and videopod from the Home of Golf and site of the 150th Open Championship in July. Nine points to match my handicap index to highlight some of the key takeaways from this trip and recent research. And on the handicap, I started playing golf when I stopped at Goldman in 2014. I am happy with the progress I have made. Back to energy, nine takeaways:* First, as an American, thank goodness for the combination of US shale oil and gas as well as Canadian energy production. We are balanced in supply/demand for oil and a natural gas exporter. That is not the case here in the UK or Europe more broadly where a climate only ideology has run rampant. To be clear, I support decarbonization efforts. But they cannot come without due consideration for energy availability, affordability, reliability and security...none of which really exists here in the UK or Europe. * Second, I suspect the relative maturity of the North Sea means greater investment spending and less hostility from local enviro extremists wouldn't materially change UK or European balances. We are already seeing the early signs of a greater desired co- operation for more American LNG. Both US gas and crude oil as well as Canadian energy are part of the solution to wean Europe off its dependency on hostile nations. * Third, in the US oil and gas development can co-exist with climate & environmental progress while also recognizing we need to ensure energy is available, affordable, reliable and secure. We do NOT need to gut climate & enviro regs. But we do need the political class to basically walk and chew gum. We need to push back against American pipeline and infrastructure obstructionism while striving to make American and Canadian barrels and MCFs methane free and ultimately net zero on Scopes 1 and 2. * Fourth, on the sector. I am realistic about the short-term-ism that comes with the institutional investor dominance of the sector. I expect commodity prices to be super volatile this decade and during times of weakness, perhaps recession related, it would be normal to expect corrections, potentially meaningful corrections, to occur. But if I could simplify it, energy troughed at 2% of the S&P 500 in October 2020. It is now back to 4%. Based on its expected 2022 earnings share, it should get back to 7% of the S&P...and in my view in the coming years will get back to at least 10% of the S&P.* Fifth, on a long-term basis, despite the sharp rally off all-time lows, the sector is still very out of favor. Returns on capital are on-track to be sustainably better than last decade, free cash flow and returning cash to shareholders has replaced production growth as the competitive lens, balance sheet strength is returning, and the wrong mindset that this is a sunset industry, especially in the USA and Canada is simply wrong. US and Canada are about 23 mn b/d of a 100 mn b/d oil (liquids) market. We should be the last barrels produced and a much larger share of the energy pie going forward. * Sixth, there is still very little competition for capital in traditional energy. Euro Majors are out. Mainstream private equity is sitting out this funding cycle. NOCs and IOCs are going in different directions. Whose left to invest and when do they come back?* Seventh, with no competition and still lots of doom and gloom about the ultimate fate of traditional energy, and what is on-track to be a multi-year possibly decade long energy crisis era, I think it is about as interesting of a time as I can remember for new capital formation. If you have a good idea, AND, can find a sponsor, it's an interesting time.* Eighth, we all owe a big thank you to oil and gas industry workers. Go visit an oilfield or refinery. These are not easy jobs. They require hard work and strict attention to health, safety, and the environment. On Wall Street, we mostly interact with senior management. They too are needed. But make no mistake it is the working class that does the hard work to ensure I have enough power to shoot this video.* Ninth, Scotland is the Home of Golf. These links courses are spectacular. There is no comparison to golf anywhere else in the world. So, I'll end on a personal note with some first hand, on the ground footage of the energy situation here in the UK. For all of you sensitive types out there, relax, it's for entertainment purposes only.⚖️ DisclaimerI certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.Regards,Arjun🔔 3 Ways to Subscribe* All Content: If you subscribe to Super-Spiked via email, you will receive all content to your inbox and it is also all on the Super-Spiked website. I have been aiming to publish about once a week, usually on Saturday, with an occasional intra-week additional video update.Subscribe to Super-Spiked to receive all content via email and directly interact with me.* YouTube channel for video only: You can subscribe directly to the video feed ofSuper-Spiked Videopods on my YouTube channel Super-Spiked by Arjun Murti.* Apple Podcasts, Spotify for audio only. You can subscribe directly to the audio only feed on Apple Podcasts, Spotif y or your favorite podcast player app. The podcast is simply the audio for the YouTube videos.📜 Credits* Intro & Outro music: The Auld Town Band & Pipes on Apple Music: Scotland The Brave.* This episode of Super-Spiked Videopods was created and lightly directed, edited, and produced by Super-Spiked Productions. Intro and outro designs were created in Canva. The body of the video was shot on an iPhone Pro. The video was produced and mixed in iMovie on a M1 Pro MacBook Pro. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit arjunmurti.substack.com

Sign in

Sign in Sign in

Sign in Sign in

Sign in