Sign in

Sign in

Business

Eric O'Rourke

Join our trading community over at https://www.stockmarketoptionstrading.net to improve your stock and options trading skills.

Want to level up your trading? Take the SPX Income Masterclass here:

https://www.stockmarketoptionstrading.net/spaces/4688450/

Check out the SMOT YouTube channel for quantitative options strategies and education here: https://www.youtube.com/stockmarketoptionstrading

For the SPX Premium Blog and Alerts, head over to Patreon here: https://www.patreon.com/VerticalSpreadOptionsTrading

Stock Market Startup: GraniteShares.com Single Stock ETFs with CEO Will Rhind

In this episode, I spoke with Will Rhind from Granite Shares about the ETF industry and some of their unique offerings of single stock ETFS. GraniteShares is an entrepreneurial ETF provider focused on providing innovative, cutting-edge alternative investment solutions. It was founded in 2016 by William “Will” Rhind, a well-known figure in the ETF industry, with backing from Bain Capital Ventures and other leading ETF investors. GraniteShares listed its first ETF in the United States in 2017 and its U.S. ETF offerings include a broad-based commodity index fund, physically backed gold and platinum funds, a high-income pass through securities index fund and a large cap U.S. equity index fund that seeks to identify and remove stocks that are “losers” rather than trying to identify “winners”.In 2019, GraniteShares officially launched its European business in London, introducing a new category of Exchange Traded Products: collateralized, short and leveraged single-stock exposure to a range of blue chip companies listed in the UK. These products are listed on the London Stock Exchange. More information is available on our UK website.GraniteShares AUM stood at $1.9 Billion as of 13th April 2022.Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/content Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

31:3925/05/2023

Stock Market Startup: Kalshi.com Event Driven Trading with Tarek Mansour

We're back with another episode in the Stock Market Startup series with Tarek Mansour from Kalshi.com. Kalshi is a brokerage that allows you to trade against events. Events can be Fed rate hike decisions, debt ceiling hike or not, and even the weather. Here's a referral link to get started: http://kalshi.com/?utm_source=stockmarketoptionstrading-05-09-23&utm_medium=podcast&utm_campaign=growth-paid&utm_term=optionWant to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/content Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

20:5018/05/2023

SPX Credit Spread Strategy for Sell in May and Go Away

In this episode, we're going test selling SPX call credit spreads using the old trading adage "Sell in May and Go Away" as our trading premise. This isn't meant to give use a strategy to actually trade but is meant to explore stop losses and profit targets how those affected the performance. The strategy discussed here was backtested at OptionOmega.com and is for educational purposes only and not a recommended strategy. Use code "SMOT" at OptionOmega.com for 50% of your subscription if you are interested in backtesting. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/contentWant to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

17:0111/05/2023

SPY Put Option Strategy for Sell in May and Go Away

In this episode, we're going test buying put options SPY using the old trading adage "Sell in May and Go Away" as our trading premise. This isn't meant to give use a strategy to actually trade but is meant to explore stop losses and profit targets how those affected the performance. The strategy discussed here was backtested at OptionOmega.com and is for educational purposes only and not a recommended strategy. Use code "SMOT" at OptionOmega.com for 50% of your subscription if you are interested in backtesting. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/contentWant to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

20:0209/05/2023

Stock Market Startup: AlphaCrunching.com for SPX 0DTE Intraday Seasonality

In this week's episode, I'm back with another edition of Stock Market Startup where I interview founders and developers who creating stock market related applications. In case you didn't know, I'm the Founder of AlphaCrunching.com which provides proprietary intraday seasonality forecasts for the S&P500. I just launched this company late last year and have a growing community of SPX 0DTE weekly options traders. Want to see the Alpha Crunching Forecast for free? Here's the link to the Alpha Crunching Community which includes a free Training course:https://www.stockmarketoptionstrading.net/spaces/10719554/contentWant to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

21:0403/05/2023

Trading SPX Credit Spreads in a Range Bound Market

In episode 74 of the podcast, I talked about an SPX credit spread I was trading in this rangebound market. In this episode, I'll cover how that went and two other similar call credit spreads we traded since then. All with the same analysis in mind. A couple points I tried to cover in the show was why sell a call spread when the market is rallying? And why take profits when there's still lots of time and value left in the spread?Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Want the support the podcast and interested in trading SPX weekly options with me?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

15:1725/04/2023

Stock Market Startup: HedgingLab.com with Simon Lee

In this week's episode, we're back with another edition of Stock Market Startup where I interview founders and developers who creating stock market related applications. In this episode, I got to speak with Simon Lee of HedginLab.com. HedgingLab is providing historical options data and volatility data services for researchers and investors.Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

21:1618/04/2023

SPX Trade Idea Ahead of CPI, FOMC, Earnings

Quick episode on a SPX options trade I'm taking ahead of tomorrow's inflation report and FOMC minutes. We also have earnings starting on Friday with some big banks. The trade idea discussed is not a recommendation and I may close or adjust this trade at anytime as market conditions change. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

06:0111/04/2023

Stock Market Startup: Magic 8 Ball with Bryan Cairns

In this week's episode, we're back with another edition of Stock Market Startup where I interview founders and developers who creating stock market related applications. In this episode, I got to speak with Bryan Cairns, the creator of Magic 8 Ball. Magic 8 Ball is a short term stock market prediction tool comprised of several factors from price and the options chain. Here's the link to a YouTube video Bryan created that shows you how Magic 8 Ball works:https://youtu.be/mqJyRXE-8C0Here's a link to the Magic 8 Ball Free Discords server:https://discord.com/channels/1075401006042591355/1075401683598835834Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

30:4504/04/2023

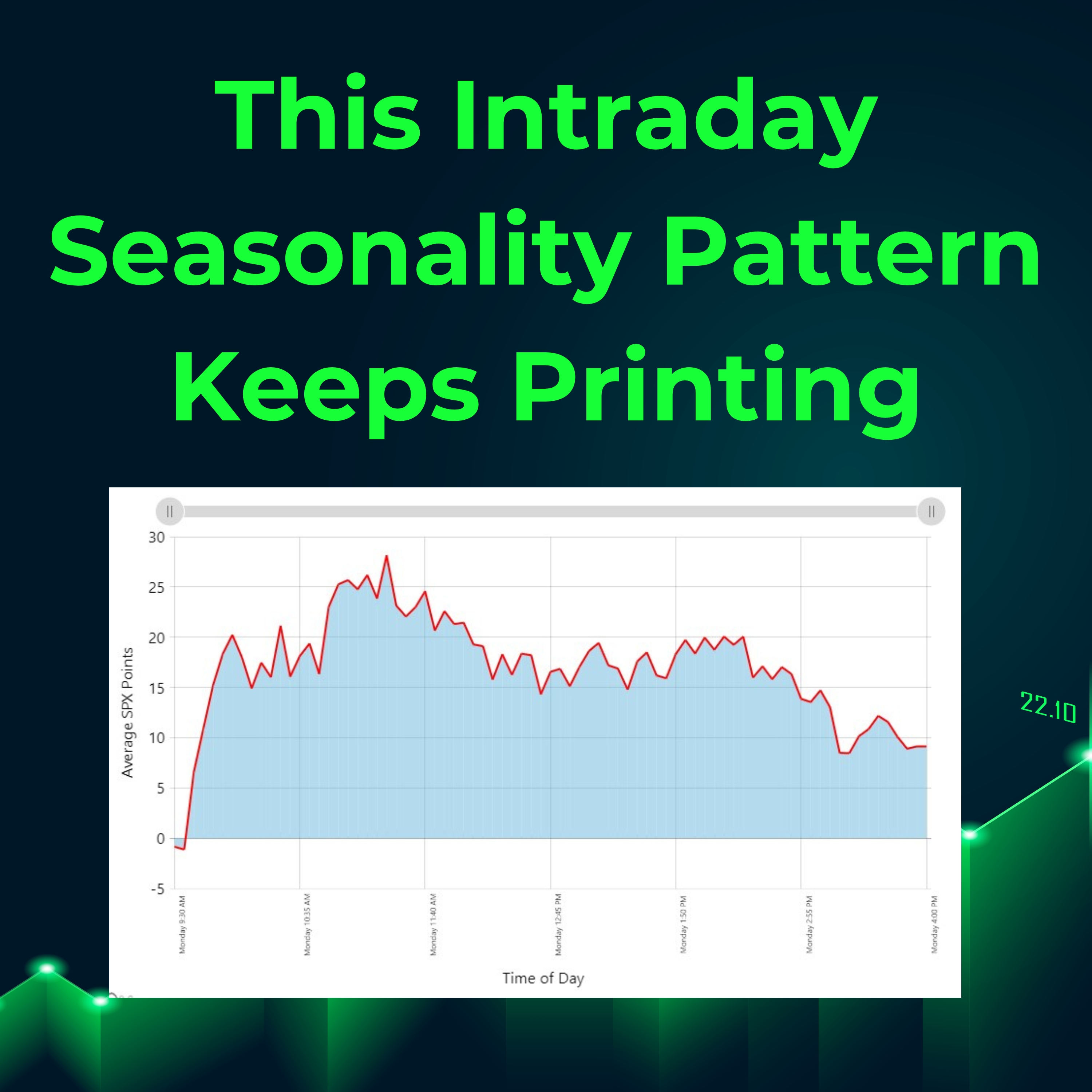

This Intraday Seasonality Pattern Keeps Printing

There's an intraday seasonality pattern that continues to work this year and I decided to explore it further. This pattern has been coming up at AlphaCrunching.com which is a web app that tracks intraday seasonality patterns of the S&P500 via SPX. I've been trading the pattern with success lately through 0DTE or same day expiration options and wanted to share how its going as well as backtest this farther back in time to see just how long this pattern has been working. For video tutorials of this type of trading, check out the Alpha Crunching group over at https://StockMarketOptionsTrading.net Use code "SPX50" for 50% off your first month at AlphaCrunching.com if you want to find more patterns like this one as well as track when they may be changing. Use code "SMOT" at OptionOmega.com for 50% if you want to get into backtesting short dated options on SPX, SPY, and others. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

18:2328/03/2023

3 Awesome Tips For Trading Credit Spreads

In this episode, I cover 3 awesome tips for trading credit spreads that most books and videos don't talk about. Be sure to check out Episode 2 "Best Options Strategy For Beginners Explained" that dives even deeper for understanding credit spreads options trading. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

14:4921/03/2023

Stock Market Startup: OptionOmega.com

We're back with another Stock Market Startup episode. This time with Troy, Rusty, and Matt from OptionOmega.com. These guys were on about a year ago in Episode 41 and it was great having them back on to discuss all the changes and evolution of our options trading, SPX 0DTE, as well as additional features that OptionOmega.com provides for retail traders like us. Use the code "SMOT" at OptionOmega.com for 50% off their advanced backtesting software. Want to connect with your host and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

56:5014/03/2023

S&P500 Analysis, Key Levels, What to Look For!

Markets dropped hard today after Powell's testimony to the Senate where he stated that inflationary pressures were running higher than expected and that policymakers were open to raising rates higher than earlier expectations. We're now seeing about 53% chance of a 50bps hike later this month which was previously at around a 10% chance. Either way, we're continuing to watch how the options market is positioned which as of today looks to be a range of 3900-4200 on SPX.Want to connect with your host and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

08:1807/03/2023

How I'm Staying on the Right Side of the Market in 2023!

In this episode, I explain how I've been staying on the right side of the market so far in 2023 through a combination of determining the range of the market, where we're at in that range, and looking at the way the options market is positioned. The tools I use mentioned in this episode are:SpotGamma.com for key option insights. Tradytics.com for options analysis. AlphaCrunching.com for intraday seasonality of the S&P500. Want to connect with your host and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

16:0528/02/2023

Stock Market Startup: TradersPost.io with Jonathan Wage

Welcome to Stock Market Startup series here on the Stock Market Options Trading Podcast where we dive into the world of stock market software companies and the founders behind them. Join me as I interview some of the most innovative minds in the industry, exploring their journey from ideation to execution and everything in between. From trading platforms to investment analysis tools, we'll explore the latest trends and technologies driving the future of the stock market.In this episode, I spoke with Jonathan Wage from TradersPost.io. TradersPost can automate stocks, options and futures trading strategies from TradingView or TrendSpider in popular brokers like TDAmeritrade, TradeStation and others. If you ever thought about automating a trading strategy, this episode it for you. Want to connect further with Jonathan or myself?TradersPost Website: https://traderspost.io/Jonathan Wage Twitter: https://twitter.com/jwageEric O'Rourke Twitter: https://twitter.com/OptionAssassinFree Podcast Trading Group: https://www.stockmarketoptionstrading.net/

35:5421/02/2023

Trading Options With $100

Many traders get into options because of the low cost of entry but there's a smarter way to trade with less money. In this episode, we'll talk through some basic concepts of trading options with as little as $100 to reduce risk and increase probability of profit. Want to connect with your host and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

11:4314/02/2023

Profits Taken, S&P500 Key Levels, Options Flow Analysis

Profits taken today from last week based off these key levels in the S&P500 right now. We'll also go over what I'm seeing in the options market that tells me that the upside may be limited over the next week or so. Looking to trade the range for now. This podcast is for informational and educational purposes only. Additional Resources:Call and Put Wall levels provided by SpotGamma.comCheck out Episode 49 of this podcast to learn more. Want to connect with your host and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

11:1206/02/2023

Big Week for the S&P500

It's a big week for the S&P500 with Consumer Confidence, FOMC rate hike decision and guidance, big tech earnings, and Friday's jobs report. Whew!Weekly Forecast provided by AlphaCrunching.com (use code SPX50 for 50% off your first month)Call and Put Wall levels provided by SpotGamma.comCheck out Episode 49 of this podcast to learn more. Want to connect with your host and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

07:4130/01/2023

Explained: VIX Up, Market Up with Brent Kochuba

Brent Kochuba from SpotGamma.com is back on the show to explain a recent article they posted about getting used to both the VIX being up while the market is up. Most of us think of the VIX as the "fear gauge" but it could also become the "fear of missing out" gauge 2023. This is an extremely valuable educational lesson so be sure to listen to it in its entirety. Here's the link to the article:https://spotgamma.com/get-comfortable-with-vix-up-market-up/SpotGamma Twitter: https://twitter.com/spotgammaWant to connect with your host and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

27:2927/01/2023

SPX Trade Idea For This Week

Has the market already priced the weaker than expected inflation numbers that keep coming out? With January OpEx upon us and the Core PCE inflation report coming out next week, here's a trade idea I'm considering over the next few days. This is not a recommendation and if the market conditions were to change, I would simply scratch this idea. Want to connect with your host and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

17:1918/01/2023

S&P 500 Analysis, CPI, and Earnings

Quick discussion of key levels in the S&P500 as we head into the CPI report with earnings season kicking off the day after. Want to connect with your host and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

08:3511/01/2023

3 Trading Truths You Must Accept

There are several trading truths that veteran traders have accepted and incorporated into their trading in order to be successful over time. In this episode, we'll talk through 3 of them that beginning traders need to understand and accept if they want to be successful in the stock market. Want to connect with your host and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now. Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

18:4005/01/2023

Profit Taking Concepts For Credit Spreads

In this episode, we'll discuss when to take profits when trading credit spreads. https://AlphaCrunching.com is the forecast tool mentioned in this episode. Here's the link to the chart with trade details discussed in this episode. https://www.stockmarketoptionstrading.net/posts/29890882Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started.

15:5114/12/2022

Are You Guilty of Survivorship Bias?

Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Summary:Survivorship bias or survival bias is the logical error of concentrating on entities that passed a selection process while overlooking those that did not. This can lead to incorrect conclusions because of incomplete data.In this episode, we'll discuss how this can apply in the financial world as well as the rest of the world. Note: This is not financial advice and I am not a financial advisor. Additional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/Stock Market Options Trading YouTube Channel:https://www.youtube.com/c/stockmarketoptionstradingEric O'Rourke Twitter:https://twitter.com/OptionAssassin

08:5329/11/2022

Could You Trade This Strategy?

Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Summary:In this episode we talk through the results of a backtested winning strategy and go into details about various aspects of the results and ask the question, "Could you trade this strategy?"Here's the link to the strategy results discussed in this episode:https://www.stockmarketoptionstrading.net/posts/28983911Come join conversation. Note: This is not financial advice and I am not a financial advisor. Additional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/Stock Market Options Trading YouTube Channel:https://www.youtube.com/c/stockmarketoptionstradingEric O'Rourke Twitter:https://twitter.com/OptionAssassin

16:1515/11/2022

Are You A "Real" Options Trader?

Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Summary:"Are you a real options trader?" is our topic today and is meant to hep you understand what you are actually trading so that you can know what to do when a trade goes against you. Are you trading the greeks, trying to create income, or using options for trading price action of a stock? In this episode, we'll discuss a question that was asked over on podcast website at https://www.stockmarketoptionstrading.net/Come join conversation. Note: This is not financial advice and I am not a financial advisor. Additional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/Stock Market Options Trading YouTube Channel:https://www.youtube.com/c/stockmarketoptionstradingEric O'Rourke Twitter:https://twitter.com/OptionAssassin

10:4208/11/2022

3 Tips For Trading a New Strategy

Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Summary:Trading a new strategy can be difficult so in this episode, I'll give 3 tips to help you balance between the research and the execution your strategy so you can trade with confidence. Note: This is not financial advice and I am not a financial advisor. Additional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/Stock Market Options Trading YouTube Channel:https://www.youtube.com/c/stockmarketoptionstradingEric O'Rourke Twitter:https://twitter.com/OptionAssassin

12:5401/11/2022

Building a Position in Amazon (AMZN)

Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Summary:In this episode, I share how I am building a long term position in Amazon (AMZN) via buying shares and covered calls. Note: This is not financial advice and I am not a financial advisor. Additional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/Stock Market Options Trading YouTube Channel:https://www.youtube.com/c/stockmarketoptionstradingJ. Eric O'Rourke Twitter:https://twitter.com/OptionAssassin

19:1625/10/2022

The Best Fed Pivot Indicator

Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Summary:The Fed continues to raise interest rates at the fastest pace in recent history which continues to pressure the stock market to new lows. Once demand has been reduced and inflation starts to level off, the Fed will have to pivot and become more neutral to dovish to avoid a major recession. This is when the stock market will find a major bottom and this episode discusses what to look for when this starts to happen. Additional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/Stock Market Options Trading YouTube Channel:https://www.youtube.com/c/stockmarketoptionstradingJ. Eric O'Rourke Twitter:https://twitter.com/OptionAssassin

09:3719/10/2022

Trading The Drunk Man

The stock market is a drunk man that never falls down and doesn't ever go to sleep. Let's discuss this analogy and the challenges it brings to trading stocks and options. Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Additional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/Stock Market Options Trading YouTube Channel:https://www.youtube.com/c/stockmarketoptionstradingJ. Eric O'Rourke Twitter:https://twitter.com/OptionAssassin

10:4406/10/2022

The Stock Market Doesn't Like You, Here's Why

In order to even begin to trade, it's likely you are smart and successful. What many underestimate though is a certain skill that worked in their day job or career that simply doesn't translate over into trading. So in this episode, we're going to talk about that skill and what you should be focusing on to become a successful trader. Deep Work by Cal Newport was mentioned in this episode. You can find it on Amazon and Audible for this who want to learn more. Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Additional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/Stock Market Options Trading YouTube Channel:https://www.youtube.com/c/stockmarketoptionstradingJ. Eric O'Rourke Twitter:https://twitter.com/OptionAssassin

15:4619/09/2022

My Top 3 Paid Trading Tools and How They Work

Are paid trading tools worth it? Do they really help? Will you really use it?I'm sharing my top 3 paid trading tools in this episode to shed some light on how I use paid trading tools in the context of my SPX trading business. I discuss these tools in order of my trading process, not necessarily in the order of best tool. If you are looking at a new trading tool, you need to see where the tool will fit in your trading process or you'll probably not use it and will waste your money. Here are the tools discussed in this episode and how I use them in my trading:Spot Gamma for options insight on the stock market as well as individual stocks:https://spotgamma.com/SPX Weekly Options Blueprint for finding high probability intraday turning points on SPX:https://www.patreon.com/VerticalSpreadOptionsTradingHere's a video of how the SPX Weekly Options Blueprint can be used:https://youtu.be/iKUbjh-_FdkTradytics for real time market analysis using options flow:https://tradytics.com/?ref_link=UOSWExvggCbFrFx4VuZIBPCi2HiI6wgmA4RHW29285xAMyaeNote: This Tradytics link is a referral link in which I get a small credit for those who use it.

20:4629/08/2022

What is a Call Wall? w/ Brent Kochuba from SpotGamma.com

Excited to have Brent Kochuba back on the show to help explain call and put walls in regards to the options market. Here's a link to a study they did on the subject: https://spotgamma.com/option-wall-stats/Spotgamma.com provides powerful insights from the options market through their proprietary stats and indicators. Be sure to check them out. Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Additional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/Stock Market Options Trading YouTube Channel:https://www.youtube.com/c/stockmarketoptionstradingJ. Eric O'Rourke Twitter:https://twitter.com/OptionAssassin

22:1912/08/2022

Stop Asking This Question!

Who's taking the other side of your trade and why would someone take the other side if your analysis is so good?Stop asking these types of questions and focus on your analysis and risk management. The stock market is simply a way for you to express your opinion in a financial way. Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Additional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/Stock Market Options Trading YouTube Channel:https://www.youtube.com/c/stockmarketoptionstradingJ. Eric O'Rourke Twitter:https://twitter.com/OptionAssassin

05:1905/08/2022

Consistency In Trading Stocks and Options

When podcast listeners join the free community over at https://www.stockmarketoptionstrading.net , I ask them this simple question.What's the one thing you need to help you make more money trading stocks and options? The more details the better.Here's the link to this post so you can see the responses:https://www.stockmarketoptionstrading.net/posts/whats-the-one-thing-you-need-to-help-you-make-more-money-trading-stocks-and-options-the-more-details-the-betterOne of the most common answers to this question is centered around consistency in trading. So in this episode, I talk through a few different ways to think about consistency as it can mean different things to different people. Also, https://www.stockmarketoptionstrading.net/ is free website that operates like Facebook without all the ads, spam, trolls. It's free to join which allows you to post charts, ask questions, and see what others are trading. There's even a free trading course centered around an SPY option strategy. Hope to see you on the website. Thanks for listening.

09:4127/07/2022

These Trades Are Working Right Now

Each week at https://www.stockmarketoptionstrading.net/ myself and other traders share some recent winning trades to let the community know what trades are working right now. We call it Winning Wednesday and in this episode, we're going to review a several trades that other members are trading that are working in 2022. Here's the direct link to the Winning Wednesday post discussed in this episode:https://www.stockmarketoptionstrading.net/posts/24706207Here's the link to the SPX Weekly Options Blueprint video mentioned in this episode:https://youtu.be/iKUbjh-_FdkA free resource for you:https://www.stockmarketoptionstrading.net/ is free website that operates like Facebook without all the ads, spam, trolls. It's free to join which allows you to post charts, ask questions, and see what others are trading. There's even a free trading course centered around an SPY option strategy. Hope to see you on the website. Thanks for listening.

11:0206/07/2022

$22Million SPY Put Order Today!

On June 28, 2022, SPY had a small gap up and then $22Million worth of SPY put options were bought and then the market tanked. Talking through this trade and why it would've put some pressure on the market. Here's a quick video showing the trades and charts:https://youtu.be/k6obAo16W6UBe sure to check Episode 42 with Brent Kachuba from SpotGamma.com to learn more about the hedging impact of options flow. Additional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/Stock Market Options Trading YouTube Channel:https://www.youtube.com/c/stockmarketoptionstradingJ. Eric O'Rourke Twitter:https://twitter.com/OptionAssassin

07:2028/06/2022

Options Trading and Darkpools with Angie Gaskill

Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Angie Gaskill is an independent trader, wife, and mom. She's been trading 15 years and share her approach to options trading and how she uses darkpool data in her trading. Angie Gaskill Twitter:https://twitter.com/MomAngtradesAdditional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/Stock Market Options Trading YouTube Channel:https://www.youtube.com/c/stockmarketoptionstradingJ. Eric O'Rourke Twitter:https://twitter.com/OptionAssassin

37:5920/06/2022

Trading in 2022 With Erik Smolinski

Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Erik Smolinski joined me for this weeks episode where we discussed his evolution of trading and some of the adjustments he made for trading options in 2022. You can find Erik over on his YouTube channel where posts informative and educational content for beginners and advanced traders. You can also connect with him Twitter as well. esInvests YouTube Channel:https://www.youtube.com/c/esInvestsErik Smolinksi Twitter:https://twitter.com/esInvestsAdditional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/Stock Market Options Trading YouTube Channel:https://www.youtube.com/c/stockmarketoptionstradingJ. Eric O'Rourke Twitter:https://twitter.com/OptionAssassin

41:0017/05/2022

Brent Kochuba from SpotGamma

In this episode, I got to speak with Brent Kochuba, Founder of SpotGamma.com where he explains to me some advanced concepts of what makes the stock market really move by way of the options market. After listening, head over to https://spotgamma.com/about/ to learn more about Brent and the proprietary technology and methodology we discuss in this episode.Want to support the podcast and get access to my latest research? Head over to https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Join the podcast community over at https://www.stockmarketoptionstrading.net to ask questions and connect with other retail traders.

58:0926/04/2022

Advanced Options Backtesting With Option Omega

Use the code "SMOT" at OptionOmega.com for 50% off their advanced backtesting software. In this episode, I talk with Troy and Rusty from Option Omega on the creativity of options trading and how advanced backtesting can help retail traders improve their strategies. We discuss some of the challenges of backtesting and how this software addresses that in an easy to use interface. Join the podcast community over at https://www.stockmarketoptionstrading.net to ask questions and connect with other retail traders. Free SPY Call Buying Strategy Course:https://www.stockmarketoptionstrading.net/all-courses

58:2031/03/2022

Kelly Criterion For Position Sizing Credit Spreads

In this episode, I cover my interpretation of the Kelly Criterion to help determine the optimum position size for a credit spread strategy. We'll talk through the basic idea as well as the four factors or variables you need to calculate the Kelly Criterion. This episode will give an example for applying it to a credit spread strategy but the Kelly Criterion can also be used for other strategies too. Free SPY Call Buying Strategy Course:https://www.stockmarketoptionstrading.net/all-coursesGreat YouTube Video on the Kelly Criterion:https://youtu.be/THYLv5_0Vm8Books Mentioned:Fortune's Formula: The Untold Story of the Scientific Betting System That Beat the Casinos and Wall Street by William PoundstoneThe Man Who Solved the Market: How Jim Simons Launched The Quant Revolution by Gregory ZuckermanCredit Spread Strategy Mentioned:https://www.patreon.com/posts/62651192

19:5415/03/2022

R Multiple for Credit Spreads

R Multiple is the amount you won or lost in terms of your risk. Knowing your R Multiple will help you position size correctly in which we will cover in another episode. In this episode, we'll talk through the basics of the R Multiple and how to think about it when it comes to credit spreads. I learned the concept of R-Multiples from a book called "Trading Your Way To Financial Freedom" by Van Tharp. Upon preparing for this episode, I found out that Van Tharp recently passed away and am dedicating this episode to him as he has helped so many traders in his lifetime. Thanks for listening. https://www.stockmarketoptionstrading.net

16:2102/03/2022

Index Options Trading with David Sun

David Sun is an index options trader and has his own podcast called The Trade Busters where he details his index options trading strategies. David was on Episode 20 and 21 of the podcast about a year ago so it was great catching up with him in this episode to see how's he's adjusted his strategies this past year.Here's a link to David's TastyTrade Rising Star segment:https://youtu.be/EG3kKNZxkBQBe sure to check out David's podcast called The Trade Busters when you get a chance. He's also posted so of his research and strategies on his trading page at TheTradeBusters.com Thanks for listening. https://www.stockmarketoptionstrading.net

49:2828/01/2022

5 Huge Option Trading Tips For Beginners

This is a must listen episode if you are a new options trader. The goal here is to help get you to consistent profits and these tips can help when you're first starting out with options. Want to discuss this episode with us? Come join us at https://www.stockmarketoptionstrading.net/ where you ask questions and comment about this episode or anything else related to stocks and options. Want to trade with me or get advanced training? Come join me over on https://www.patreon.com/VerticalSpreadOptionsTrading for intermediate and advanced options strategies.Be sure to Follow the podcast on your favorite podcast player and leave a review to help the show spread the word about trading stocks and options.

27:3319/01/2022

Running a Stock Market Insurance Company

Great discussion with another SPX options trader where we discuss his approach to trading put options like a stock market insurance company. Want to discuss this episode with us? Come join us at https://www.stockmarketoptionstrading.net/ where you ask questions and comment about this episode or anything else related to stocks and options. Want to trade with me or get advanced training? Come join me over on https://www.patreon.com/VerticalSpreadOptionsTrading for intermediate and advanced options strategies.Be sure to Follow the podcast on your favorite podcast player and leave a review to help the show spread the word about trading stocks and options.

53:2218/11/2021

SPX 0DTE Options Trading For The Rest Of Us

In this episode, I'm sharing my exact SPX 0DTE Put Credit Spread strategy for Mondays. SPX 0DTE is the act of trading options the day they expire. Typically, to take advantage of selling premium on the last of expiration. The goal of this episode is to give you a full strategy to walk away with but also an invite to join us for more options trading research. The SPX 0DTE strategy in this episode is from a module out of the SPX 0DTE Masterclass and Community hosted on the website at https://www.stockmarketoptionstrading.net/all-courses .Its combination of a complete course and live chat room for students to share trades each week. The course is complete with videos, spreadsheets with dozens of variations, and includes lifetime access and updates. There is a one time cost for the course and chat room. There is no subscription. If you are interested in probabilities, expectancy, and statistics, consider joining us as we crunch all the numbers for you. Thanks for listening.

26:0215/10/2021

When to Buy SPY Call Options

In this episode we'll backtest an SPY call option buying strategy during market pullbacks like we're in the middle of here in October 2021. We'll look at a 5 year study and talk through exactly the market condition, the buy signal, which call options and expiration, and exit strategy. This is for informational purposes and should not be considered financial advice. Join our trading community over at https://www.stockmarketoptionstrading.net to improve your stock and options trading skills. Check out the SMOT YouTube channel for quantitative options strategies and education here: https://www.youtube.com/stockmarketoptionstradingFor premium trading services and daily market updates, head over to Patreon here: https://www.patreon.com/VerticalSpreadOptionsTrading

18:3706/10/2021

El Salvador Trader Discuss Bitcoin As A Currency

In September of 2021, the country of El Salvador made Bitcoin legal tender. Shortly after, the price of Bitcoin dropped about 20%. In this episode, I talk to a trading buddy who lives in El Salvador to discuss what it looks like to have Bitcoin as legal tender as well as his perception of it all. After listening, head over to the website at https://www.stockmarketoptionstrading.net/ and join the discussion around stocks, options, and crypto in a positive constructive environment with absolutely no spam or trolls. Thank you.

32:0316/09/2021

Trader Chat: Regular Income vs. Trading Income

In this episode, I'm sharing a casual conversation with one of my Patreon members around trading for income and hedging with options.It was a great conversation and I regret having to cut it so short. Head over to https://www.patreon.com/VerticalSpreadOptionsTrading for more details around some of the strategies we were discussing in this episode. Thanks for listening.

20:3307/09/2021