Sign in

Sign in

Business

Eric O'Rourke

Join our trading community over at https://www.stockmarketoptionstrading.net to improve your stock and options trading skills.

Want to level up your trading? Take the SPX Income Masterclass here:

https://www.stockmarketoptionstrading.net/spaces/4688450/

Check out the SMOT YouTube channel for quantitative options strategies and education here: https://www.youtube.com/stockmarketoptionstrading

For the SPX Premium Blog and Alerts, head over to Patreon here: https://www.patreon.com/VerticalSpreadOptionsTrading

131: All Time Stock Market Highs! Now What?

In this episode, we'll cover some thoughts at what to think about the market here has we're hitting new all time highs post US Election. We've got several key economic reports coming this week too around inflation and the labor market. Want to connect? Find me on LinkedIn or X:Eric O'Rourke: https://www.linkedin.com/in/jericorourke/Eric O'Rourke: https://twitter.com/OptionAssassinAfter that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Also on the website, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice. PS:Updated options trading research now available in the SPX Income Masterclass geared towards beginners with small accounts and for those who don't want to watch the market all day. The strategies included in this Lifetime Access and Updates course are mechanical in nature and lend themselves to automated trading which is also discussed in the course. Here's the link to the SPX Income Masterclass:https://www.stockmarketoptionstrading.net/spaces/4688450

17:0211/11/2024

130: GOOGL Earnings Trade Success

In this episode, I walk through my recent GOOGL earning trade in which I held shares into the earnings event but added a risk free collar trade for protection. As you'll hear, the collar trade caps my upside but gives some downside protection in case the stock were to rollover. At the time of this posting, GOOGL was up a little over 5% on an earnings pop and I've since exited most of the trade for profit. Feel free to reach out to your host Eric O'Rourke on Twitter for any follow up questions, comments, or feedback. Eric O'Rourke: https://twitter.com/OptionAssassinAfter that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Also on the website, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

11:5730/10/2024

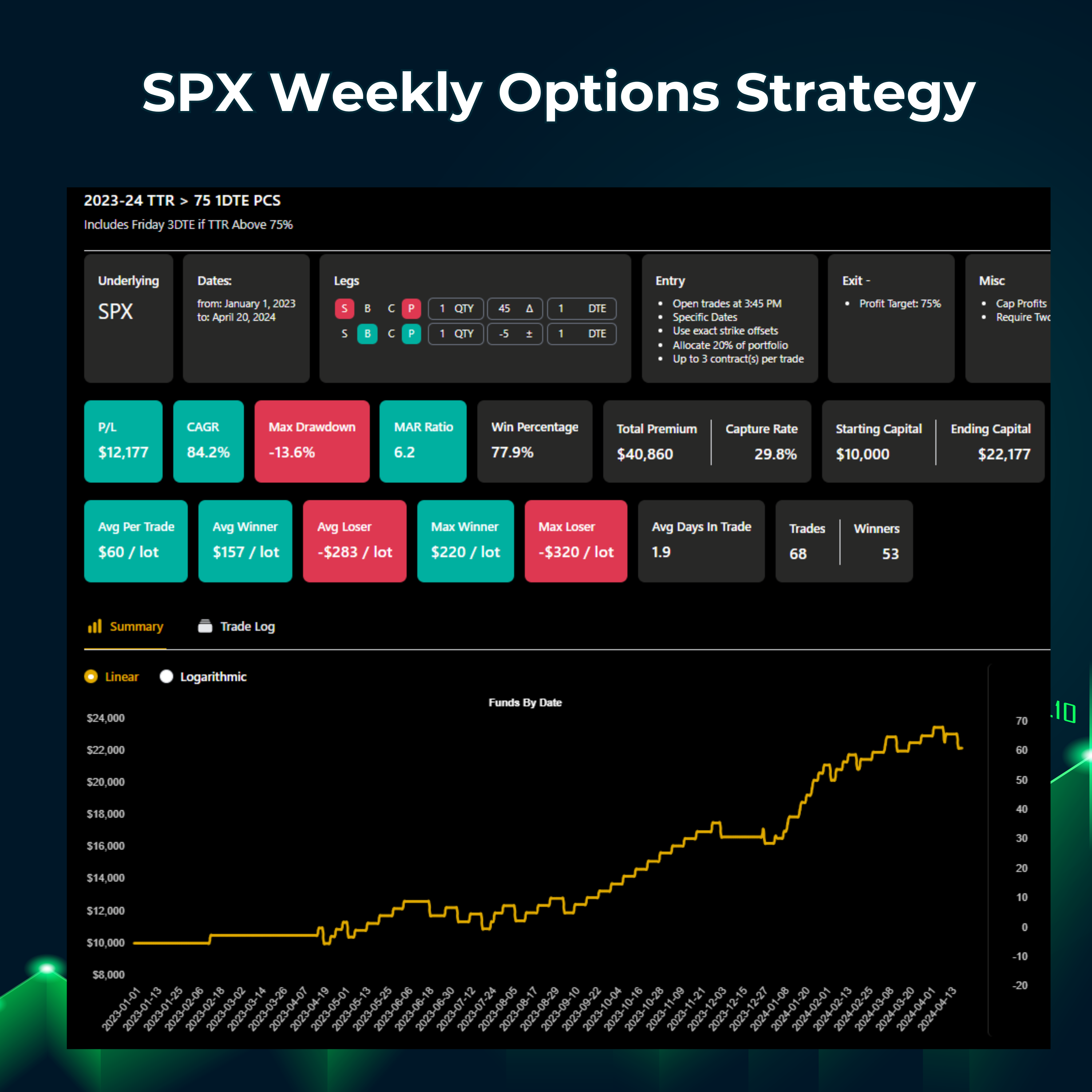

129: Case Study: Take Profits Early or Hold To Expiration?

In this episode, we'll dive into an options strategy and compare backtest results of holding the trades to expiration, aka HTE, versus taking profits at 50% of the max gain. We'll discuss some of the less discussed nuances of a strategy like this that may get you thinking about which is best for you and your trading style and risk tolerance. Here's the link to the video discussed in the episode that explains the strategy:https://youtu.be/2sM-6QTWWz8Check out the Alpha Crunching Blog for more strategies like the one in today's episode:https://www.alphacrunching.com/blogUse code SPX50 for 50% off your first month of Alpha Crunching for backtested trade ideas posted each week before the trading week begins. Feel free to reach out to your host Eric O'Rourke on Twitter for any follow up questions, comments, or feedback. Eric O'Rourke: https://twitter.com/OptionAssassinAfter that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Also on the website, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice. PS:Updated options trading research now available in the SPX Income Masterclass geared towards beginners with small accounts and for those who don't want to watch the market all day. The strategies included in this Lifetime Access and Updates course are mechanical in nature and lend themselves to automated trading which is also discussed in the course. Here's the link to the SPX Income Masterclass:https://www.stockmarketoptionstrading.net/spaces/4688450

19:4121/10/2024

128: The New Spot Gamma TRACE Indicator Explained

In this episode, we have Brent Kachuba from Spot Gamma on to discuss their newly released game changing indicator called TRACE. The TRACE indicator is expertly designed to show options positioning from a dealer's perspective in a heat map form making it so much easier to structure various types of trades.If you are an SPX weekly options trader, pay close attention to this episode and use this link to learn more: https://spotgamma.com/trace-the-market-vertical-spread-academy/?aff=VSacademyBe sure to follow Spot Gamma on X at: https://twitter.com/spotgammaAlso follow Eric O'Rourke there too: https://twitter.com/OptionAssassinAfter that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Also on the website, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice. PS:Updated options trading research now available in the SPX Income Masterclass geared towards beginners with small accounts and for those who don't want to watch the market all day. The strategies included in this Lifetime Access and Updates course are mechanical in nature and lend themselves to automated trading which is also discussed in the course. Here's the link to the SPX Income Masterclass:https://www.stockmarketoptionstrading.net/spaces/4688450

47:5127/09/2024

127: The Psychology of Automated Trading w/ Mike Christensen of TradersPost.io

Greats discussion this week around the psychology of automated trading with Co-Founder Mike Christensen of TradersPost.io. Traders Post allows you to automate trades using buy and sell signals from platforms like Trading View and Trend Spider. Even though automated trading can reduce human execution errors, the psychology of automated trading is still something traders have to grapple with despite offloading some of the work to an algo rhythm. Feel free to reach out to Mike or Eric on Twitter for any following questions, comments, or feedback. Mike Christensen: https://twitter.com/Mik3Christ3ns3nEric O'Rourke: https://twitter.com/OptionAssassinAfter that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Also on the website, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice. PS:Updated options trading research now available in the SPX Income Masterclass geared towards beginners with small accounts and for those who don't want to watch the market all day. The strategies included in this Lifetime Access and Updates course are mechanical in nature and lend themselves to automated trading which is also discussed in the course. Here's the link to the SPX Income Masterclass:https://www.stockmarketoptionstrading.net/spaces/4688450

37:1912/09/2024

126: For Every Strategy, Cash Is A Position

Patience and discipline are a big part of trading and when you are executing on a strategy, its important to understand that being in cash and not in a particular trade is part of that strategy.Want to connect? Find me on LinkedIn or X:Eric O'Rourke: https://www.linkedin.com/in/jericorourke/Eric O'Rourke: https://twitter.com/OptionAssassinAfter that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Also on the website, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice. PS:Updated options trading research now available in the SPX Income Masterclass geared towards beginners with small accounts and for those who don't want to watch the market all day. The strategies included in this Lifetime Access and Updates course are mechanical in nature and lend themselves to automated trading which is also discussed in the course. Here's the link to the SPX Income Masterclass:https://www.stockmarketoptionstrading.net/spaces/4688450

09:0203/09/2024

125: What the Books Don’t Teach About Vertical Spreads

Updated options trading research now available in the SPX Income Masterclass geared towards beginners with small accounts and for those who don't want to watch the market all day. The strategies included in this Lifetime Access and Updates course are mechanical in nature and lend themselves to automated trading which is also discussed in the course. Here's the link to the SPX Income Masterclass:https://www.stockmarketoptionstrading.net/spaces/4688450In this episode, I discuss something about vertical spreads that options education books typically don't include. We'll explore comparing buying a single call option vs. buying a long call spread aka. bull put spread through the lens of trading strategy. The primary point is that there is a level of consistency with vertical spreads over single options in that the cost of the spread is relatively the same over time whereas the cost of the call can vary due to volatility. This can make it harder to allocate a consistent amount of capital to a strategy. The downside with vertical debit spreads of course is that you gaining consistency but at the cost of capping your upside gains if the market moves heavily in your favor. Want to connect with myself? Find me on LinkedIn or X:Eric O'Rourke: https://www.linkedin.com/in/jericorourke/Eric O'Rourke: https://twitter.com/OptionAssassinAfter that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Also on the website, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

14:5923/08/2024

124: S&P 500 Navigator: Short Term Bearish Thesis and Trade Idea

If you trade the S&P500, then this series is for you. In the S&P500 Navigator series, we'll discuss current market conditions including options positions, major economic events, and AlphaCrunching.com's Triumph Rates for trading short term SPX weekly options. In this episode, we'll talk about a trade idea to express a short term bearish thesis of SPX making a move to its 200sma over the next week or so. The key takeaway is that you are able to create trade structures with options to express you r idea of what you think the market may do or not do over a certain period of time. As long as you are ok with the risk reward, then you can express that opinion and then find out later if you are right or wrong. Want to connect with myself? Find me on LinkedIn and X:LinkedIn https://www.linkedin.com/in/jericorourke/X(Twitter): https://twitter.com/OptionAssassinAfter that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. There you will also find the SPX Income Masterclass which will teach mechanical strategies you can trade with this episode in mind. Also on the website, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

13:4606/08/2024

123: My Secret To Staying Profitable Over Time

Updated options trading research now available in the SPX Income Masterclass geared towards beginners with small accounts and for those who don't want to watch the market all day. The strategies included in this Lifetime Access and Updates course are mechanical in nature and lend themselves to automated trading which is also discussed in the course. Here's the link to the SPX Income Masterclass:https://www.stockmarketoptionstrading.net/spaces/4688450In this episode, I'll discuss what I think my secret is to staying profitable over time.Want to connect with myself? Find me on LinkedIn or X:Eric O'Rourke: https://www.linkedin.com/in/jericorourke/Eric O'Rourke: https://twitter.com/OptionAssassinAfter that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Also on the website, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

13:3701/08/2024

122: Hedging With a Put Spread Collar

As the market continues to defy gravity and hit new highs every week it seems, you may be thinking about how you can protect any stocks you may be holding. In this episode, we'll discuss a put spread collar trade which can allow you to get some downside protection while at the same time giving you room for more upside participation. I came across this trade idea on X and brought Jon on the show to walk us through it. Here's Jon's Twitter if you want to check him out: https://twitter.com/optionacejonHere's the Put Spread Collar Post for more details: https://twitter.com/optionacejon/status/1803563695169044503In this example, he shared what a put spread collar on SPY might look like. Want to connect with myself? Find me on LinkedIn or X:Eric O'Rourke: https://www.linkedin.com/in/jericorourke/Eric O'Rourke: https://twitter.com/OptionAssassinAfter that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. There you will also find the SPX Income Masterclass which will teach mechanical strategies you can trade with this episode in mind. Also on the website, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

15:3918/07/2024

121: S&P 500 Navigator: New All Time Highs on SPX. Now What?

If you trade the S&P500, then this series is for you. In the S&P500 Navigator series, we'll discuss current market conditions including options positions, major economic events, and AlphaCrunching.com's Triumph Rates for trading short term SPX weekly options. Want to connect with myself? Find me on LinkedIn and X:LinkedIn https://www.linkedin.com/in/jericorourke/X(Twitter): https://twitter.com/OptionAssassinAfter that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. There you will also find the SPX Income Masterclass which will teach mechanical strategies you can trade with this episode in mind. Also on the website, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

17:4203/07/2024

120: Caitlin Clark is the NVDA of the WNBA

Caitlin Clark is the NVDA of the WNBA and Cathie Wood is Team USA.In today's episode, we'll go over some similarities between these two powerhouses who both have strong momentum and putting up staggering numbers in their respective domains. But the decision to leave Clark off Team USA for the 2022 Summer Olympics is like cutting your winners short leaving millions of dollars on the table. Want to connect with myself? Find me on LinkedIn:Eric O'Rourke: https://www.linkedin.com/in/jericorourke/After that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. There you will also find the SPX Income Masterclass which will teach mechanical strategies you can trade with this episode in mind. Also on the website, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Alpha Traders Club also posts Conservative Covered Call trades each week for generating weekly and monthly income trading options on high quality stocks and ETFs. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

10:5424/06/2024

119: Choosing Your Profits and Losses

When researching a new trading strategy, its important to not only look at things like total profit and win rate, but its just as important to look at the P/L curve of the strategy to determine if its something you'll actually be able to trade. In this episode, we'll discuss some of the nuances that the P/L curve can give you as opposed to just profits, wins, and losses. Here's the link to System #3 mentioned in the episode to get some context around the P/L curve that was discussed:Click Here: https://www.stockmarketoptionstrading.net/posts/58404617Want to connect with myself? Find me on LinkedIn:Eric O'Rourke: https://www.linkedin.com/in/jericorourke/After that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. There you will also find the SPX Income Masterclass which will teach mechanical strategies you can trade with this episode in mind. Also on the website, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Alpha Traders Club also posts Conservative Covered Call trades each week for generating weekly and monthly income trading options on high quality stocks and ETFs. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

17:0914/06/2024

118: Applying First Principles to Options Trading

Erik Smolinski is back on the show to talk about applying the concept of First Principles to options trading. Erik is behind the esInvests YouTube channel where he puts out regular content around trading. I had so much fun in the conversation talking about out approaches to options trading these days, how we have evolved over time, backtesting, psychology, and so much more. I hope you find this show as entertaining as it was to create. To connect with Erik, check out his links below. esInvests on YouTube: https://www.youtube.com/esinvestsesInvests on X(Twitter): https://x.com/esInvestsWant to connect with myself? Find me on LinkedIn:Eric O'Rourke: https://www.linkedin.com/in/jericorourke/After that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. There you will also find the SPX Income Masterclass which will teach mechanical strategies you can trade with this episode in mind. Also on the website, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Alpha Traders Club also posts Conservative Covered Call trades each week for generating weekly and monthly income trading options on high quality stocks and ETFs. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

01:30:3901/06/2024

117: 1DTE The Longest Trade of My Life

The full trade details and options trading research discussed in this episode can be found in this YouTube video: https://youtu.be/RxWg5HdeiEYWhen it comes to researching and trading strategies and then implementing them, there are many additional factors that don't make it into the backtest. In this episode, I walk through a recent 1DTE trade in which the options expire the following day. Despite the trade only being 24 hours long, it was the longest trade of my life. Want to connect with myself? Find me on LinkedIn:Eric O'Rourke: https://www.linkedin.com/in/jericorourke/After that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. There you will also find the SPX Income Masterclass which will teach mechanical strategies you can trade with this episode in mind. Also on the website, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Alpha Traders Club also posts Conservative Covered Call trades each week for generating weekly and monthly income trading options on high quality stocks and ETFs. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

17:1015/05/2024

116: How I'd Trade Options With a $1k Account

Trading options in a small account is possible and in this episode, we'll cover several considerations for doing so. These include: realistic expectations, which strategies are best, and what to focus on. Want to connect with myself? Find me on LinkedIn:Eric O'Rourke: https://www.linkedin.com/in/jericorourke/After that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. There you will also find the SPX Income Masterclass which will teach mechanical strategies you can trade with this episode in mind. Also on the website, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Alpha Traders Club also posts Conservative Covered Call trades each week for generating weekly and monthly income trading options on high quality stocks and ETFs. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

24:0502/05/2024

115: Edge Alert: Mechanical Next Day Put Credit Spread Strategy

In this episode, we reveal a SPX weekly options strategy selling put credit spreads that expire the following day. This strategy uses bullish TTR readings from Alpha Crunching to determine whether or not to take the trade that day. Today's episode is from a video training recently sent to Alpha Crunching subscribers and posted in the free community. Here's the link to watch the 10m video presentation of this strategy:https://www.stockmarketoptionstrading.net/posts/55173187The TTR is a metric from https://www.alphacrunching.com that shows the tendency for the next day to close higher from the current day. TTR stands for Tomorrow's Triumph rate. Use code SPX50 at https://www.alphacrunching.com for 50% off your first month. Want to connect with myself? Find me on LinkedIn:Eric O'Rourke: https://www.linkedin.com/in/jericorourke/After that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Also, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Alpha Traders Club also posts Conservative Covered Call trades each week for generating weekly and monthly income trading options on high quality stocks and ETFs. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

13:1822/04/2024

114: What is Options Net Flow?

In this episode, I'll briefly explain what options net flow is. In short, many of the options flow providers now offer some version of options net flow which is a graphical way to gauge the options sentiment of a stock or index. I find this mush more useful and applicable compare to the traditional overwhelm of a grid based data feed. Want to connect with myself? Find me on LinkedIn:Eric O'Rourke: https://www.linkedin.com/in/jericorourke/After that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Want to try the Alpha Crunching forecasts for the S&P500?Use code SPX50 for 50% your first month of https://www.alphacrunching.com. Alpha Crunching is a unique analytics app for short term traders of the S&P500. Also, Alpha Traders Club is where I host my SPX Live Chat each day for trading SPX weekly options. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Alpha Traders Club also posts Conservative Covered Call trades each week for generating weekly and monthly income trading options on high quality stocks and ETFs. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

13:4015/04/2024

113: The Life Cycle of an Options Trade

In this episode, I got to speak to Mat Cashman, Principal of Investor Education at OCC. Mat takes us through the life cycle of an options trade by explaining the inner workings of the market and some of the players and institutions that make it all possible. One of those institutions is the OCC (The Options Clearing Corporation) which is the world’s largest equity derivatives clearing organization. For nearly 50 years, OCC has provided financial stability and risk management to the U.S. listed-options marketplace.Want to connect with myself or Mat? Follow us on LinkedIn:Mat Cashman: https://www.linkedin.com/in/mat-cashman/Eric O'Rourke: https://www.linkedin.com/in/jericorourke/After that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Want to try the Alpha Crunching forecasts for the S&P500?Use code SPX50 for 50% your first month of https://www.alphacrunching.com. Alpha Crunching is a unique analytics app for short term traders of the S&P500. Alpha Traders Club is where I host my 0DTE Live Chat each day for trading SPX 0DTE and 1DTE trades. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Alpha Traders Club also posts Conservative Covered Call trades each week for generating weekly and monthly income trading options on high quality stocks and ETFs. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

47:1928/03/2024

112: Edge Alert: SPX Weekly Options with Alpha Crunching Insights

In this new segment, we'll discuss current micro trends and patterns in the stock market using insights from Alpha Crunching. Alpha Crunching provides time series analysis and forecasts for the S&P500 which can reveal short term trading patterns in the context of larger trend. In this episode, we'll discuss a neutral bearish strategy of selling call credit spreads in the context of the current uptrend so far in 2024. It's important to remember that the trend is our friend until it ends and we're expecting the trend discussed in this episode to end at some point as well. The options strategy discussed in this episode is for educational and illustrative purposes only and should not be considered financial advice. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Want to try the Alpha Crunching forecasts for the S&P500?Use code SPX50 for 50% your first month of https://www.alphacrunching.com. Alpha Crunching is a unique analytics app for short term traders of the S&P500. Alpha Traders Club is where I host my 0DTE Live Chat each day for trading SPX 0DTE and 1DTE trades. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Alpha Traders Club also posts Conservative Covered Call trades each week for generating weekly and monthly income trading options on high quality stocks and ETFs. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

10:1920/03/2024

111: To Hold or Not to Hold to Expiration

In this episode, we'll try to answer the question of whether or not holding to expiration is better than taking profits early when being a net options seller. We'll explore this question by comparing a recently posted SPX Weekly Options Strategy from the SPX Income Masterclass. We'll compare holding the trades to expiration from 2021-2023 vs. taking profits a 50% of the max gain. As we'll discuss, strike selection and win rate can be determining factors in deciding when to take profits as part of the strategy you are trading. Want the full video training of today's strategy?Here's the link to the SPX Income Masterclass:https://www.stockmarketoptionstrading.net/spaces/4688450Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Want to try the Intraday Seasonality indicator for the S&P500?Use code SPX50 for 50% your first month of https://www.alphacrunching.com. Alpha Crunching is a unique analytics app for short term traders of the S&P500. Alpha Traders Club is where I host my 0DTE Live Chat each day for trading SPX 0DTE and 1DTE trades. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Alpha Traders Club also posts Conservative Covered Call trades each week for generating weekly and monthly income trading options on high quality stocks and ETFs. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

13:3105/03/2024

110: Rolling an Iron Condor for Beginners

In this episode, I detail a recent Iron Condor trade I ended up rolling up and out due to bullish stock market conditions.I'll explain how I was able to recenter the Iron Condor around the current price without having to add any more risk to the trade. This allowed me to stay in the trade longer so I could profit from time decay. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Want to try the Intraday Seasonality indicator for the S&P500?Use code SPX50 for 50% your first month of https://www.alphacrunching.com. Alpha Crunching is a unique analytics app for short term traders of the S&P500. Alpha Traders Club is where I host my 0DTE Live Chat each day for trading SPX 0DTE and 1DTE trades. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Alpha Traders Club also posts Conservative Covered Call trades each week for generating weekly and monthly income trading options on high quality stocks and ETFs. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

13:0323/02/2024

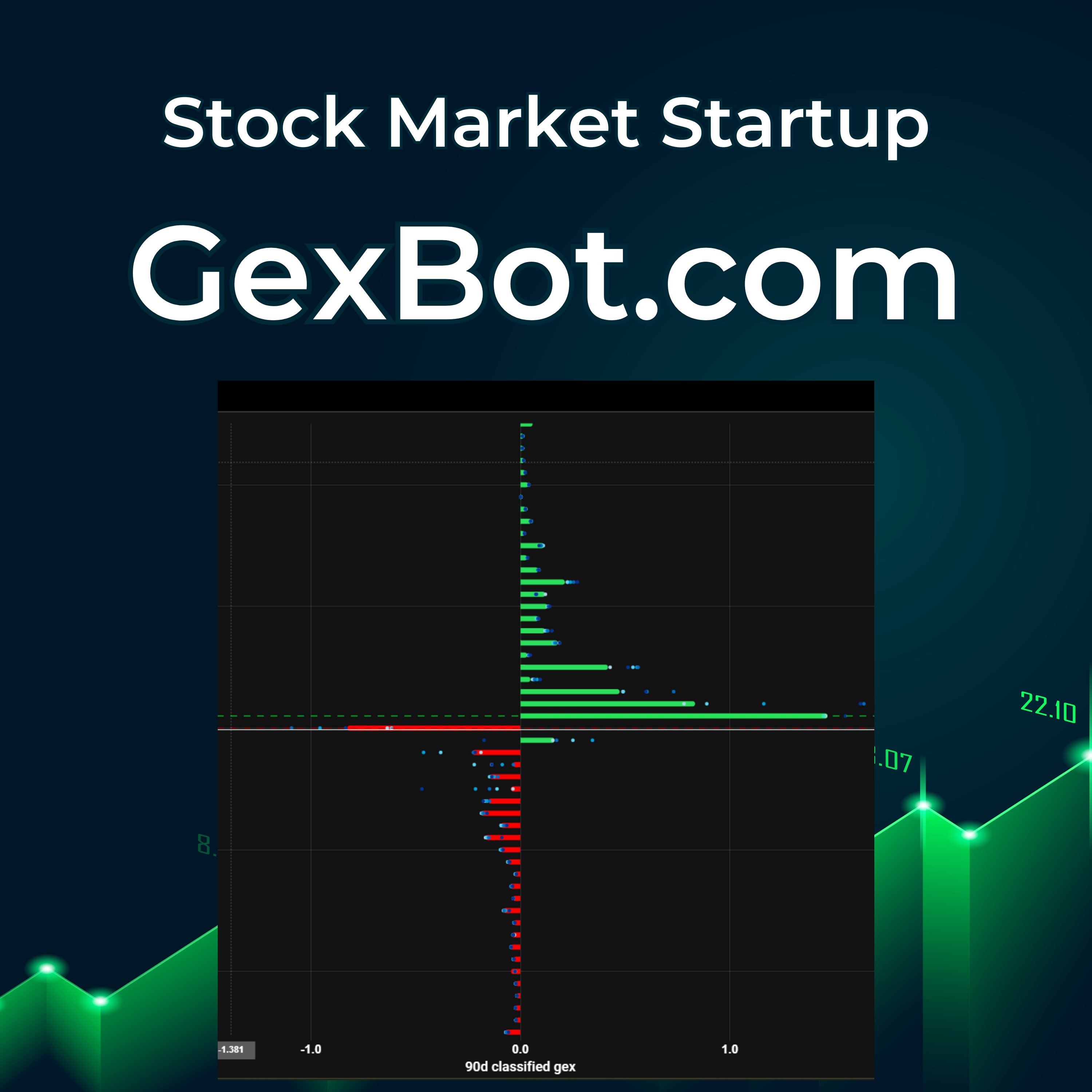

109: Stock Market Startup: GexBot.com

In this episode, I got to speak with John from GexBot.com to talk about how the stock market startup came to be as well as the information it provides short term traders using GEX (gamma exposure) and the options profile. To learn more about GexBot, check out their YouTube channel here:https://www.youtube.com/@gexbotand be sure to follow them on Twitter here:https://twitter.com/thegexbotWant to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Want to try the Intraday Seasonality indicator for the S&P500?Use code SPX50 for 50% your first month of https://www.alphacrunching.com. Alpha Crunching is a unique analytics app for short term traders of the S&P500. Alpha Traders Club is where I host my 0DTE Live Chat each day for trading SPX 0DTE and 1DTE trades. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Alpha Traders Club also posts Conservative Covered Call trades each week for generating weekly and monthly income trading options on high quality stocks and ETFs. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

37:0616/02/2024

108: Building a Position in Tesla (TSLA)

In this episode, I discuss how I'm building a position with Tesla stock and two things that spooked me after entering. Depending on when you are listening to this episode, my position may have changed or been closed depending on market conditions. This episode is for educational purposes only and should not be considered financial advice of any kind. As mentioned in the episode, TSLA stock is in a downtrend and the downtrend is not over. Contrarian trading like this can have greater downside risk. Here's the link to the TSLA chart post mentioned in the episode:https://www.stockmarketoptionstrading.net/posts/49101242Alpha Traders Club is where I host my 0DTE Live Chat each day for trading SPX 0DTE and 1DTE trades. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Alpha Traders Club also posts Conservative Covered Call trades each week for generating income. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Want to try the Intraday Seasonality indicator for the S&P500?Use code SPX50 for 50% your first month of https://www.alphacrunching.com. Alpha Crunching is a unique analytics app for short term traders of the S&P500. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

12:3331/01/2024

107: The Trick To Buy Sell Indicators

In this episode, we'll cover some tips an tricks when putting Buy Sell Indicators on your charts so that you don't get chopped up and frustrated. Finding the usefulness of the indicator should be the primary goal when adding it your chart. Alpha Traders Club is where I host my 0DTE Live Chat each day for trading SPX 0DTE and 1DTE trades. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Alpha Traders Club also posts Conservative Covered Call trades each week for generating income. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Want to try the Intraday Seasonality indicator for the S&P500?Use code SPX50 for 50% your first month of https://www.alphacrunching.com. Alpha Crunching is a unique analytics app for short term traders of the S&P500. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

13:2621/01/2024

106: First Trading Mistake of 2024

I made my first trading mistake of 2024 on the very first trading day of the year. So in this episode, I walk you through that day and the mistake I made with my trade. Alpha Traders Club is where I host my 0DTE Live Chat each day for trading SPX 0DTE and 1DTE trades. We focus on the premarket data and levels, technical analysis, and options flow for trading high probability trades for weekly income. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Want to try the Intraday Seasonality indicator for the S&P500?Use code SPX50 for 50% your first month of https://www.alphacrunching.com. Alpha Crunching is a unique analytics app for short term traders of the S&P500. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Disclaimer: This podcast is for informational and educational purposes only and should not be considered financial advice.

13:0407/01/2024

105: 300% Gain, 50% Win Rate

In this last episode for 2023, I'll share a trade taken in our Alpha Traders Club group last week on FOMC day. This trade was a way to make money if the market moved a lot after the FOMC minutes were released. Interested in Alpha Traders Club for trading SPX 0DTE and 1DTE as well as Covered Calls on stocks and ETFS?Here's the link to join: https://www.stockmarketoptionstrading.net/spaces/12282222Want to try the Intraday Seasonality indicator for the S&P500?Use code SPX50 for 50% your first month of https://www.alphacrunching.com. Alpha Crunching is a unique analytics app for short term traders of the S&P500. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next.

13:0121/12/2023

104: Low VIX Options Trading Adjustments

Low VIX got you think about changing your options trades? Here's my thoughts on the adjustments I'm making in some of my options trades because of the low volatility in late 2023. Use code SPX50 for 50% your first month of https://www.alphacrunching.com. Alpha Crunching is a unique analytics app for short term traders of the S&P500. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Want to trade with us?Check out our new group Alpha Traders Club on the website. https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: Everything in this episode and on this podcast is for informational purposes only and should not be considered financial advice. There is substantial risk trading options if not done properly.

14:1408/12/2023

103: Finding an Edge in Options Trading

In this episode, I'll talk about how when it comes to options trading, you need more than the options probabilities to have an edge and to make money over time. We'll go through an example of using a put credit spread backtest as well as some new research from Alpha Crunching for trading them. The TTR is a new metric from https://www.alphacrunching.comUse code SPX50 for 50% your first month. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Want to trade with us?Check out our new group Alpha Traders Club on the website. https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: Everything in this episode and on this podcast is for informational purposes only and should not be considered financial advice. There is substantial risk trading options if not done properly.

22:2130/11/2023

102: Best Options Strategy For Small Accounts and Beginners

Best Options Strategy For Small Accounts and BeginnersIn this episode, we'll revisit what I think is the best options strategy for small accounts and beginners. We're going replay Episode 2 of the podcast from March 2020 where I explained the idea of selling put credit spreads similar to how an insurance company would sell car insurance. If you are a working professional and can’t watch the market all day but want to learn how you can implement the strategy discussed in this episode geared towards beginners and small accounts, head on over to the website and check out my SPX Income Masterclass where you’ll learn a mechanical strategy for trading weekly options that only requires you to check the market a couple times per week. Here's the link: https://www.stockmarketoptionstrading.net/spaces/4688450Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Want to trade with us?Check out our new group Alpha Traders Club on the website. https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: Everything in this episode and on this podcast is for informational purposes only and should not be considered financial advice. There is substantial risk trading options if not done properly.

19:5416/11/2023

101: Conservative Options Strategy For Consistent Income

Check out Alpha Traders Club for live conservative option alerts each and every week. Here's the link: https://www.stockmarketoptionstrading.net/spaces/12282222Creating consistent income trading options come down to having a repeatable process that you can execute. Brian Terry shared his process that he uses week over week to create additional retirement income trading covered calls in a conservative manner. Here is the video presentation of today's episode:https://youtu.be/LMEYgvK2IVsBrian's Conservative Covered Calls Facebook Group:https://www.facebook.com/groups/conservativecoveredcallsGet Brian's Weekly Watchlist Here:https://www.stockmarketoptionstrading.net/Check Out Brian's Live Trades Here:https://www.stockmarketoptionstrading.net/spaces/12282222Disclaimer: Everything in this episode and on this podcast is for informational purposes only and should not be considered financial advice. There is substantial risk trading options if not done properly.

12:5503/11/2023

100: The Compound Code Book with Scott Kyle and Patrick Fischer

The Compound Code Book was written by financial advisors Scott Kyle and Patrick Fischer. To connect with the authors, go to their website here: https://www.coastwisegroup.com/The book is a great read for anyone interested incorporating options into their income or investment strategies. Click Here to get the book on Amazon. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Want to trade with us?Check out our new group Alpha Traders Club on the website. https://www.stockmarketoptionstrading.net/spaces/12282222

31:4324/10/2023

SPX TTR Options Strategy (Beta)

In this episode, we'll cover a new strategy that uses the TTR from https://AlphaCrunching.com The TTR = Tomorrow's Triumph Rate which shows the historical percentage of times SPX has closed higher the next day over the past two months.This strategy is geared towards trading SPX options that expire the following day. By trading 1DTE options, 3DTE on Friday, you can avoid any PDT issues but also increase the number of high probability trades using the TTR to gain an edge in the market. More research on this strategy is coming and will be posted and updated in the Alpha Traders Club at https://www.stockmarketoptionstrading.net

18:1119/10/2023

SPX Options Trading Ideas

In this episode, I talk through the current market after recent FOMC, PPI, CPI, and jobs data as we head into October OpEx (options expiration) next week. There's been a shift in the market reactions to some of this data which is something I'm keeping an eye on.Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Want to trade with us?Check out our new group Alpha Traders Club on the website. https://www.stockmarketoptionstrading.net/spaces/12282222YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassinEverything on this podcast and on the website is for informational and educational purposes only. We are not financial advisors of any kind.

10:2312/10/2023

Credit Spreads Vs. Butterflies

In this episode, we'll compare credit spreads vs butterflies from a recent real world trade I took where I to decide which trade was best for the situation. The decision to go with one over the other hinged on the market situation, the risk reward, and the probability. In hindsight, both trades would've worked but one carried more risk than the other. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/content YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

12:2105/10/2023

This Could Mark a Short Term Bottom

This episode is for informational purposes only and should not be considered financial advice. I'm taking cues from the US Dollar in looking for a short term bottom in the stock market. The strong USD is a result of rising interest rates and can put pressure on stocks. As the market is still in correction as of this episode, I'll be looking for UUP to break its uptrend using a simple moving average cross as a clue that a short term bottom may be in place. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/content YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

07:3528/09/2023

Options Trading This Week: FOMC, Calendars, Covered Calls

Eric O'Rourke and Brian Terry discuss what they're looking at this week for their options trades. Got to https://www.stockmarketoptionstrading.net/ and join the free podcasts community to discuss the trade ideas discussed in this episode. Disclaimer: This episode is for informational purposes only. Eric and Brian are not financial advisors and this is not financial advice. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/content YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

21:5218/09/2023

How To Trade AI Stocks With Leverage Without Options with Will Rhind From Granite Shares

In this episode, I've got Will Rhind back on the show to discuss Granite Shares Single Stock ETF offerings in names like TSLA and NVDA which are some of the biggest AI plays right now. Ticker: TSLR is a 1.75x Long TSLA ETFTicker: NVDL is a 1.5x Long NVDA ETFBe sure to check their website to understand more about these and some of their other offerings including AAPL, META, and COIN. https://graniteshares.com/Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/content YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

26:0614/09/2023

When Repainting Is Acceptable

In this episode, we'll discuss repainting. When its bad and when its ok. Repainting is the concept that the visual representation of an indicator could change its past value based on current or new data. This not good when it comes to technical analysis but there are couple instances where this may be acceptable. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/content Want the support the podcast and interested in trading SPX weekly options with me?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

19:0710/09/2023

SPX 0DTE Options Trading Framework

In this episode, I walk through a framework I've been developing the past several months around trading weekly options on SPX with zero days to expiration, aka 0DTE. This episode is the first part of a free video series for AlphaCrunching.com subscribers but you don't need to be a subscriber to check it out. Here's the link to access the free video course for learning more about this SPX 0DTE Framework. https://www.stockmarketoptionstrading.net/posts/alpha-crunching-community-spx-0dte-frameworkUse code SPX50 at https://AlphaCrunching.com for 50% off your first month if you are interested in trading this method. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Want the support the podcast and interested in trading SPX weekly options with me?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

17:3924/08/2023

The Nuclear Option with David Janello

In this week's episode, I spoke with veteran trader and author David Janello to talk about his new book The Nuclear Option: Trading To Win With Options Momentum Strategies.Here's the link to the book on Amazon: https://a.co/d/6Gz95xTIt's a great read and focuses on actual strategies as well as many real world examples and definitely recommend you get a copy. If you'd like to connect with David after the episode, head over to https://nuclearoption.trading and check out his Substack. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/content Want the support the podcast and interested in trading SPX weekly options with me?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

26:5715/08/2023

SPX 3DTE Iron Condor Options Strategy Research

In this episode, we're going to continue our SPX iron condor discussion and research from last week's episode. Last week we talked about placing high probability 0DTE iron condor trades on days when the Alpha Crunching forecast shows low volatility days. Today, we're going to use the same analysis but research selling 3DTE iron condors on Friday's. Selling farther out in time gives you more room for your trade to work out when keeping the rest of the trade the same in terms of strike selection. The strategy discussed in this episode has had a 100% win rate the past 4 months but I'm still considering preliminary research as I have not traded this myself yet. To learn more, join our free Alpha Crunching group for discussion around this topic. Use code SPX50 at https://AlphaCrunching.com for 50% off your first month. Use code SMOT at https://optionomega.com for 50% off your subscription. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/content Want the support the podcast and interested in trading SPX weekly options with me?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

12:3608/08/2023

SPX 0DTE Iron Condor Options Strategy

In this episode, we'll cover the basics of the iron condor options strategy as well as dive into a new approach on deciding which days of the week may be best for trading them. We'll be focused on 0DTE or 0 days to expiration iron condors on SPX and backtest some recent trades using the Daily Forecasts from AlphaCrunching.com only on days that are forecasted to be choppy and indecisive. Full details in the episode. Here's a link to the companion video discussed in this episode: https://youtu.be/WcwoDbo2fUYUse code SPX50 at https://AlphaCrunching.com for 50% off your first month. Use code SMOT at https://optionomega.com for 50% off your subscription. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/content Want the support the podcast and interested in trading SPX weekly options with me?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

27:4027/07/2023

Probability Stacking and Edges

In this episode, we'll discuss the importance of trading with a probabilistic mindset and stacking the odds in your favor using various types of analysis. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/content Want the support the podcast and interested in trading SPX weekly options with me?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

24:2320/07/2023

Charting the Price Time Continuum

In this episode, we refer to the price chart as a price time continuum and compare to the space time continuum in that large objects passing through space can warp the the fabric of space time. In financial markets, the price time continuum can be warped by major known catalysts such as FOMC meetings, inflation reports, and jobs reports.Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/content Want the support the podcast and interested in trading SPX weekly options with me?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

13:5110/07/2023

This SPX 0DTE Strategy Has a 100% Win Rate The Past 3 Months

The intraday seasonality indicator for the S&P500 from AlphaCrunching.com has been showing a persistent bullish pattern on Thursday the past several weeks. I've been trading SPX 0DTE put credit spreads using chart confirmation on Thursday and have been doing really well. In this episode, we'll talk through how this works and backtest against it to see how's its performed the past 90 days and even the first 6 months of 2023.To learn about Alpha Crunching's intraday seasonality indicator, go here:https://www.stockmarketoptionstrading.net/spaces/10719554/content Check this link to last week's trade recap:https://www.stockmarketoptionstrading.net/posts/38504231Use code SPX50 at https://alphacrunching.com/ for 50% off your first month. For backtesting, checkout OptionOmega.com and use code SMOT for 50% off your subscription

13:3303/07/2023

Dividend Capture Strategy With Brian Terry CFP

Brian Terry is back on the show sharing one of his go to strategies for generating income in retirement. He calls it the Dividend Capture Strategy. Brian was on episode 14 of the show with another strategy titled Conservative Options Strategy involving selling in the money calls. Brian going to start sharing some of his trades over on the podcast website for free. Head on over to https://www.stockmarketoptionstrading.net/ and be sure to Follow Brisn so you get notified when he posts trade ideas. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/content Want the support the podcast and interested in trading SPX weekly options with me?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

29:5222/06/2023

How to Deal With Closing a Trade Too Early

Have you ever been in a trade, decide to close for a valid reason, only then for the stock to take off in the direction you thought it would and you miss out on the profits? This can be so frustrating because you were essentially right about the direction but missed out on the profits. In this episode, we'll explore 8 tips for dealing with missed profits according to ChatGPT. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/content Want the support the podcast and interested in trading SPX weekly options with me?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

15:3615/06/2023

The Snow Fight Metaphor by Van Tharp

In this episode, we'll go over Van Tharp's Snow Fight Metaphor from the book Trade Your Way to Financial Freedom. This is a continuation of episode 82 where we covered the 6 Keys to a Great Trading System so be sure to give that a listen when you get a chance. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/content Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

10:1106/06/2023

6 Keys to a Great Trading System by Van Tharp

Trade Your Way To Financial Freedom by Van K. Tharp is one of my favorite trading books where describes how to develop a trading system that works for you. In this episode, we'll cover the 6 Keys to a Great Trading System that is still very relevant today. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to the where the market may be headed next. Check out this free SPX 0DTE training course in the Alpha Crunching Community:https://www.stockmarketoptionstrading.net/spaces/10719554/content Want the support the podcast and interested in trading SPX weekly options?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. YouTube: https://www.youtube.com/stockmarketoptionstradingTwitter: https://twitter.com/OptionAssassin

20:2001/06/2023