Financial Overview for Realtors

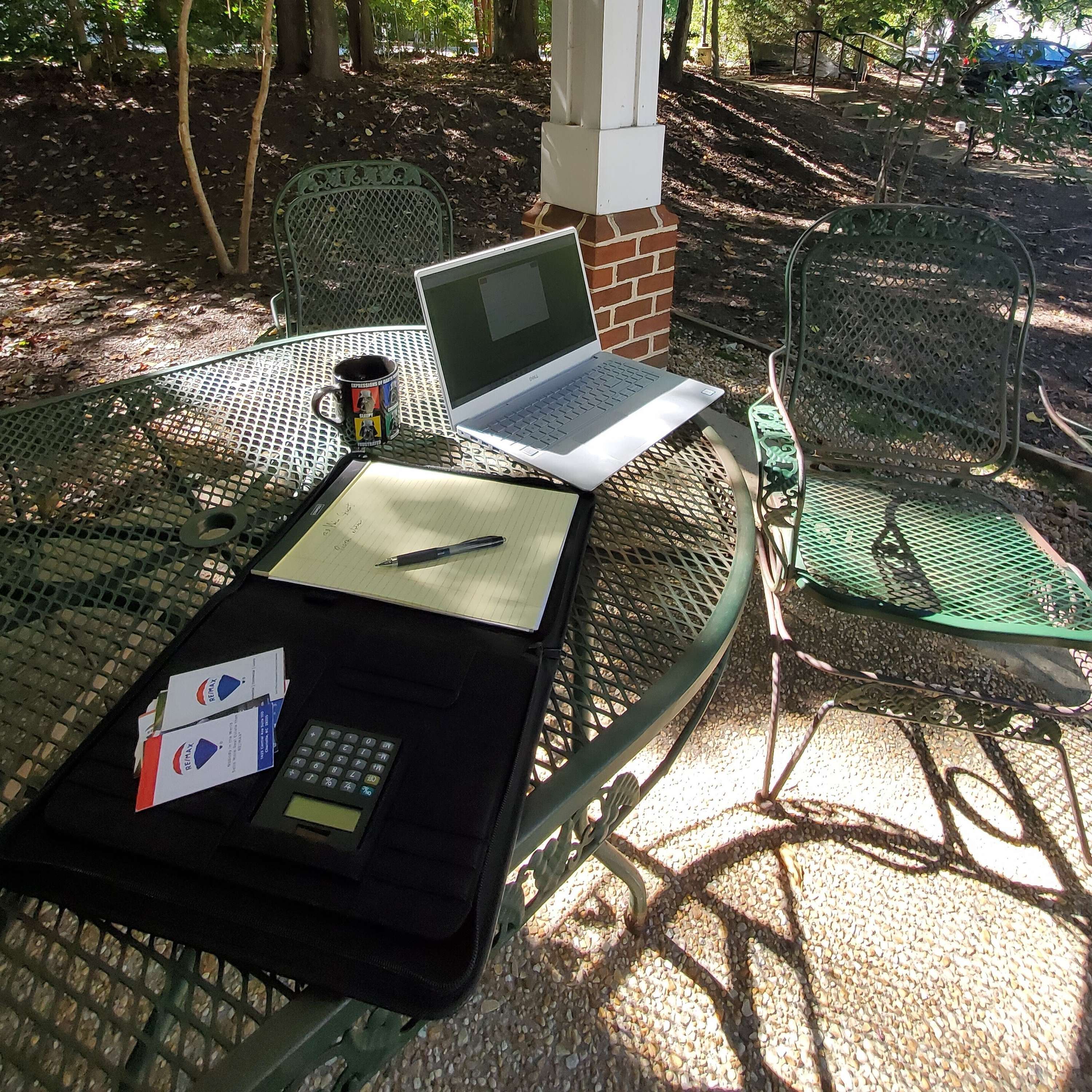

Planning- a-get a goal based on your needs and wants--not sure what to list for your wants? Talk to your family and they will surely give you some ideas. Not sure what to list for needs? Look at last two years of expenses and average them. housing + lodging+ food+ utils+ insurance+ b-be sure to write it down. I strongly suggest using an excel spread sheet, but paper and pencil is fine also c-Consider breaking your annual goal into smaller quarterly goals, book idea the twelve week year. Advantages are that you do not get lost in the distant ending of the year from now. You can also adjust as you go.The 12 Week Yearby Brian P. Moran (Author), Michael Lennington (Author)d-know your expenses, your financial needs, MLS dues, Realtor Dues, key fees, advertising expenses. I am sorry to say, but this is called budgeting. Ugly word that no one likes. But if nothing else look at your last 2 years of taxes and especially at your Schedule C. Take the average of those expenses and plan your budget for the next year. Execution a-if you have reasonable goals and expectations your goal should be achievable in modest routine steps through out the year. You should have monthly goals (1/12 of annual or 1/3 of quarterly) b-And those tasks and expenses can be divided into weekly and even daily tasks. USE GOOGLE Calendar for tracking your due dates for business expenses (color code them to schedule C) All advertising might be red, dues could be green, etc. c-separate spending into personal and business. Though not required, it makes tracking much simpler at tax time and any time you want to analyhttps://www.irs.gov/pub/irs-pdf/i1040sc.pdfze either personal or business. I suggest a separate business credit card, checking and savings account. d.-plan expenses ahead, document them, and be able to prove the expenses are justifiable business expenses. Know your schedule C categories. See attached and also the link to IRS instructions. https://www.irs.gov/pub/irs-pdf/i1040sc.pdf Strategy a-If you commit to tracking, you can work a strategy into place. Track results to watch expenses, using an app or a simple spreadsheet. Old school? No prob, just use a notepad. Apps are BizXpenseTracker, Shoeboxed, Expensify, Foreceipt b-tracking will allow you to identify what works and what is not working so you can fine tune, reallocate, and improve. Look for patterns, make connections, fix what needs fixing and dump the rest. Do not obsess over small abnormalities, especially if you know the root cause (ie. lost your phone and had to replace it for a big expense) that is not likely to occur again soon. Pay more attention to the routine day to day, month by month patterns. c-cancel old subscriptions to websites, clubs, services you do not use or that were not helping. Call and negotiate terms on existing ones you want to keep, look for cheaper alternatives prior to calling so you are ready to walk away. Doing this could easily free up $1000 you could reapply to market to past clients.Application a- be very careful look at your commission income as divisible and not the whole dollar. You are dealing with a raw dollar that has other obligations. As a 1099 independent contractor you absolutely must pay taxes, must consider other benefits you do not get afforded by your work such as health insurance, retirement, sick leave, emergency fund, etc. Consider AFLAC, consider hiring an accountant to advise you b-diversify your income. Consider multiple streams of income as a Real Estate agent. You should work with sellers, buyers, tenants, landlords, and you should participate actively in referral, incoming and outgoing, you should be a buyer, a landlord, a seller. You are on the front lines of RE and you get a discount due to your job. c-invest in relationships. Always work to strengthen your relationships with other practitioners, vendors, your clients and the public in general. If you do nothing else this day or this week, but build up a handful of relationships, you will have helped your self and those others. d-have a business reserve fund to get you through the down times. If you do your business planning correctly these should not happen or they should happen ingrequently, however, you MUST have reserves so that you can withstand the unforeseen months with no income. It gives you financial muscle and the confidence in your deeper abilities when you know you can withstand slow periods. I suggest starting small, a month or two, then build to 3 or 4. Aim to hit a target you can live with, but 6-8 months would be IDEAL for any business.

Sign in

Sign in Sign in

Sign in Sign in

Sign in