Sign in

Sign in

Technology

Business

Andreessen Horowitz

The a16z Podcast discusses tech and culture trends, news, and the future – especially as ‘software eats the world’. It features industry experts, business leaders, and other interesting thinkers and voices from around the world. This podcast is produced by Andreessen Horowitz (aka “a16z”), a Silicon Valley-based venture capital firm. Multiple episodes are released every week; visit a16z.com for more details and to sign up for our newsletters and other content as well!

Rebel Talent

When we think about rebellious behavior in the context of organizations and companies, we tend to think of rebels as trouble-makers, rabble-rousers; in other words, people who make decisions and processes more difficult because they may not follow the established rules or norms. But rebel behavior can also be incredibly positive and constructive—in keeping us from stagnation, encouraging growth and learning, increasing curiosity and creativity.In this episode of the a16z Podcast, Harvard Business School Professor Francesca Gino, a social scientist who studies organizations, breaks down with a16z's Hanne Tidnam what makes rebels different in how they tend to see and do things—whether that’s cooking, flying planes, or holding board meetings—and what we can all learn from “rebel talent” to make our organizations more productive and innovative.

33:0104/02/2020

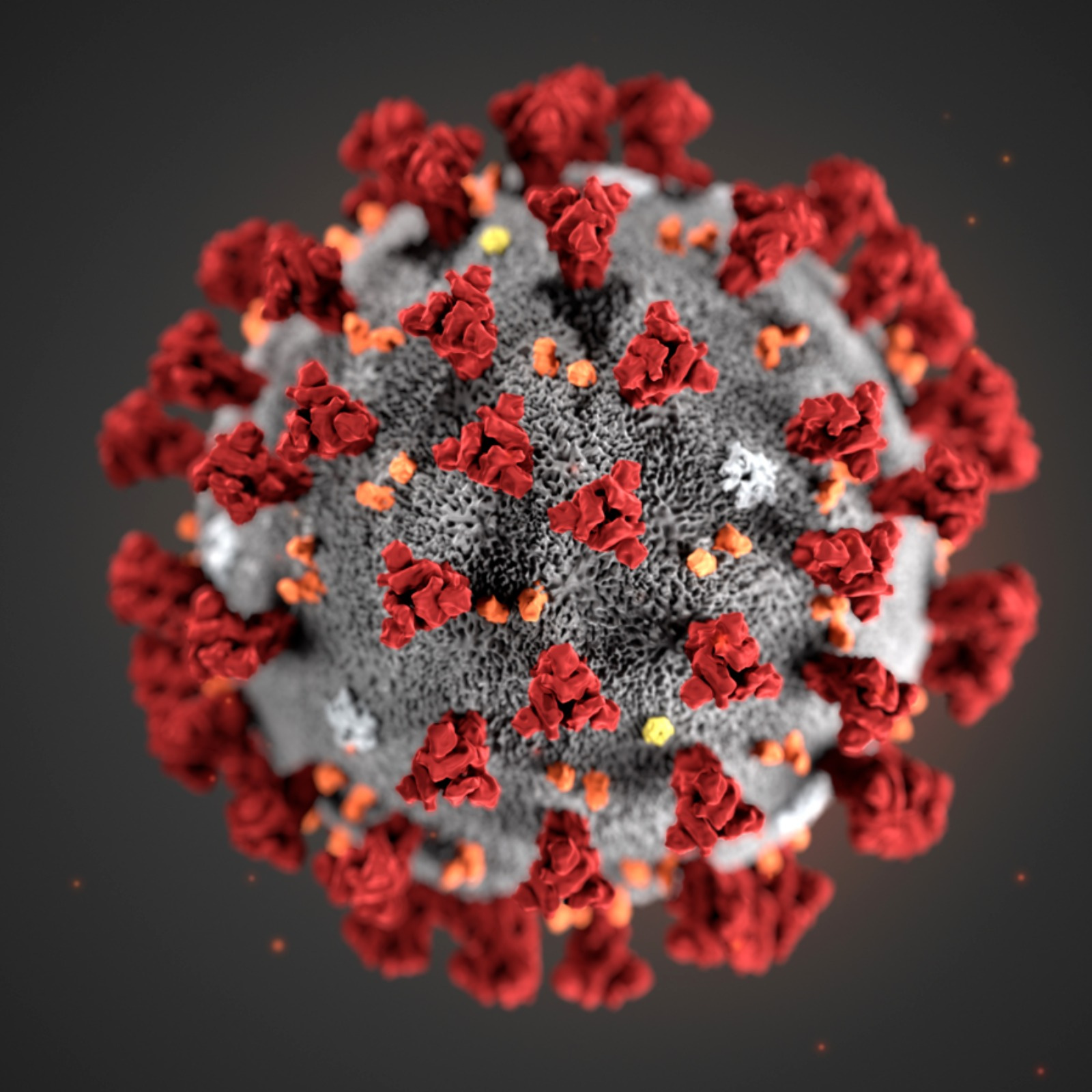

All about the Coronavirus

This episode of 16 Minutes on the news from a16z is all about the recent coronavirus outbreak -- or rather, a new type of coronavirus called 2019-nCoV for 2019 novel coronavirus. Since it's an ongoing and fast-developing news cycle, we take a quick snapshot for where we are, what we know, and what we don't know, and discuss the vantage point of where tech comes in. Topics covered include:definition of a virus, categories of coronavirusesorigins and spreadhow this stacks up so far against SARS and MERSspeed of sequencing, implications of genomic infospeed of information sharingR0 ("r-naught"/"nought") and what it measuresdifferent ways to think about how bad a given epidemic iscurrent moves and treatmentsOur a16z guest is Judy Savitskaya on the bio team, in conversation with Sonal Chokshi.Link sources or background readings for this episode:Centers for Disease Control and Prevention (in the U.S. Department of Health and Human Services) + typesWorld Health Organization (in the United Nations) -- situation report #6, January 26Other background readings / pieces mentioned in this episode: "Scientists are moving at record speed to create new coronavirus vaccines--but they may come too late", Jon Cohen, Science (AAAS), January 27"Clinical features of patients infected with 2019 novel coronavirus in Wuhan, China", The Lancet, January 24"Discovery of a novel coronavirus associated with the recent pneumonia outbreak in humans and its potential bat origin", bioRxiv, January 2 *note - preprint, NOT peer reviewed*"The deceptively simple number sparking coronavirus fears", Ed Yong, The Atlantic, January 28 *this appeared AFTER this episode was recorded, so sharing here as additional reading only*image: CDC

19:4930/01/2020

The Truth about 1000 True Fans + Pricing Our Attention

The idea of "1000 true fans" -- first proposed by Kevin Kelly in 2008 and later updated for Tools of Titans -- argued that to be a successful creator, you don’t need millions of customers or clients, but need only thousands of true fans. Such a true, diehard fan "will buy anything you produce", and as such, creators can make a living from them as long as they: (1) create enough each year to earn profit from each fan, plus it's easier and better to give existing fans more; (2) have a direct relationship with those fans, which the internet (and long tail) now make possible.But patronage models have been around forever; what's new there? How has the web evolved; and how are media, and audiences/voices finding and subscribing to each other changing as a result? If the 1000-true-fans concept is also more broadly "useful to anyone making things, or making things happen" -- then what nuances do people often miss about it? For instance: That there are also regular fans in the next concentric circle around true fans, and that the most obscure node is only one click away from the most popular node.Finally -- when you combine this big idea with another idea Kelly proposed in his most recent book The Inevitable (covered previously on this episode) on inverting attention economies so audiences monetize their attention vs. the other way around, how do we connect the dots between them and some novel thought experiments? In this hallway-style episode of the a16z Podcast, which Sonal Chokshi recorded with Kevin in our pop-up podcast booth at our most recent a16z Summit, we discuss all this and more. Because on average, we all currently surrender our attention (whether to TV, books, or whatever) for about $3 an hour. Whoa?! image: whatleydude/Flickr

15:3227/01/2020

Writers Writing, Readers Reading, Creators Creating

We've been financing good writing with bad advertising -- and "attention monsters" (to quote Craig Mod) for way too long. So what happens when the technology for creators finally falls into place? We're finally starting to see shift in power away from publications as the sole gatekeepers of talent, towards individual writers. Especially when the best possible predictor of the value of a piece of writing is, well, the writer. The publication's brand is no longer the guarantee of quality, or the only entity we should be paying and be loyal to, when a new ecosystem is forming around the direct relationship between consumers, content creators, and the tools and business models to facilitate all this.So where do readers come in... how do they find signal in the noisy world of drive-by billboard advertising, "attention-monster" feeds, and the death of Google Reader? Particularly as machine learning-based translation, summarization, and other mediums beyond text increasingly enter our information diets, for better and for worse?This episode of the a16z Podcast features Robert Cottrell, formerly of The Economist and Financial Times and now editor of The Browser (which selects 5 pieces of writing worth reading delivered daily); Chris Best, formerly CTO of Kik and now co-founder and CEO of Substack (a full-stack platform for independent writers to publish newsletters, podcasts, and more); and Andrew Chen, formerly independent blogger/ newsletter publisher, now also an a16z general partner investing in consumer -- all in conversation with Sonal Chokshi. The discussion is all about writing and reading... but we're not just seeing this phenomenon in newsletters and podcasting, but also in people setting up e-commerce shops, video streaming, and more. Is it possible that the stars, the incentives, are finally aligning between creators and consumers? What happens next, what happens when you get more than -- and even less than -- "1000 true fans"? image: Thad Zajdowicz/ Flickr

40:2527/01/2020

What's Next for the Internet?

How can we evolve the web for a better future? Has the web become a mature platform — or are we still in the early days of knowing what it can do and what role it might have in our lives? Just as “social/local/mobile” once did, what are the new trends — like crypto and blockchain networks and commerce everywhere — that might converge into new products and experiences?Chris Dixon (general partner at a16z and co-lead of the a16z crypto fund) discusses all things internet with Jonah Peretti (founder and CEO of BuzzFeed). Their conversation ranges from the early days of the web to the way innovation happens (what Chris calls “outside-in vs inside-out”) to the promise of a community-owned and operated internet, and more.Together they explore the possibilities that could co-evolve and converge are we enter into the next era of the web, and they share how we might not be quite as far removed from the “wild west days” of the internet as we imagined.

41:1219/01/2020

Controlling AI

AI can do a lot of specific tasks as well as, or even better than, humans can — for example, it can more accurately classify images, more efficiently process mail, and more logically manipulate a Go board. While we have made a lot of advances in task-specific AI, how far are we from artificial general intelligence (AGI), that is AI that matches general human intelligence and capabilities?In this podcast, a16z operating partner Frank Chen interviews Stuart Russell, the Founder of the Center for Human-Compatible Artificial Intelligence (CHAI) at UC Berkeley. They outline the conceptual breakthroughs, like natural language understanding, still required for AGI. But more importantly, they explain how and why we should design AI systems to ensure that we can control AI, and eventually AGI, when it’s smarter than we are. The conversation starts by explaining what Hollywood's Skynet gets wrong and ends with why AI is better as "the perfect Butler, than the genie in the lamp."

26:0316/01/2020

Food, Drugs, and Tech—100 Years of Public Health

The federal agency known as the FDA, or the Food and Drug Administration, was born over 100 years ago—at the turn of the industrial revolution, in a time of enormous upheaval and change, and rapidly emerging technology. The same could be said to be just as true today. From CRISPR to synthetic biology to using artificial intelligence in medicine, our healthcare system is undergoing massive amounts of innovation and change. Covering everything from gene-editing your dog to tracking the next foodborne outbreak, this wide-ranging conversation between Principal Commissioner of the FDA Amy Abernethy and Vijay Pande, GP on the Bio Fund at a16z, discusses how the agency is evolving to keep pace with the scientific breakthroughs coming, while staying true to its core mission of assessing safety and effectiveness for consumers in the world of food and medicine. Highlights:What the FDA looks like today and the key steps of the FDA process to getting a drug/product to market [2:20] How to manage a culture when mitigating risk is a top priority while aiming to innovate for the future [5:22] Creative problem-solving in times of crisis, such as the Opioid crisis [9:58] Preparing for and preventing drug shortages at scale [13:30] How advances in bioengineering are transforming healthcare [16:00] How the FDA is thinking about n=1 therapies and its applications in the future [18:54] The future of healthcare privacy [26:10] The ways the clinical trial process are shifting [29:26] Innovations in Bioengineering as they relate to regulating food in the future [36:02] How the FDA handles foodborne illnesses and its plans to innovate food safety [39:12] Discussion about the next 100 years of the FDA [41:25]

44:5514/01/2020

On Pharma Trends and Big Company Innovation

How does the world’s largest producer of medicines in terms of volume balance the science and the business of innovation? How does an enterprise at such vast scale make decisions about what to build vs. buy, especially given the fast pace of science today? How does it balance attitudes between “not invented here” and “not invented yet”?Vas Narasimhan, CEO of Novartis, sat down with a16z bio general partners Jorge Conde and Vijay Pande, and editor in chief Sonal Chokshi, during the JP Morgan Healthcare Conference around this time last year, to discuss the latest trends in therapeutics; go to market and why both big companies and bio startups need to get market value signals (not just approvals!) from payers earlier in the process; clinical trials, talent, leadership, and more in this rerun of the a16z Podcast. image: Global Panorama/ Flickr

59:1711/01/2020

Personal Genomics: Where Are We, Really?

This is a turn of the decade (and January-themed) look backward/ look forward into personal genomics, given recent and past retrospective and prospective pieces in the media on the promise, and perils, of the ability to sequence one's DNA: What did it, and does it, mean for personalized medicine, criminal investigations, privacy, and more?General partner Jorge Conde, who has a long history in the space, covers everything from where genealogy databases and large datasets come in to fetal testing, multi-omics, and other themes spanning the past, present, and future of personal genomics in conversation with Sonal Chokshi for episode #18 our news show 16 Minutes, where we cover recent headlines, the a16z way, from our vantage point in tech -- and especially what's hype/ what's real. While we typically cover multiple headlines, this is one of our special deep-dive episodes on a single topic. (You catch up on other such deep dives, on the opioid crisis and other evergreen episodes, at a16z.com/16Minutes). And if you haven't already, be sure to subscribe to the separate feed for "16 Minutes" to continue getting new episodes. image: Petra Fritz / Flickr

19:5706/01/2020

Why We Should Be Optimistic About the Future

Many skeptics thought the internet would never reach mass adoption, but today it’s shaping global culture, is integral to our lives -- and it's just the beginning. In this conversation from our 2019 innovation summit, Kevin Kelly (Founding Executive Editor, WIRED magazine) and Marc Andreessen sit down to discuss the evolution of technology, key trends, and why they're the most optimistic people in the room.***The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.

44:3002/01/2020

What to Know about CFIUS

When innovation and capital go global, so do restrictions on trade, foreign investment, and more. Over the past couple years, U.S. policymakers have expanded the scope of the Committee on Foreign Investment in the U.S. (CFIUS) through the Foreign Investment Risk Review Modernization Act (FIRRMA) of 2018 which was recently updated through proposed reforms this September 2019.So what does this all mean for tech founders taking investments from, or doing joint ventures with, foreign entities -- or just doing business globally in general? What does and doesn't CFIUS cover, and how might one structure partnerships strategically as a result? In this episode, a16z general partner Katie Haun interviews Michael Leiter (of law firm Skadden Arps) who specializes in CFIUS as well as matters involving U.S. national security and cybersecurity, cross-border transactions, aerospace and defense mergers and acquisitions, and government relations and investigations.The Q&A took place in September 2019 as part of an event hosted by Andreessen Horowitz. The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.

46:0323/12/2019

Are ISAs the Solution to Student Debt?

A bold proposal: You go to college for free, then pay back the school after graduation—but only if you get a job in your field of study and make a high enough salary to afford it. It's called an income share agreement, and Austen Allred, the CEO and cofounder of Lambda School, thinks it's the future of education.Student debt currently stands at more than 1.5 trillion dollars, which makes it the second-highest consumer debt category behind mortgage debt. The crisis has saddled much of a generation, with far reaching effects. Income share agreements, or ISAs, have been put forth as an alternative to the current system. Put simply, an ISA is an agreement between a school and a student for the student to pay a defined percentage of income to the school, for a particular period of time, up to a certain cap. It's a seemingly simple conceit with complex design considerations, and it's spurring debate across media and politics.In this episode, Lambda School CEO Austen Allred, a16z general partner D'Arcy Coolican, and a16z editorial partner Lauren Murrow delve into the greater implications ISAs may have for education and the economy. The discussion covers both the promise and the challenges of ISAs—why they've been relatively slow to gain traction, why they've failed in the past, and why some in the political sphere are still skeptical.

27:5119/12/2019

Shonda Rhimes on How to Create Stories (and Products) People Want

Hollywood and Silicon Valley seem so different, but are more alike than we think. What challenges do tech startup founders and other creative founders -- like showrunners and executive producers -- similarly face? Both have to deeply understand and respect their audiences; learn how to scale themselves beyond one person; and even figure out how and when to use data... or follow their intuitions.In the end, it’s all about creating a story (product!) that sticks.In this conversation with Andreessen Horowitz cofounder and general partner Marc Andreessen, Shonda Rhimes -- executive producer, writer, creator of hit 100+ episode shows hows like Grey’s Anatomy and Scandal, and founder of the media company Shondaland -- shares the mindsets that drive her to pitch ideas, think about new mediums, and what happens when make believe veers too close to reality.Rhimes is the recipient of several industry awards and accolades, including a Golden Globe for Outstanding Television Drama, the Peabody Award, Time 100 most influential people, Fortune's “50 Most Powerful Women in Business", and lifetime achievement awards from the Directors Guild of America, the Writers Guild of America, and the Producers Guild of America. She has been inducted into the National Association of Broadcasters Broadcasting Hall of Fame and to the Television Academy of Arts & Sciences Hall of Fame. She is also the creative director of Dove’s #RealBeauty campaign and authored NYT bestseller Year of Yes.The conversation originally took place at our most recent annual innovation Summit -- which features a16z speakers and invited experts from various organizations discussing innovation at companies large and small, as well as tech trends spanning bio, consumer, crypto, fintech, and more.

34:5817/12/2019

The Journey from 0 to 1, from Mosaic to Netscape

As part of a new series where we will share select a16z partner appearances on other podcasts with our audience here, this episode is cross-posted from the new show Starting Greatness -- featuring interviews with startup builders before they were successful -- hosted by Mike Maples junior.In the conversation, a16z co-founder Marc Andreessen shares some rare, behind-the-scenes details of his story from 0 to 1 -- from the University of Illinois and Mosaic to Netscape -- and along the journey, really, to product-market fit...

44:0717/12/2019

Direct Listings, Myths and Facts

We’ve covered a lot of the strategic financing milestones for startups seeking to build a sustainable and enduring business -- from mindsets for startup fundraising to when and how to build a finance functionwith a CFO to what it takes to do an initial public offering (IPO) and stories from the inside out. There’s also a lot that goes on behind the scenes en route to IPO, including how they’re priced and what the "pop" means.Yet another route to the public markets is the direct listing, recently reinvented for tech companies (with Spotify and Slack so far). We explained the process and tradeoffs in this early primer by Jamie McGurk, so this episode of the a16z Podcast brings together two experts from the frontlines: the architect of the direct listings in their current form, Barry McCarthy, current CFO of Spotify (and former CFO of Netflix); and Stacey Cunningham, president of the NYSE where they were listed -- in conversation with Sonal Chokshi to share more about the what, the how, and the why from an insider perspective.What's the bigger picture here, including secular shifts in the public and private markets? Zooming in closer, what are all the details and nuances involved in true pricing, investor days, forward guidance, and other market mechanisms for "radical transparency"? What did it take behind the scenes to make this all happen, and what's still happening? And finally, what are some of the common myths and misconceptions around direct listings (and IPOs) as methods for going public? Turns out, there's a lot that goes into making markets... and market making.---The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.

44:2011/12/2019

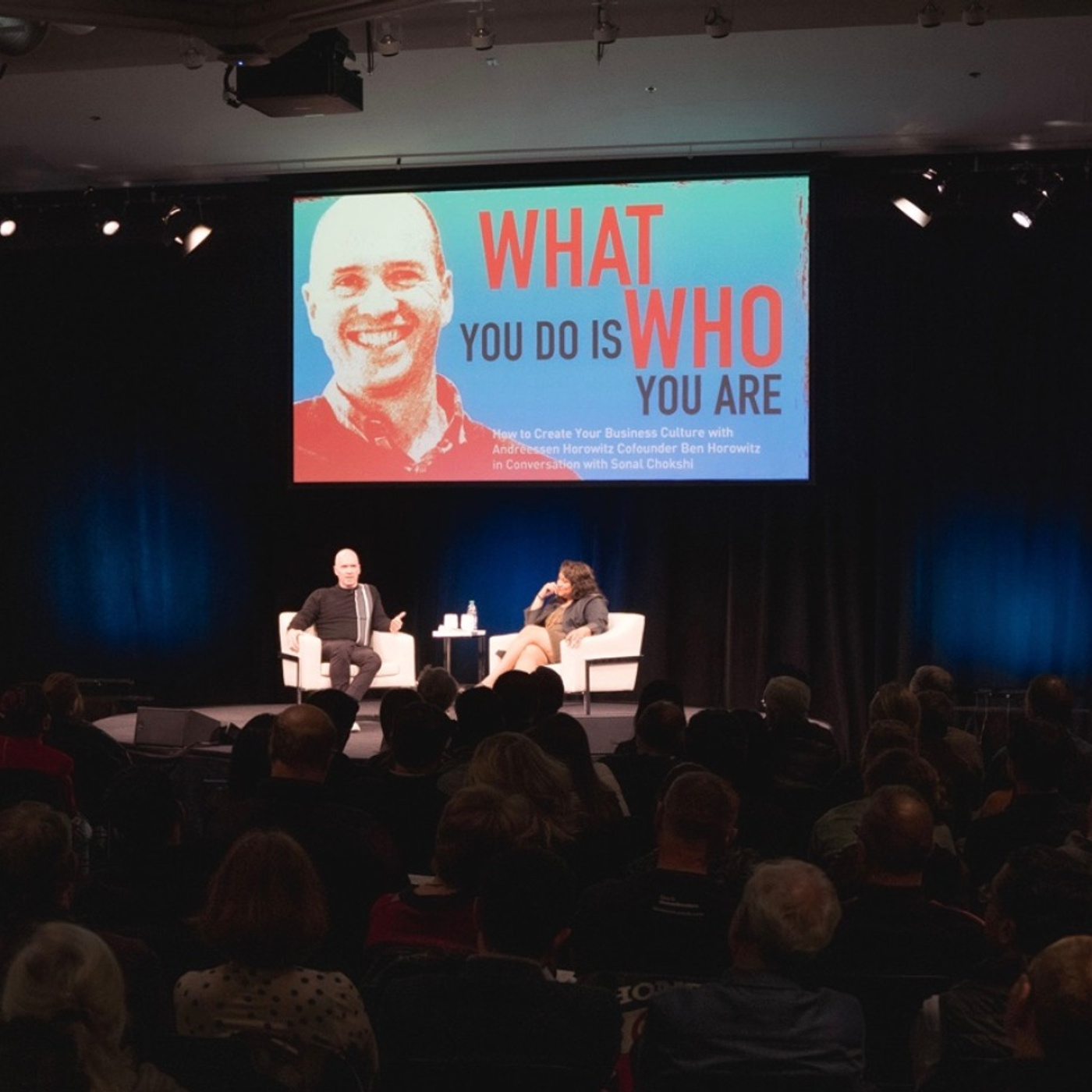

The Stories and Code of Culture Change

There are some common tropes that can kill your company culture -- whether it's that corporate values can be weaponized; "fake it til you make it"; the "reality distortion fields" of visionaries vs. liars; and so on. All of this just reveals the confusing, sometimes blurry line between the yellow zones and red zones of behavior, because the very things that are strengths can also become weaknesses (and vice versa!). The fact is, in any complex adaptive system (which is what a company is), even the seemingly smallest behaviors will move the culture where the loudest proclamations do not.That's why so much of culture -- whether building and setting it or fixing and changing it -- comes down to the difference between actions and words, to the tacit vs. the explicit, to the difference between what you do vs. what you say (and what employees see vs. what they hear). So in this episode of the a16z Podcast, based on a conversation that recently took place at the Computer History Museum in Silicon Valley, Sonal Chokshi interviews Ben Horowitz about his new book, What You Do Is Who You Are, probing on all the tricky nuances of the themes covered in it -- and also how to practically apply principles from it to the tech industry and beyond.Are mistakes of omission more important than mistakes of commission, when it comes to ethical lines? What can employees, not just leaders, do when it comes to culture? Where does the idea of "culture fit" come in? What happens when startups go from being the pirates to being the navy? Drawing on examples of culture as code from a thousand years ago to today -- spanning empires, wars, revolutions, prisons, and even hip-hop -- Horowitz shares the power of song and story. Including even violent, "shocking" ones that reset cultures... because they make you ask, WHY?!100% of the proceeds from the book will go to anti-recidivism, and to making Haiti great again

59:0707/12/2019

Of Container Ships, Supply Chains, and Retail

This podcast rerun -- first recorded over two and a half years ago, now being rerun as one of our evergreen classics on the tails of the world's largest designated shopping days (Black Friday, Singles Day in China, Prime Day online, and so on) -- is ALL about the container ship. Also known as "The Box", with author Marc Levinson (in conversation with Sonal Chokshi and Hanne Tidnam). But this episode is really about connecting the dots between logistics, transportation, infrastructure, and much more.What do we make of the so-called "death of retail", especially when seen through the retail history of the once-largest retailer in the world? How are supply chains changing today? One thing's for sure: the shipping container made the world much smaller... and the world much economy bigger. image: Kevin Talec / Flickr

33:5803/12/2019

Nursing Today, From the Bedside and Beyond

"Constant attention by a good nurse may be just as important as a major operation by a surgeon”, diplomat Dag Hammarskjöld once observed -- and that may be more true today than ever before. For most of us, nurses are essentially the face of the healthcare system: the person you’ll see the most of while you’re in it, who will monitor your vitals, administer medications, hold your hand when you’re in pain or scared, answer all the questions you forgot to ask the doctor.So in this episode, we take a look at the role of that unsung hero of healthcare -- the nurse -- at an industry level. Iman Abuzeid, CEO and co-founder of Incredible Health (a hiring platform for nurses), and a16z general partners Julie Yoo and Jeff Jordan discuss with Hanne Tidnam how the scope of the job is changing today and why; what’s driving the looming nursing shortage crisis, and ways we can help solve it; what it’s like to build a new marketplace platform in healthcare; and how best to introduce innovation into the healthcare system overall.

32:4328/11/2019

How We Podcast

"Hi everyone, welcome to the a16z Podcast..." ... and welcome to our 500th episode, where, for the first time, we reveal behind-the-scenes details and the backstory of how we built this show, and the broader editorial operation. [You can also listen to episode 499, with head of marketing Margit Wennmachers, on building the a16z brand, here.]We've talked a lot about the podcasting industry, and even done podcasts about podcasting, so for this special episode, editor-in-chief and showrunner Sonal Chokshi reveals the how, what, and why in conversation with a16z general partner (and guest-host for this special episode) podcasting fan Connie Chan. We also answer some frequently asked questions that we often get (and recently got via Twitter), such as:how we program podcastswhat's the process, from ideas to publishingdo we edit them and how!do guests prep, do we have a scripttechnical stack...and much more. In fact, much of the conversation goes beyond the a16z Podcast and towards Sonal's broader principles of 'editorial content marketing', which hopefully helps those thinking about their own content operations and podcasts, too. Including where podcasting may be going.Finally, we share some unexpected moments, and lessons learned along the way; our positions on "tics", swear-words, and talking too fast; failed experiments, and new directions. But most importantly, we share some of the people behind the scenes who help make the a16z Podcast what it was, is, and can be... with thanks most of all to *you*, our wonderful fans!

47:4427/11/2019

Brand Building Ideas… and People

Many technical founders, academics, and other experts often believe that great products -- or great ideas! -- sell themselves, without any extra effort or marketing. But in reality, they often need PR (public relations).The irony is, most of the work involved in PR is actually invisible to the public -- when it works, that is -- and therefore hard for those from the outside to see let alone understand. So how does such brand-building really work? In this 10-year anniversary episode of the a16z Podcast (and our 499th episode), a16z operating partner Margit Wennmachers shares the case study of her work at The Outcast Agency (which she co-founded) and of building the a16z brand (where she heads marketing and was the first and one of the earliest hires).What's the backstory there? What's the backstory behind some of the most popular media stories and op-eds -- like "software is eating the world" -- and what can it teach us about how PR and brand-building works in practice? Because -- like many software companies -- the product is so abstract, and not something you can physically touch, what kind of subtle decisions and tactics big and small does it take? Answering some frequently asked questions (in conversation with editor in chief Sonal Chokshi) that we often get around how things work, Wennmachers reveals (just some;) of the details behind the scenes. Given that technology is all about disintermediating "brokers" in the middle, will tech one day replace PR? And finally, what's the hidden Silicon Valley network mafia that NO one talks about?

35:0220/11/2019

Come for the Games, Stay for the Party

The games industry is in the midst of a tectonic shift. Powered by platform convergence, games-as-a-service, and user-generated content, modern video games—what we call next-generation games—are unlike anything we've seen before. In the past decade, gaming has grown from a niche hobby into a global, culture-defining phenomenon.Not only are the games themselves becoming increasingly immersive, the way we develop and discover them has fundamentally changed. In contrast to the hits-driven business model of the past, now games are shaped in real time by player feedback. And thanks to the rise of influencer gamers, the experience of finding new games has become organic and social.In this episode, a16z general partner Andrew Chen, deal partner Jon Lai, and host Lauren Murrow discuss how gaming is dominating not only the entertainment industry, but also pop culture at large. (Why can't we quit you, Untitled Goose Game?!) Andrew and Jon share how they think about emerging technologies in the space, as well as the features they look for in next-gen games and game developers.

22:3402/11/2019

AI in B2B

Consumer software may have adopted and incorporated AI ahead of enterprise software, where the data is more proprietary, and the market is a few thousand companies not hundreds of millions of smartphone users. But recently AI has found its way into B2B, and it is rapidly transforming how we work and the software we use, across all industries and organizational functions. In this episode, Das Rush interviews Oleg Rogynskyy, founder of People.ai, an AI platform for sales and marketers, and Peter Lauten from the a16z Enterprise investing team about what the rise AI in B2B means for enterprises, workers, and startups. They explain why AI provides a strong first mover advantage to enterprises that adopt it early; how it can automate lower level tasks, maximize our focus, and, ultimately, make our work more meaningful; and for startups, they provide a playbook for seizing the next AI opportunity.

24:1124/10/2019

Free Software and Open Source Business

Today, despite the critical importance of open source to software, it’s still seen by some as blasphemous to make money as an open source business. In this podcast, Armon Dadgar, Cofounder and CTO of HashiCorp; Ali Ghodsi, CEO of Databricks; and a16z General Partner Peter Levine explain why it's necessary to turn some open source projects into businesses.They also cover the most important questions for open source leaders to answer: How do you keep community engaged while building a business? What new opportunities does SaaS (software-as-a-service) present? And if you are a SaaS business, how should you approach cloud service companies, like Amazon Web Services (AWS)?

35:0421/10/2019

Of Emojis and Innovation

This rerun podcast (first recorded in 2015, now being rerun as one of our evergreen classics/ favorites) -- is ALL about emoji. But it's really about how innovation really comes about: through the tension between open standards vs. closed/ proprietary systems; the politics of time and place; and the economics of creativity, from making to funding.So yes, this podcast is all about emoji. But it's also about where emoji fits in the taxonomy of social communication, and why that matters -- from making emotions machine-readable to being able to add "limbic" visual expression to our world of text. And if emoji is a language, why can't we translate it; why so ambiguous?? How do emojis work, both technically underneath the hood... and in the (committee) Room Where It Happens?Joining this episode are former VP of Data at Kickstarter Fred Benenson (and the man behind 'Emoji Dick'); and former New York Times reporter and current Unicode Emoji subcommittee vice-chair, Jennifer 8. Lee (and one of the women behind the dumpling emoji) -- in conversation with Sonal Chokshi.image: Yiying Lu (@yiyinglu)

38:4015/10/2019

The Environment, Capitalism, Technology

It used to be that the only way for humanity to grow -- and progress -- was through destroying the environment. Sure, the Industrial Revolution brought about the growth of our economies, our population, our prosperity; but it also led to our extracting more resources from the planet, more pollution, and some nightmarish human conditions as well. But is this interplay between the two -- of human growth vs. environment, of protection vs. destruction -- really a zero-sum game? Even if it were true in history, is it true today? How about for developing economies around the world today -- do they have to go through an extractive phase first before entering a protective one... or can they skip that phase altogether through better technology (the way they leapt to mobile)?And if capitalism is not responsible for environmental degradation, than who or what is? Where does technology come in, and where doesn't it -- if you believe we already have the answers to saving the environment? Marc Andreessen and Sonal Chokshi interview MIT economist Andrew McAfee about all this and more, given his new book, More from Less: The Surprising Story of How We Learned to Prosper Using Fewer Resources -- and What Happens Next.So what does happen next? From nuclear power to dematerialization to Tesla and the next cleantech revolution (or not), this episode of the a16z Podcast brings a different perspective to an important discussion around taking care of our planet... and also ensuring human progress through the spread of human capital and technology. image: Kevin Gill / Flickr

46:5904/10/2019

16 Minutes on the News #10: Amazon Healthcare, Oculus VR/AR, Google Quantum Supremacy?

Our news podcast, 16 Minutes -- where we quickly cover the top headlines of the week, the a16z way (why are these topics in the news; what's real, what's hype from our vantage point of tech trends) -- is now only available as its own show feed, separately from the main a16z Podcast... so be sure to subscribe wherever you get your podcasts if you want our weekly news & tech take!This is the tenth episode of the show, and this week we cover a variety of topics with the following a16z experts:Amazon Care healthcare news this week that they're now providing a virtual medical clinic for employees, initially in Seattle, using telemedicine and in-home visits; what does their delivering healthcare actually mean for both incumbents and startups... and the future of medicine? -- with Julie Yoo and Jorge CondeOculus Connect 6, Facebook's annual developer event, where there were a number of announcements about devices, content, and more that could be key to the evolution of virtual reality (VR) and augmented reality (AR) -- with Chris DixonGoogle quantum supremacy claim, as shared in a paper with/via NASA; what's fact, what's fiction about it; what does it actually mean (or not mean) for cryptography and other applications; and where are we, really, in quantum computing? -- with Vijay Pande...hosted by Sonal Chokshi.---The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.

22:3330/09/2019

New Business Models for Gaming, Collaboration, Creativity

The combination of cloud, social, and mobile took gaming beyond a small base of just console- and PC-gamers to a massive player base. But the underlying business model -- the concept of "free-to-play", built on top of games-as-a-service -- may have been the real innovation that led us to the global gaming phenomenons we have today.Unfortunately, observes gaming veteran Kevin Chou -- who's seen it all when it comes to tech platform shifts and gaming as a longtime gamer, founding CEO of Kabam, and now founder and CEO of Forte -- there is "a dark side" to free-to-play: Game developers have to balance the gamers who aren't paying with those who are, and especially those who are paying a helluva lot more (the whales) in order to make money and keep the game going. This balance becomes incredibly challenging over time; it is, quite frankly, a lopsided economy. The players will leave: The incentives between game publishers and players are simply not aligned.Yet what if we could re-align those incentives -- really, the economic relationships -- between game publishers/developers; players and guilds and clans; those who create on top of games (like on Roblox and Minecraft); those who trade and otherwise transact both inside and outside games (it's already happening in secondary markets and gold farms). We could do this in a more balanced way, thanks to blockchain technology and cryptoeconomic business models -- leading to thriving gaming economies with better monetization and deeper engagement, as well as new forms of collaboration, community, and creativity.But smart contracts, cryptoeconomies, security, etc. is hard for gamers who just want to focus on designing the best game, so how do we get here? Chou shares his thoughts in this episode of the a16z Podcast with Sonal Chokshi and general partner Chris Dixon. In gaming (and in fact, with other tech trends too), innovation happens when there's a combination of new devices, new technology platforms, and new delivery mechanisms... but it's the business-model innovations, argues Dixon, that tend to create the most startup opportunities.image: battle scene from Eve Online, a game with an economy (via Forte.io)---The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.

42:0428/09/2019

16 Minutes on the News #9: All the Recent Phone Hacks

This is episode #9 of our news show, 16 Minutes, where we quickly cover recent headlines of the week, the a16z way -- why they’re in the news; why they matter from our vantage point in tech -- and share our experts’ views on the trends involved.This week we do a short but deep dive to tease apart the FUD from the facts on all the phone hacks of late (also, arguably, one of the worst years on record for certain device manufacturers) -- given the following news:Just this week, the FBI’s Cyber Division released a notification to private industry on “Cyber Criminals Use Social Engineering and Technical Attacks to Circumvent Multi-Factor Authentication”;Last week, a telecom security firm reported a vulnerability called “Simjacker” where SMS containing spyware-like code "takes over" a phone's SIM card in order to retrieve and perform sensitive commands, regardless of platform or device;Over the past month, Google and Apple have been going back and forth over a post the former released, “A very deep dive into iOS Exploit chains found in the wild”, where a small collection of hacked websites were using iPhone zero-day vulnerabilities to target China's Uyghur Muslim community (though Google is not the one who revealed the specific websites, Apple did confirm it in their response a week later) -- what do we make of this exchange; of the fact that zero-day hacks are now more expensive on Android than on Apple; and of Apple's ethos when it comes to a third-party ecosystem for security?Finally, how should we think about phone authentication overall when it comes to security, and what can we do to secure ourselves? Our a16z experts -- general partner Martin Casado and former chief security officer/ operating partner for security Joel de la Garza -- share their thoughts on all this and more with host Sonal Chokshi, in this episode of 16 Minutes.---The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at a16z.com/investments.Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see a16z.com/disclosures for additional important information.

19:5023/09/2019

a16z Podcast: The Biology of Pain

What is the nature of physical pain? Why do we even experience it? Is there one type, or many? Do people experience pain differently? What is happening in our brains and our bodies when we experience pain? What is the biological link between pain and addiction? In this episode Clifford Woolf, Professor of Neurobiology at Harvard Medical School and a renowned expert on understanding pain, shares with with a16z's Hanne Tidnam all we know about the biology of pain.

Technology is enabling a new, deeper, and much more complex understanding of pain—which pathways and neurons are activated in the brain when, what patterns might represent which experiences of pain. We now understand that the notion of pain as a simple switch that can be switched on or off (you have pain/you don't have pain) and measured by categories like mild, moderate, or severe is just incorrect. Woolf describes the 4 different broad types of pain we in fact experience, what the purpose of each is, and what it means now that we can phenotype them and begin to understand them as distinct. Now that we have this deeper and much more complex understanding of pain, what does it mean for how we can treat pain in the future, and where we can intervene?

36:5217/09/2019

16 Minutes on the News #8: Apple Camera, Services; Wearables - Where are We

with @benedictevans @vijaypande and @smc90

This is episode #8 of our news show, 16 Minutes, where we quickly cover recent headlines of the week, the a16z way -- why they're in the news; why they matter from our vantage point in tech -- and share our experts' views on these trends.

This week we cover, with the following a16z experts:

Apple's latest event announcing new products and services across mobile, TV, and gaming; where is (and isn't) innovation happening, and what's next -- with a16z's Benedict Evans;

wearables and health trackers such as Fitbit supplying services to the government of Singapore, and what it means for the hype vs. reality of the current trends of wearables (and "the quantified self"); going beyond counting steps to clinical applications and detecting comorbid conditions; strong vs. weak technologies and how to pay beyond fee-for-service to fee-for-value; and where does this all fit in a sensor-ified future? -- with a16z bio general partner Vijay Pande;

...hosted by Sonal Chokshi.

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.

20:0016/09/2019

a16z Podcast: How to Pay for Healthcare Based on Health

There's been a lot of talk about the need for our healthcare system to shift away from volume and fee-for-service, where you pay by appointment, procedure, etc, to value-based care, where you pay for both quality and outcomes—essentially, good health. But there's also been a real dearth of seeing how that might work in action, or concrete models for how to implement it at scale. In this episode, CEO of Blue Cross Blue Shield North Carolina Patrick Conway dives deep into how exactly we can make the move towards this kind of healthcare a reality, in conversation with a16z's General Partner Jorge Conde, Venkat Mocherla and Hanne Tidnam.Conway—also a pediatrician, and formerly Deputy Administrator at the Centers for Medicare and Medicaid Services (CMS) and Director of the Center for Medicare and Medicaid Innovation (CMMI)—gets into what value-based care really means; different ideas for how payors can implement the shift away from fee-for-service and volume-based care towards outcomes; as well as the critical role social determinants (food insecurity, transportation, and more) play in our health—and how tech can be a driver of change. And finally, Conway shares thoughtful analysis from an insider’s point of view from the Hill on how to actually effect change in policy and regulation in healthcare to move the entire system in this direction.This podcast was recorded on April 10, 2019. As of September 25, 2019, Patrick Conway is no longer CEO and President of Blue Cross Blue Shield North Carolina.

36:3106/09/2019

The Hustler's Guide to the Hair Business

with @bhorowitz @shakasenghor @diishanimira @therealritabee

Hustlin’ Tech is a new show (part of the a16z Podcast) that introduces the technology platforms -- and mindsets -- for everybody and anybody who has the desire, the talent, and the hustle to do great things. Read more about it here.

Episode #3, "The Hustler's Guide to the Hair Business" features Diishan Imira, CEO and co-founder of Mayvenn, a technology company re-shaping salon retail distribution; Sherita (SherriAnn) Cole, who uses Mayvenn for her hair stylist business -- both interviewed by Ben Horowitz and Shaka Senghor.

"Can you fit in this box? You always have to fit in a box, and for the first time in a life, it's like I didn't have to fit in anyone's box, and I could create my own box -- maybe it's not a box, maybe it’s a star shape."

music: Chris Lyons

40:4606/09/2019

The Hustler's Guide to Getting Paid

with @bhorowitz @shakasenghor ram @earnin & vaughn ferguson

Hustlin’ Tech is a new show (part of the a16z Podcast) that introduces the technology platforms — and mindsets — for everybody and anybody who has the desire, the talent, and the hustle to do great things. Read more about it here.

Episode #2, “The Hustler’s Guide to Getting Paid” (early, but actually, on time) features Ram Palianappan, CEO and founder of Earnin, which allows workers to access their pay instantly with no fees or interest; Vaughn Ferguson, who uses Earnin to avoid overdraft fees or payday loans -- both interviewed by Ben Horowitz and Shaka Senghor.

"Just knowing that more people are really using these things that are out there, to their advantage and not their detriment."

music: Chris Lyons

30:1406/09/2019

The Hustler's Guide to Preschool

with @bhorowitz @shakasenghor @8ennett & sherie james

Hustlin’ Tech is a new show (part of the a16z Podcast) that introduces the technology platforms -- and mindsets -- for everybody and anybody who has the desire, the talent, and the hustle to do great things. Read more about it here.

Episode #1, "The Hustler's Guide to Preschool" features Chris Bennett, CEO and co-founder of Wonderschool, a network of modern early education programs that helps both parents and teachers to start and manage early childhood education centers; Sherie James, who uses Wonderschool to operate her own in-home preschool and daycare -- both interviewed by Ben Horowitz and Shaka Senghor, live at the 25th Anniversary Essence Festival Global Economic Black Forum in New Orleans.

music: Chris Lyons

37:1406/09/2019

Introducing Hustlin' Tech

We're excited to introduce a new podcast series hosted by a16z co-founder Ben Horowitz and Shaka Senghor, a leading voice in criminal justice reform and bestselling author. The series is called “Hustlin’ Tech” and so far, there are three episodes to follow, which you can find in this feed:

#1 The Hustler’s Guide to Preschool

#2 The Hustler’s Guide to Getting Paid

#3 The Hustler’s Guide to the Hair Business

You can read more about the what and the why of this new series -- and sign up to be notified about future episodes -- at: a16z.com/hustlin

00:3706/09/2019

a16z Podcast: Making Culture, Making Influence -- Dapper Dan!

"You cannot be IN it... and not be OF it."

Dapper Dan a.k.a. Daniel Day shares his remarkable history and story of defining an era of fashion and cultural influence in this special episode of the a16z Podcast — based on his conversation in San Francisco (also available as video here) with a16z co-founder Ben Horowitz around his memoir, Made in Harlem.

Dapper Dan pioneered high-end streetwear in the early 1980s, remixing luxury brand logos into his own designs for gangsters, athletes, and musicians — dressing cultural icons from Salt-N-Pepa and Eric B. & Rakim to Beyoncé and Jay-Z along the way. Going on to define an era, Dapper Dan’s work has been featured in exhibitions at the Museum of Modern Art, the Met, The Smithsonian, and more. But he began as a hungry, fast learner in Harlem who became a gambler; spent a brief stint in a foreign jail where he nourished himself with reading; and then studied the market to build his fashion business, trendsetting the concepts of logomania and later, influencer marketing. Today, Dapper Dan has a unique partnership with Gucci and reopened his boutique in 2017.

From “the struggle” when not given the privileges and opportunities that others have to the struggle of building and then losing and then reinventing oneself again and again, this special episode offers inspiration for all kinds of makers — including the power of “studying the game”; the power of listening to your customers (not in the cliché way!); and the power of cultural influence… and voice.

photo credits: Alain McLaughlin

01:08:0902/09/2019

a16z Podcast: From the Internet's Past to the Future of Crypto

What can we learn from the history of the internet for the future of crypto? In this episode of the a16z Podcast, general partner Katie Haun interviews a16z co-founder Marc Andreessen -- and co-founder of Netscape, which helped popularize and mainstream the internet for many -- and who also penned "Why Software is Eating the World" (in the Wall Street Journal in 2011) and "Why Bitcoin Matters" (in the New York Times in 2014).

This episode is based on a fireside chat between Katie and Marc at our inaugural Crypto Regulatory Summit, which brings together leading crypto experts and builders, other technologists, academics, industry executives, and government officials -- along with forward-thinking regulators -- to foster collaboration and the exchange of ideas around this important emerging industry.

Why is crypto an important evolution (or revolution) of the internet? What can entrepreneurs, corporations, and policymakers learn from the beginnings of the browser, e-commerce, and other examples about how emerging technologies move forward?

26:5929/08/2019

a16z Podcast: What to Know about FedRAMP

with @ldhawke and @stevesi

The government wants to get onto the cloud! But how do they assess the levels of risk in adopting specific cloud products, and which "cloud service providers" (aka "CSPs") to work with? That's where FedRAMP -- the Federal Risk and Authorization Management Program -- comes in. And enterprise SaaS companies need to pay attention, since it will be a requirement for selling to the U.S. government, which is one of the biggest buyers of tech. Not just that, but even state governments and private/public companies may seek FedRAMP certification because they either work with the federal government or are just seeking standards.

How similar or different is FedRAMP to other types of certification, authorization, and compliance (such as ISO, SOC-2, GDPR, even HIPAA); and what does it mean for a startup to go through organizationally, culturally? Is it like a check-the-box policy thing, is it like getting a driver's license... or what? One thing's for sure: It's an opportunity for enterprise SaaS startups, and the government is trying to help companies through the process.

What are the steps to certification? What are some acronyms and terms to be aware of? When and how should you bring a consultant, advisor, or third-party auditor into the process? How long does it take, really? And how does it affect your sales team? Most importantly, what is the best strategy for moving forward? (Hint: start with a customer). Lisa Hawke, VP of Security and Compliance at Everlaw, an a16z company, shares her expertise and their experience in navigating all this, as well as the resources below, in this episode of the a16z Podcast hosted by board partner Steven Sinofsky. (The two were also previously on another episode sharing everything startups need to know about GDPR.)

For links mentioned in this episode and other resources, see: https://a16z.com/2019/08/28/fedramp-why-what-how-for-startups/

34:0828/08/2019

16 Minutes on the News #7: Apple Card, BEC Scams Federal Indictment

with @illscience and @smc90

This is episode #7 of our news show, 16 Minutes, where we quickly cover recent headlines of the week, the a16z way -- why they're in the news; why they matter from our vantage point in tech -- and share our experts' views on these trends.

This week we cover, with the following a16z experts:

Apple releasing a credit card, and what it means beyond the card features itself, what it means for consumer credit (and recession risks), and the financial ecosystem overall -- with new a16z fintech general partner Anish Acharya;

BEC frauds and scams indictment and the FBI bringing a massive federal grand jury indictment, one of the biggest of its kind, and what it means and how to prevent this type of cyber fraud -- with a16z operating partner for security Joel de la Garza;

...hosted by Sonal Chokshi.

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.

17:5625/08/2019

a16z Podcast: Software has eaten the world...and healthcare is next

Back in 2011, a16z cofounder Marc Andreessen first made the bold claim that software would eat the world. In this episode (originally recorded as part of an event at a16z), Andreesseen and a16z general partner on the bio fund Jorge Conde (@JorgeCondeBio) take a look back at that thesis, and think about where we are now, nearly a decade later—how software has delivered on that promise… and most of all, where it is yet to come.

In the wide-ranging conversation, the two partners discuss everything from the translatable learnings of software’s transformation of the music and automotive industries, to how software will now eat healthcare (including what exactly changed in the fields of bio and computer science to make Marc eat his own words!).

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.

46:4915/08/2019

16 Minutes on the News #6: Health Claims, Corporate Breaches

with @julesyoo @smc90

This is episode #6 of our new show, 16 Minutes, where we quickly cover recent headlines of the week, the a16z way -- why they're in the news; why they matter from our vantage point in tech -- and share our experts' views on these trends as well.

This week we cover, with the following a16z experts:

health claims, insurance & big tech, and healthcare data liquidity -- with a16z bio partner Julie Yoo;

Capital One data breach, cloud security, and corporate hacks -- with a16z operating partner for security Joel de la Garza;

...hosted by Sonal Chokshi.

17:1412/08/2019

16 Minutes on the News #5: Fed Real-time Payments, Death of Retail

with @astrange @jeff_jordan and @smc90

This is episode #5 of our new show, 16 Minutes, where we quickly cover recent headlines of the week, the a16z way -- why they're in the news; why they matter from our vantage point in tech -- and share our experts' views on these trends as well.

This week we cover, with the following a16z experts:

Federal Reserve real-time payment and settlement service FedNow, the U.S. payments rail, and fintech -- with a16z general partner Angela Strange;

Barney's bankruptcy, the "death of retail", and ecommerce -- with a16z general partner Jeff Jordan;

...hosted by Sonal Chokshi.

16:4411/08/2019

16 Minutes on the News: The Opioid Crisis

with @jorgecondebio @vijaypande and @smc90

This is episode #4 of our new show, 16 Minutes, where we quickly cover recent headlines of the week, the a16z way -- why they're in the news; why they matter from our vantage point in tech -- and share our experts' views on these trends as well.

This week we do a short but deep dive on the opioid crisis, given recent data around where and who was behind the manufacturing and distribution of specific opioids:

How do opioids work, why these drugs?

Who's to blame?

What are other directions for managing pain -- and where could tech come in, even with the broader social, cultural, and structural context involved?

Our a16z experts in this episode are a16z bio general partners Jorge Conde and Vijay Pande, in conversation with host Sonal Chokshi.

18:1804/08/2019

16 Minutes on the News: Fortnite, Esports, Gaming, and Entertainment

with @andrewchen @dcoolican and @smc90

This is episode #3 of our new show, 16 Minutes, where we quickly cover recent headlines of the week, the a16z way -- why they're in the news; why they matter from our vantage point in tech -- and share our experts' views on these trends as well.

This week we do a short but deep dive on esports, given recent news of the inaugural Fortnite World Cup champion, and how this all fits into the broader trends in gaming, social networks, and the future of entertainment.

Our a16z experts in this episode are general partner Andrew Chen and investing team partner D'Arcy Coolican, both of the consumer vertical, in conversation with host Sonal Chokshi.

18:1404/08/2019

16 Minutes on the News: Mobile Malware, Drug Pricing

with @martin_casado @jorgeconde @jayrughani and @smc90

This is episode #2 of our new show, 16 Minutes, where we quickly cover recent headlines of the week, the a16z way -- why they're in the news; why they matter from our vantage point in tech -- and share our experts' views on these trends as well.

This week we cover, with the following a16z experts:

. mobile malware and a recent report of a new kind in the wild and security in a post-perimeter world -- with a16z general partner Martin Casado;

drug pricing given recent proposals on the table, sharing a lay of the land for why drug pricing is so damn hard, what is a medicine, and where tech comes in -- with a16z bio general partner Jorge Conde and market dev partner Jay Rughani;

...hosted by Sonal Chokshi.

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.